S&P 500's Biggest Jump Since 2008: Why Smart Investors Are Looking Beyond the Tariff Rally

Market whiplash got you worried? Here's why long-term investors should stay calm during tariff-driven volatility (like any other headline-worthy market crash or rally).

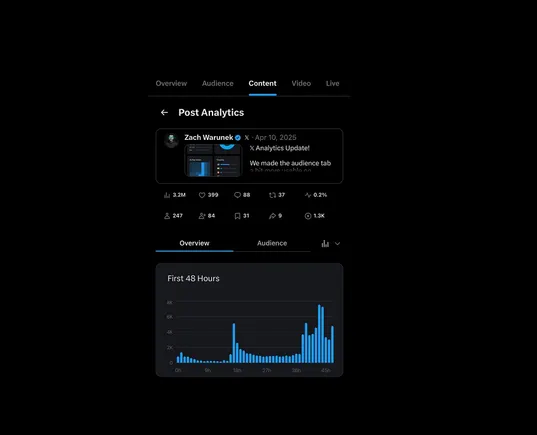

It's been quite a week on Wall Street. The S&P 500 (SNPINDEX: ^GSPC) market index rose 9.5% on Wednesday as President Trump hit the pause button for 90 days on most of his new tariff policies.

Many headlines highlighted this massive gain as a historic moment. And why not? This was the S&P 500's biggest single-day gain since October 2008, after all. It was also a historic rebound for the tech-oriented Nasdaq Composite (NASDAQINDEX: ^IXIC) index and the quality-focused grandaddy, the Dow Jones Industrial Average (DJINDICES: ^DJI) The leading market indices posted two price spikes of at least 10% in the late-2008 aftermath of the subprime mortgage meltdown. Investors had their long-term hopes goosed by a $250 billion quantitative easing program, followed by very steep federal interest rate cuts.

That's the level of historic importance this week competes with. It's a big deal.

.jpg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)