From spray-and-pray to precision: VCs shift gears in deeptech playbook

Deeptech investments have picked up compared to last year as venture capital firms tailor their approach to this segment—one that demands time and patience but churns out high value innovation and exits.

It was meant to be a celebration—another event where everyone pats each other's backs for doing a great job at whatever they do. Instead, as entrepreneurs and investors gathered at Startup Mahakumbh earlier this month, they found themselves facing an unexpected reality check.

Commerce Minister Piyush Goyal, never one to mince words, dropped what can only be described as a truth bomb on the world's third-largest startup ecosystem. The digital realm erupted almost immediately as founders and VCs who had arrived expecting validation found themselves on the defensive.

The Minister had veered sharply from the expected script of nationalist tech cheerleading. Rather than the customary platitudes about Indian innovation, Goyal painted a sobering picture of a country struggling to keep pace with global competitors.

He made pointed remarks about how other countries are making leaps and bounds in innovation, especially in artificial intelligence and semiconductors, while India, in his view, is falling behind. The internet was quick to read between the lines, interpreting the comments as a reference to China’s DeepSeek and its accelerating progress in advanced technologies.

Though the reaction was immediate, the unease ran deeper. While India’s deeptech ecosystem is still evolving, the criticism underscored a reality that many in the startup world already acknowledge—building truly innovative, research-driven companies remains a work in progress. At the same time, venture capitalists are gradually learning how to engage with these complex, tech-heavy ventures.

In recent months, the growing excitement around AI and deeptech has begun to reshape investor priorities. Recognising the distinct growth trajectory of these companies, many Indian investors are now adapting their strategies—but not without caution. There is enthusiasm, but there is also a clear understanding that deeptech demands a different playbook.

Funding activity in the segment reflects this shift. Some investors are now gaining access to longer windows to support follow-on rounds, while others are taking a more tailored approach, focusing on specific sub-segments within deeptech. It’s no longer a one-size-fits-all strategy.

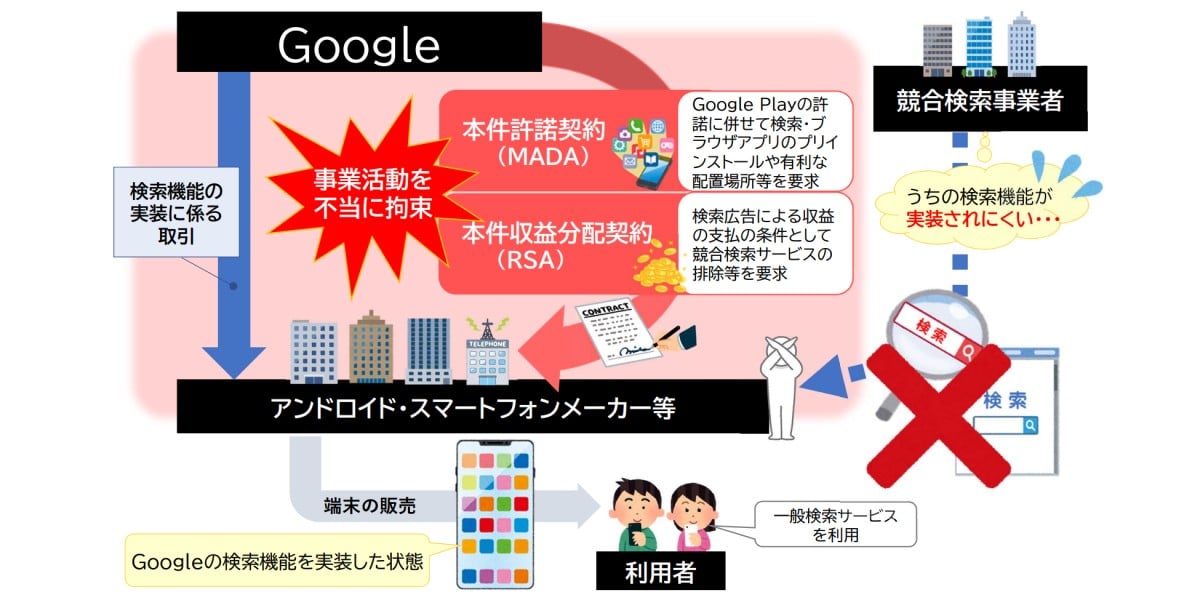

The momentum is backed by data. Between January and March this year, 24 deeptech startups raised around $169 million, according to Venture Intelligence. That’s a significant uptick compared to the same period in 2024, when just 17 startups raised a total of $107 million.

Still, the numbers haven’t reached the highs of 2023, when 31 deals brought in $396 million—the most capital the sector has seen since 2018. But even so, current funding levels have surpassed those of 2022 and 2021, years that were otherwise buoyed by a broader tech funding surge.

In the wake of Goyal’s remarks, the spotlight is firmly on the deeptech space. The criticism may have sparked a wave of defensiveness, but it also seems to have reignited urgency—and a renewed focus—around building for the long haul. Number of deep-tech deals in Q1 2025 has been higher than Q1 2024

Tailoring a term sheet

Investors are being more calculative while scouting for talent in the deeptech pool, often trying to keep in mind the funding needs of the startup as well as the returns they have to churn out for their limited partners at the end of the fund tenure.

VC firms making investments with an eye on the long game are strategically allocating risk capital, often placing bold bets shortly after raising a new fund, for instance. This would give the startups the much-needed window to commercialise their innovations and the VCs, time to churn out the returns.

“If you take our Rs 400 crore fund, Seed and Series B (funding), we need a commitment period, but a large part of our deeptech seed space will happen in year one and year two. To make sure we get the longest part of the tenure there, you've got to play it differently,” says Ashish Taneja, Founding Partner and CEO at growX Ventures, an early and growth stage investment firm that looks at deeptech and business-to-business (B2B) segments.

Many believe the reason VC firms are taking these strategy calls is due to the comparatively longer gestation periods that deeptech firms take. However, according to Taneja, this is largely a misconception.

“Within deeptech, there is a misconception that it takes eight to ten years to commercialise. It may be the case for a group of investors who are maybe thinking about figuring out a scientific breakthrough and then seeing its use cases and everything. But what we have observed is, there are companies building products that can be commercialised in three to five years.”

Another strategic way of sifting through the large influx of deeptech startups today is by filtering the use case for the product that is being built and the market it caters to.

“The way we view deeptech is that you have to build in India, but the product has to be globally acceptable because that's what eventually will make the company large. India itself is a very small market for the purchase of deeptech,” says Kanika Mayar, Partner at Vertex Ventures SEA & India, an early and growth stage investment firm. In February, the firm led a $16 million Series A funding round into deeptech startup Spyne.

As VCs step up the criteria for investments into the sector, up-and-coming startups have evolved both in terms of the technology being built as well as the founder mindset. Average cheque size in Q1 2025 is higher than Q1 2024 but remain lower than 2022 and 2023 levels

The deeptech evolution

The Indian deeptech ecosystem is relatively nascent, with big-ticket funding and companies alike still emerging as the segment matures.

“The reality is that the market has seen only a few outcomes from deeptech in India yet. And it is not a single person's fault. It is a maturity of the ecosystem. It is a measure of where we are as a country, as a nation. It's an evolution,” says Arpit Agarwal, Partner at Blume Ventures.

Agarwal adds that at the end of the day, VCs are answerable to their limited partners (LPs). “If our sector or any investment, any subsector, delivers inferior returns, then it is my fiduciary responsibility to take less interest in it. The only thing that I can think of about deep-tech and how to support deeptech is by having a lot more patience and by having a different approach to things. Like, for example, I should have patience about the company taking a few years before the product comes to life, given that the company might have a lot of scientific uncertainty and growth playbooks may not be clearly established, ” he added.

Despite these companies taking a longer period of time to achieve product market fit and revenue realisation, for VC firms, it is a segment of high risks and high returns.

“If you took five or six years to build a cutting-edge product, by default, the assumption is that it is a very complex product that 20 others have not built. Therefore, in the market, you have higher demand, you have pricing power, so on and so forth. So your revenue uptake in the first one to two years after commercialisation will be very fast,” says Arjun Rao, Partner at Speciale Invest, an early-stage deeptech-focused VC firm.

Today, there is significant funding coming into the ecosystem at the seed and Series A level. According to data from Venture Intelligence, the first quarter of the year saw 16 seed-stage funding rounds with a deal value of $29 million and four Series A rounds with a total deal value of $31 million.

Deeptech company Spyne’s co-founder, Sanjay Varnwal, echoes Rao’s comment. “If you are doing and solving the right kind of problem statement, it can get you to the revenue journey much quicker than earlier time frames,” he says. Spyne primarily serves automotive dealers in the US and Europe.

The company recently raised $16 million in a Series A round led by Vertex Ventures.

However, Rao added that deeptech companies at a pre- or early-commercialisation stage are struggling to raise subsequent funding rounds. “At the pre-revenue and early commercialisation stage is where maybe there's a little gap in the ecosystem. But it is also starting to get filled. However, we are very early in that life cycle and hence, the next few years are when this will play out.”

Edited by Jyoti Narayan

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)