Who is Greg Abel, Berkshire Hathaway’s new CEO who will succeed Warren Buffett?

Warren Buffett’s announcement Saturday that he would be retiring as CEO of Berkshire Hathaway came as a surprise to lots of people, including the person who was elected to succeed him the next day. Greg Abel has been Buffett’s right-hand man for many years and the public heir apparent for the past five, but Buffett, in making his announcement, said he hadn’t told Abel the moment was coming. Buffett, 94, will stay on as chairman at Berkshire, but by the end of this year, Abel will be in the driver’s seat – and will have a big legacy to follow. Buffett took over Berkshire Hathaway in 1965. Things began to take off in 1978, when he convinced his friend Charlie Munger to come on board. Together, the two created a company that was the envy of the investing world. The price of Berkshire Class B shares (NYSE: BRK-B), the most widely held shares of the company, has gone up more than 2,000% since they began trading in 1996. The price of Class A shares (NYSE: BRK-A), held by Buffett and institutional shareholders, is up 42,413% since they began trading in 1985. Abel is fairly well-known to people who closely follow Berkshire Hathaway, but he’s less familiar to people who only know Buffett. Here’s a look at the man who will try to fill Warren Buffett’s shoes. Who is Greg Abel? Abel, 62, currently serves as vice chair of non-insurance operations at Berkshire. He’s also the chair of Berkshire Hathaway Energy, which Buffett called one of the company’s four “jewels” in his 2021 shareholder letter. (The other three are Berkshire’s property and casualty insurance businesses, Burlington Northern Santa Fe railroad, and the company’s stake in Apple.) He has been the designated successor to Buffett for at least four years and has joined Buffett on stage at the company’s investor meeting for the past several years, even before Munger’s death in November 2023. Away from the office, he’s a huge hockey fan and serves as assistant volunteer coach for his son’s team in his hometown of Des Moines, Iowa. He’s said to have a quick wit and nurtures strong personal relationships. “He’s not loud or bombastic, but he’s 500% friendly,” Mark Oman, a retired Wells Fargo executive and friend of Abel’s told Fortune. What is Greg Abel’s background? Abel started his career at the PricewaterhouseCoopers consulting firm in Canada, eventually moving to the San Francisco office. He joined CalEnergy in 1992, which six years later would acquire Des Moines-based MidAmerican Energy Holdings (which would eventually be renamed Berkshire Hathaway Energy). He began running that company in 2009. In 2018, he was asked to join the Berkshire board. Why did Buffett pick Greg Abel to succeed him at Berkshire Hathaway? Abel’s performance with Berkshire Hathaway Energy caught the eye of senior Berkshire executives. Through a series of acquisitions, he transformed that company into a major player in the power industry, with earnings of $5 billion in the first quarter of 2025. In 2023, Buffett told CNBC that Abel “does all the work and I take all the bows.” He’s also seen, in many ways, as the spiritual successor to the plain-spoken, non-flashy Buffett, ensuring the culture at Berkshire Hathaway doesn’t change. What is Greg Abel’s investment strategy? Abel, when asked Saturday to compare his approach to dealing with Berkshire’s subsidiaries to Buffett’s, said he saw himself as “more active, but hopefully in a very positive way.” Buffett jokingly offer a more succinct answer: “Better.” He later added, “You really need someone that behaves well on top and is not playing games for their own benefit.” Munger, in 2023, told CNBC Abel was “a tremendous learning machine” and one could “argue that he’s just as good as Warren in learning all kinds of things.” Abel’s not expected to pick the companies that go into the Berkshire portfolio. That will be handled by Todd Combs and Ted Weschler, who already help Buffett with that.

Warren Buffett’s announcement Saturday that he would be retiring as CEO of Berkshire Hathaway came as a surprise to lots of people, including the person who was elected to succeed him the next day. Greg Abel has been Buffett’s right-hand man for many years and the public heir apparent for the past five, but Buffett, in making his announcement, said he hadn’t told Abel the moment was coming.

Buffett, 94, will stay on as chairman at Berkshire, but by the end of this year, Abel will be in the driver’s seat – and will have a big legacy to follow. Buffett took over Berkshire Hathaway in 1965. Things began to take off in 1978, when he convinced his friend Charlie Munger to come on board. Together, the two created a company that was the envy of the investing world. The price of Berkshire Class B shares (NYSE: BRK-B), the most widely held shares of the company, has gone up more than 2,000% since they began trading in 1996. The price of Class A shares (NYSE: BRK-A), held by Buffett and institutional shareholders, is up 42,413% since they began trading in 1985.

Abel is fairly well-known to people who closely follow Berkshire Hathaway, but he’s less familiar to people who only know Buffett. Here’s a look at the man who will try to fill Warren Buffett’s shoes.

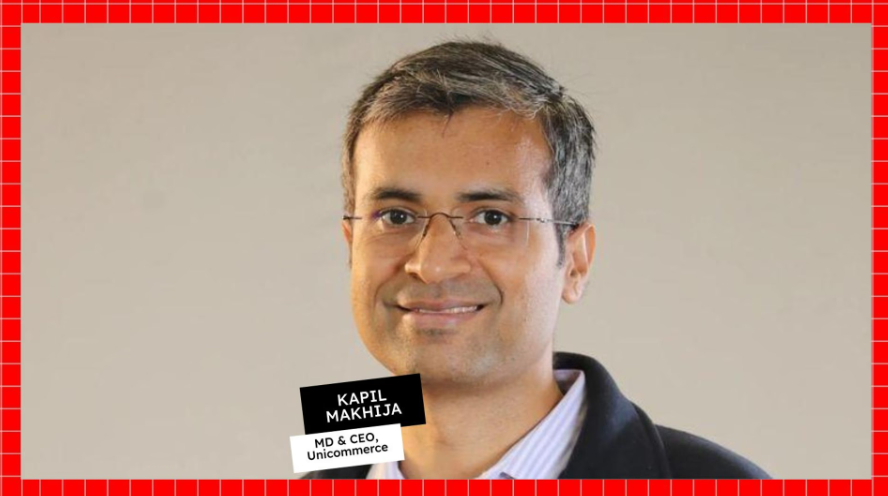

Who is Greg Abel?

Abel, 62, currently serves as vice chair of non-insurance operations at Berkshire. He’s also the chair of Berkshire Hathaway Energy, which Buffett called one of the company’s four “jewels” in his 2021 shareholder letter. (The other three are Berkshire’s property and casualty insurance businesses, Burlington Northern Santa Fe railroad, and the company’s stake in Apple.)

He has been the designated successor to Buffett for at least four years and has joined Buffett on stage at the company’s investor meeting for the past several years, even before Munger’s death in November 2023.

Away from the office, he’s a huge hockey fan and serves as assistant volunteer coach for his son’s team in his hometown of Des Moines, Iowa. He’s said to have a quick wit and nurtures strong personal relationships.

“He’s not loud or bombastic, but he’s 500% friendly,” Mark Oman, a retired Wells Fargo executive and friend of Abel’s told Fortune.

What is Greg Abel’s background?

Abel started his career at the PricewaterhouseCoopers consulting firm in Canada, eventually moving to the San Francisco office. He joined CalEnergy in 1992, which six years later would acquire Des Moines-based MidAmerican Energy Holdings (which would eventually be renamed Berkshire Hathaway Energy). He began running that company in 2009. In 2018, he was asked to join the Berkshire board.

Why did Buffett pick Greg Abel to succeed him at Berkshire Hathaway?

Abel’s performance with Berkshire Hathaway Energy caught the eye of senior Berkshire executives. Through a series of acquisitions, he transformed that company into a major player in the power industry, with earnings of $5 billion in the first quarter of 2025. In 2023, Buffett told CNBC that Abel “does all the work and I take all the bows.”

He’s also seen, in many ways, as the spiritual successor to the plain-spoken, non-flashy Buffett, ensuring the culture at Berkshire Hathaway doesn’t change.

What is Greg Abel’s investment strategy?

Abel, when asked Saturday to compare his approach to dealing with Berkshire’s subsidiaries to Buffett’s, said he saw himself as “more active, but hopefully in a very positive way.”

Buffett jokingly offer a more succinct answer: “Better.” He later added, “You really need someone that behaves well on top and is not playing games for their own benefit.”

Munger, in 2023, told CNBC Abel was “a tremendous learning machine” and one could “argue that he’s just as good as Warren in learning all kinds of things.”

Abel’s not expected to pick the companies that go into the Berkshire portfolio. That will be handled by Todd Combs and Ted Weschler, who already help Buffett with that.