VC funding into Indian startups drops 16% in April as investors remain cautious

The drop in venture capital funding for April reflects the challenging environment for the Indian startup ecosystem, and this situation is likely to persist.

The Indian startup ecosystem continues to attract a slow inflow of venture capital (VC) funding, as was reflected in the total amount raised in April, which was much below the $1 billion level.

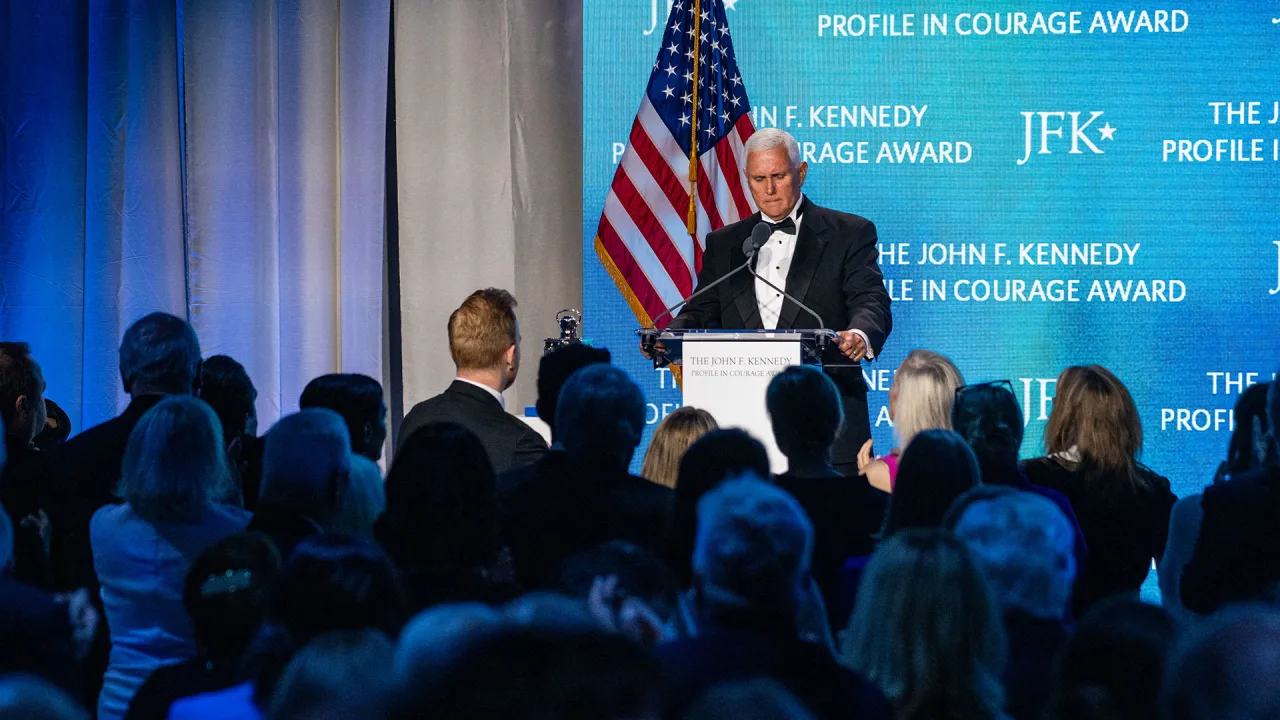

This slower inflow of VC money is primarily due to the external macroeconomic environment, triggered primarily by the tariff war unleashed by US President Donald Trump. It has led to a situation of uncertainty and volatility, which has in turn made the investors cautious.

In April, Indian startups raised a total of $716 million, a 16% year-on-year (YoY) drop when compared to April 2024, when the amount was $849 million, according to YourStory Research.

The decline was much severe at 37% compared to March 2025, when the total amount raised was $1,145 million.

March was a positive aberration in an otherwise lacklustre period, as it was the only month this year when startups collectively raised over $1 billion.

Only one deal in April—Juspay raising a Series D round—was over $50 million.

These developments prove that the Indian startup ecosystem is yet to make any significant turnaround from that of last year, and this trend is likely to persist in the days to come. However, the number of deals has not seen any major dip in the first four months of the year, revealing that the average cheque sizes continue to remain the same.

For April, early-stage funding continues to be the top segment in terms of raising the largest quantum of funding, followed by late-stage and then the growth segment. Surprisingly, startups secured only $23 million in venture debt.

Usually, debt capital rises when equity funding slows down. However, startups seem to have bucked this trend this time.

Speaking of sectors, fintech continues to maintain its dominance, followed by direct-to-consumer and Software-as-a-Service.

Investors seem to have a stronger preference for the fintech segment in terms of making their startup bets and this trend has been very noticeable for several months now.

In terms of the cities that raised funding, Mumbai emerged as the leading destination, followed closely by Bengaluru.

The mood of the Indian startup ecosystem continues to remain sombre due to the overhang of the external environment, and it is only during the second half of the year that one can realistically expect a recovery.

![[Weekly funding roundup April 26-May 2] VC inflow continues to remain downcast](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)