Palantir Is Soaring Today. Is the Stock a Buy Right Now?

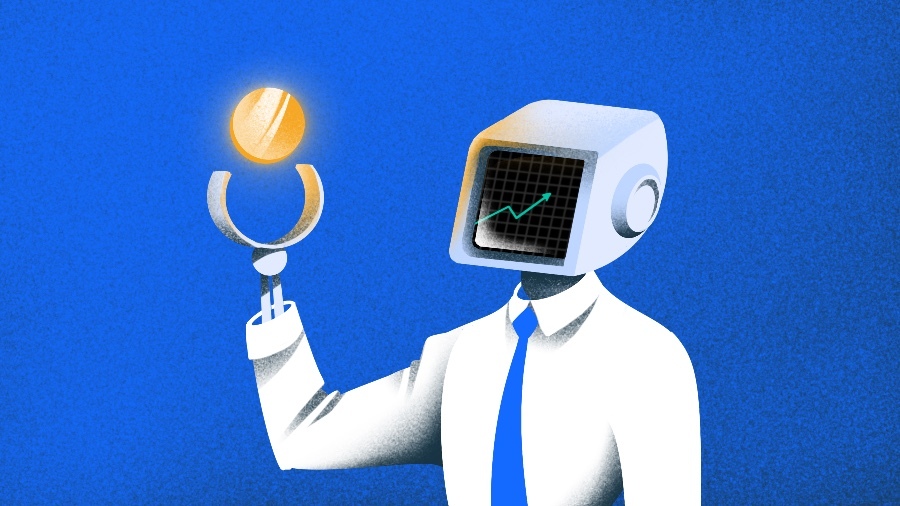

Palantir (NASDAQ: PLTR) stock is jumping in Wednesday's trading thanks to a combination of macroeconomic and business-specific catalysts. The company's share price was up 8% as of 1 p.m. ET. Meanwhile, the S&P 500 had risen 1.8%, and the Nasdaq Composite was up 2.6%.The Trump administration is signaling that it would like to get a trade deal done with China in the near term and bring tariffs between the two countries lower, and the stock market is rallying today in response. In addition to a bullish development on the macroeconomic front, Palantir stock also seems to be getting a boost from news that the company's FedStart platform for governmental compliance and operational scaling is being integrated into Alphabet's Google Cloud infrastructure service. As of this writing, Palantir stock is now up roughly 35% year to date. Palantir looks to be one of the strongest overall players in the artificial intelligence (AI) software space, and fantastic sales momentum among both public and private-sector customers makes it clear that its services are winning in the market. Heavy geographic sales concentration among the U.S. and its allies should also continue to provide some protection against trade war volatility. On the other hand, the stock is trading at roughly 183 times this year's expected earnings and 63 times expected sales -- and that means there's a very high level of investment risk involved. Continue reading

Palantir (NASDAQ: PLTR) stock is jumping in Wednesday's trading thanks to a combination of macroeconomic and business-specific catalysts. The company's share price was up 8% as of 1 p.m. ET. Meanwhile, the S&P 500 had risen 1.8%, and the Nasdaq Composite was up 2.6%.

The Trump administration is signaling that it would like to get a trade deal done with China in the near term and bring tariffs between the two countries lower, and the stock market is rallying today in response. In addition to a bullish development on the macroeconomic front, Palantir stock also seems to be getting a boost from news that the company's FedStart platform for governmental compliance and operational scaling is being integrated into Alphabet's Google Cloud infrastructure service. As of this writing, Palantir stock is now up roughly 35% year to date.

Palantir looks to be one of the strongest overall players in the artificial intelligence (AI) software space, and fantastic sales momentum among both public and private-sector customers makes it clear that its services are winning in the market. Heavy geographic sales concentration among the U.S. and its allies should also continue to provide some protection against trade war volatility. On the other hand, the stock is trading at roughly 183 times this year's expected earnings and 63 times expected sales -- and that means there's a very high level of investment risk involved.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)