BaFin Grants MiCA License to BitGo Europe for EU Crypto Operations

BitGo secured regulatory approval to offer digital asset services across the European Union, marking a major step in its global expansion and signaling increased institutional interest in the region’s growing crypto market. With Germany’s BaFin granting a Markets in Crypto-Assets Regulation (MiCA) license to BitGo Europe GmbH, the company now aims to serve both traditional finance and crypto-native firms looking for compliant infrastructure solutions.BitGo has received a MiCA license from BaFin, marking a significant milestone in our European expansion. This approval extends our digital asset services across the EU—supporting both crypto-native companies and TradFi institutions, including banks and asset managers, seeking a… pic.twitter.com/wuyf6P01kg— BitGo (@BitGo) May 12, 2025A Gateway to EU-Wide ExpansionAccording to the company, the MiCA license gives BitGo the legal framework to operate across the EU’s 27 member states under a unified regulatory standard. The approval comes as MiCA continues to transform the European digital asset landscape, offering clarity and stability for institutions seeking to enter the space.Commenting about the approval, Harald Patt, the Managing Director of BitGo Europe GmbH, said: “We are proud to receive our MiCA licence from BaFin, establishing our foothold in the European Union. We are excited to support the continued growth of crypto adoption in Europe.BitGo Europe GmbH, headquartered in Frankfurt and established in 2023, already holds registrations in multiple EU countries, including Italy, Spain, Poland, and Greece. The BaFin license now strengthens its position to act as a central provider of regulated digital asset services.Institutional FocusThe MiCA framework has helped Europe become one of the most active regions for crypto regulation and development. Recent trends include an uptick in approvals for services such as staking and stablecoin issuance, reinforcing the EU’s growing relevance in the global digital asset market.Recently, BitGo expanded its services with the launch of an over-the-counter (OTC) trading desk specifically targeting institutions to trade cryptocurrencies. The OTC desk offers around-the-clock service and lists more than 250 digital assets. Besides that, it provides trading services with both spot and derivative instruments, lending services, and yield-generating products. This article was written by Jared Kirui at www.financemagnates.com.

BitGo secured regulatory approval to offer digital asset services across the European Union, marking a major step in its global expansion and signaling increased institutional interest in the region’s growing crypto market.

With Germany’s BaFin granting a Markets in Crypto-Assets Regulation (MiCA) license to BitGo Europe GmbH, the company now aims to serve both traditional finance and crypto-native firms looking for compliant infrastructure solutions.

BitGo has received a MiCA license from BaFin, marking a significant milestone in our European expansion. This approval extends our digital asset services across the EU—supporting both crypto-native companies and TradFi institutions, including banks and asset managers, seeking a… pic.twitter.com/wuyf6P01kg— BitGo (@BitGo) May 12, 2025

A Gateway to EU-Wide Expansion

According to the company, the MiCA license gives BitGo the legal framework to operate across the EU’s 27 member states under a unified regulatory standard. The approval comes as MiCA continues to transform the European digital asset landscape, offering clarity and stability for institutions seeking to enter the space.

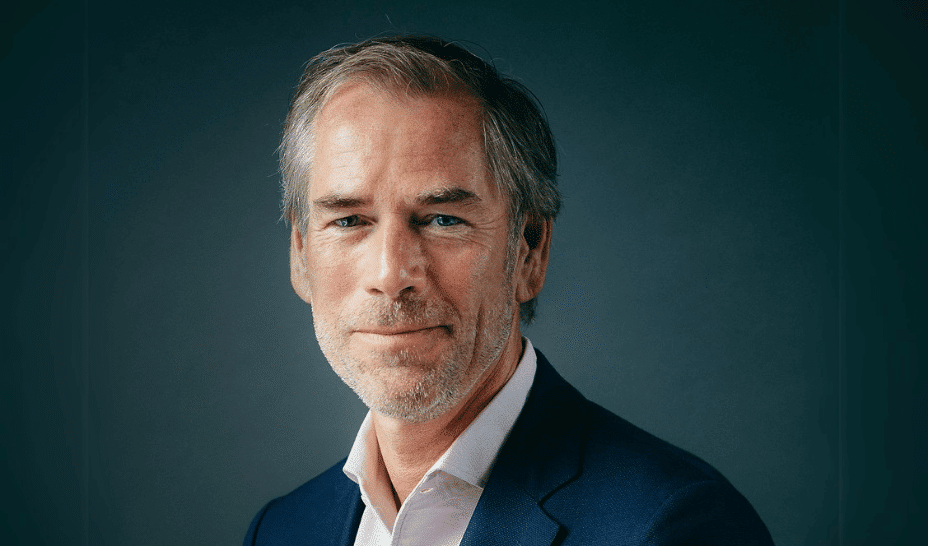

Commenting about the approval, Harald Patt, the Managing Director of BitGo Europe GmbH, said: “We are proud to receive our MiCA licence from BaFin, establishing our foothold in the European Union. We are excited to support the continued growth of crypto adoption in Europe.

BitGo Europe GmbH, headquartered in Frankfurt and established in 2023, already holds registrations in multiple EU countries, including Italy, Spain, Poland, and Greece. The BaFin license now strengthens its position to act as a central provider of regulated digital asset services.

Institutional Focus

The MiCA framework has helped Europe become one of the most active regions for crypto regulation and development. Recent trends include an uptick in approvals for services such as staking and stablecoin issuance, reinforcing the EU’s growing relevance in the global digital asset market.

Recently, BitGo expanded its services with the launch of an over-the-counter (OTC) trading desk specifically targeting institutions to trade cryptocurrencies.

The OTC desk offers around-the-clock service and lists more than 250 digital assets. Besides that, it provides trading services with both spot and derivative instruments, lending services, and yield-generating products. This article was written by Jared Kirui at www.financemagnates.com.