A91 Partners closes third fund at $665M

The announcement follows earlier disclosures that the International Finance Corporation (IFC), part of the World Bank Group, was evaluating a commitment of up to $35 million along with a potential $30 million co-investment into the fund.

Mumbai-based venture capital firm has closed its third fund to the tune of $665 million.

The announcement follows earlier disclosures that the International Finance Corporation (IFC), part of the World Bank Group, was evaluating a commitment of up to $35 million, along with a potential $30 million co-investment into the fund. At the time, A91 had set a target of $675 million for its third fund.

IFC is a United Nations agency that invests in private sector growth in developing countries.

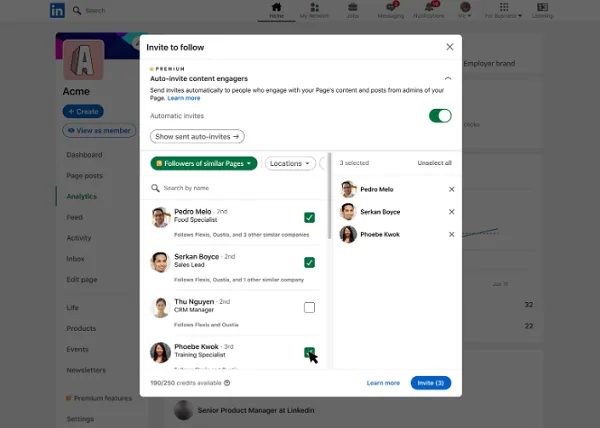

“Today we are pleased to announce the closing of $665M A91 Fund III. We are incredibly grateful to both our investors and the founders that have partnered with us and continue to inspire and educate us,” the company said in a LinkedIn post.

Founded in 2018 by Sequoia Capital's former directors Abhay Pandey, VT Bhardwaj and Gautam Mago, A91 is focused on making mid-stage investments, in Series B and C deals between $10 and $15 million.

“We started A91 in 2018 with the following beliefs—patient capital will play an important role in accelerating value creation in Indian businesses across sectors. We also believed in the opportunity to create a world-class Indian investment firm—for founders who are aiming to build large enduring businesses from India. All these beliefs have been strengthened over the last six years,” the post added.

The mid-stage VC firm raised $350 million for its debut fund in 2019 and $550 million for its second fund in 2021.

Some of its portfolio companies include dairy products startup Akshayakalpa, specialty coffee brand Blue Tokai Coffee Roasters, and beauty and personal care brand Sugar. Its portfolio company Go Digit General Insurance went public last year.

A91’s fund close adds to the recent funding surge in India’s VC market. Last month, Accel raised $650 million for its eighth India fund, and Bessemer Venture Partners in March launched a $350 million India-focused fund.

Edited by Jyoti Narayan

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)