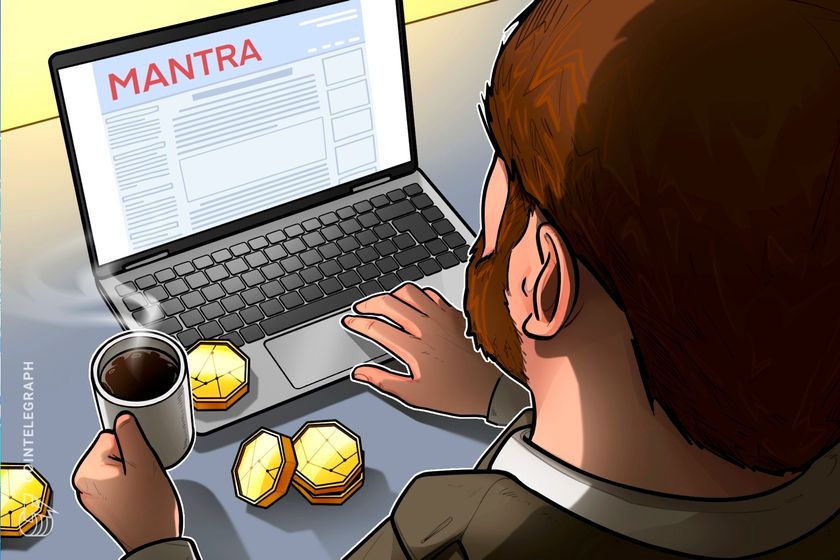

MNT/USD nears $5 milestone as Mantle’s treasury tops $3.8B

MNT/USD forms ascending triangle since late 2023. Between 200,000 and 500,000 daily transactions recorded. DeFi drives 65% of gas fees, market cap stands near $2.6 billion. The MNT/USD trading pair is gaining attention across crypto markets as a potential breakout nears. Mantle, the Ethereum layer-2 project behind the token, has formed an ascending triangle pattern […] The post MNT/USD nears $5 milestone as Mantle’s treasury tops $3.8B appeared first on CoinJournal.

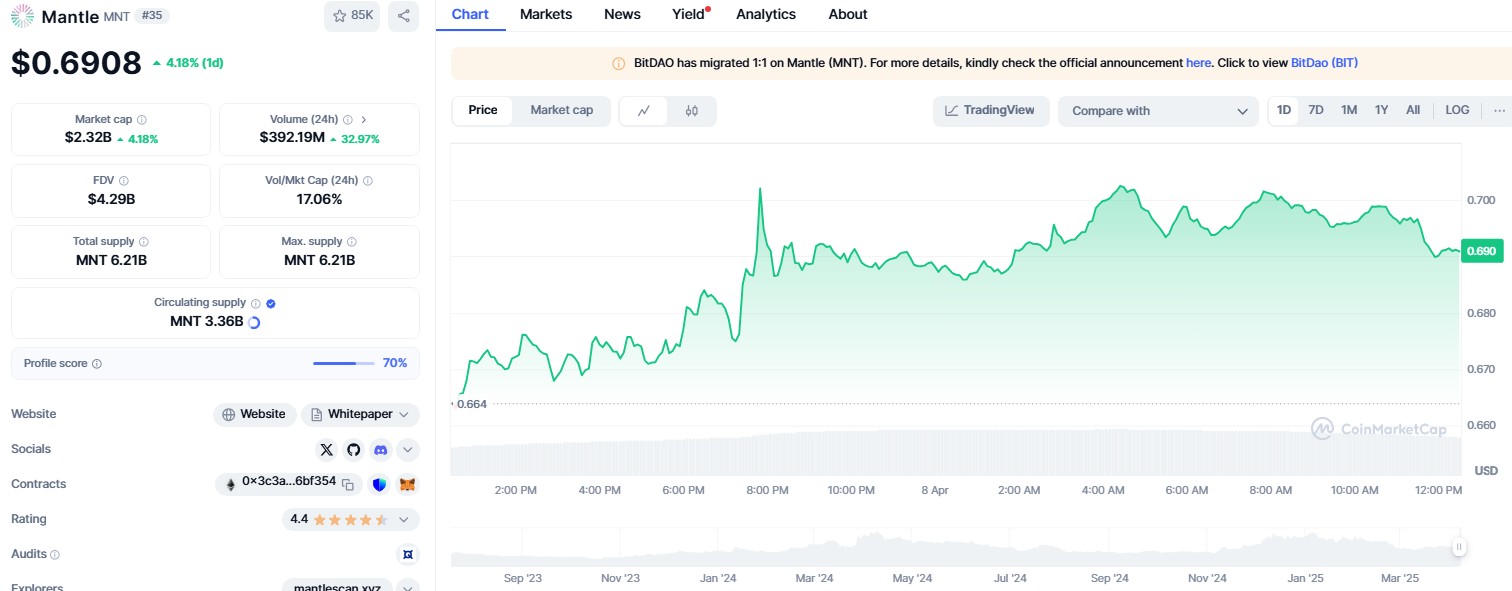

- MNT/USD forms ascending triangle since late 2023.

- Between 200,000 and 500,000 daily transactions recorded.

- DeFi drives 65% of gas fees, market cap stands near $2.6 billion.

The MNT/USD trading pair is gaining attention across crypto markets as a potential breakout nears.

Mantle, the Ethereum layer-2 project behind the token, has formed an ascending triangle pattern on the price chart since late 2023.

This setup typically indicates rising buying pressure and a looming price move.

While resistance at $1.35 has repeatedly held firm, higher lows have created a tightening range that traders believe could result in a breakout toward $5.

Source: CoinMarketCap

Meanwhile, Mantle’s fundamentals, including a $3.8 billion treasury and $67 million in annual revenue, are strengthening investor interest.

Triangle pattern signals breakout

Since early 2024, MNT/USD has steadily maintained a series of higher lows, forming the lower bound of an ascending triangle pattern.

The upper resistance line, marked at $1.35, has seen several tests through 2024 and early 2025 but has yet to be breached.

The market structure indicates consolidation, with price compression creating conditions favourable to a breakout.

A historical rally in late 2023 triggered renewed market focus on the token, as a steep green bar marked a sharp vertical rise.

That level has since acted as a key reference point for support and resistance zones.

Momentum has not yet been strong enough to surpass the $1.35 cap, but the support trendline has held consistently since early 2024.

Traders following the chart note that if the support trendline breaks, the bullish structure could fail.

Until then, the pattern remains intact, with eyes on volume activity as a critical indicator for whether the breakout is genuine or a false move.

Mantle reserves hit $3.8B

Beyond the chart, Mantle’s on-chain fundamentals have reinforced the bullish setup.

According to recent data, the project currently holds $3.8 billion in reserves, making it the largest community-governed treasury in the cryptocurrency sector.

These funds are held in liquid assets such as ETH and stablecoins, giving Mantle significant capital flexibility.

Additionally, Mantle has generated $67 million in annual protocol revenue, while distributing $50 million back to its user base.

This flow of value highlights active community participation and underlines the project’s sustainability in a volatile sector.

Mantle’s ecosystem continues to grow with a strong emphasis on capital efficiency and infrastructure reliability.

65% of gas used by DeFi

Mantle has seen steady adoption across decentralised finance (DeFi) applications, with DeFi usage accounting for 65% of its gas fee expenditure.

Current network statistics show daily transactions ranging between 200,000 and 500,000, reinforcing the idea that the project supports active and consistent usage.

Analysts believe this usage depth could support long-term price appreciation.

With a market capitalisation of approximately $2.6 billion, Mantle ranks among the more prominent layer-2 solutions.

Continued integration with DeFi projects could push transaction volume even higher, contributing to sustained growth and increased token velocity.

Break above $0.86 targets $1

While $1.35 remains the major resistance, analysts also highlight $0.86 as a short-term key level.

Breaching this level could lead to a rapid push toward $1, given the psychological significance and previous trading behaviour in this zone.

A confirmed breakout past $1.35 would then open the door to a potential move toward $5, based on the measured move from the triangle’s base.

Market participants are monitoring volume for confirmation.

If the breakout is supported by a spike in buying activity, MNT/USD could enter a new rally phase.

Conversely, a breakdown below the trendline would shift sentiment and could delay any upward momentum.

The post MNT/USD nears $5 milestone as Mantle’s treasury tops $3.8B appeared first on CoinJournal.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)