Trump-linked miner American Bitcoin going public via Gryphon merger

Bitcoin mining firm American Bitcoin is going public through a merger with crypto mining firm Gryphon Digital Mining, the companies announced on May 12.Under the terms of the deal, Gryphon Digital Mining will acquire American Bitcoin in a stock-for-stock transaction. After the merger, the new company will operate under the American Bitcoin brand and be led by its board of directors, which includes Eric Trump, son of US President Donald Trump. News of the merger coincided with a sharp rise in Graphon Digital Mining’s stock price, which climbed from $0.52 on May 9 to $2.15 at the time of writing, a gain of more than 313%, according to Google Finance.The announcement follows early April reports that American Bitcoin was considering an initial public offering (IPO).Gryphon Digital Mining share price. Source: Google FinanceAmerican Bitcoin is a majority-owned subsidiary of energy infrastructure, crypto mining, and data center firm Hut 8. Hut 8 CEO Asher Genoot said the company aims to make American Bitcoin “a purpose-built vehicle for low-cost Bitcoin accumulation at scale.” He added:“By taking American Bitcoin public, we expect to unlock direct access to dedicated growth capital independent of Hut 8’s balance sheet, while preserving long-term exposure to Bitcoin upside for our shareholders.”Related: Top Bitcoin miners produced nearly $800M of BTC in Q1 2025Shareholders and post-merger structureAccording to the announcement, existing American Bitcoin shareholders will own roughly 98% of the newly formed company. Following the transaction, the new company will control most of the outstanding stock.Hut 8 will continue to manage American Bitcoin’s infrastructure and operations through long-term commercial agreements. Those deals are expected, according to the announcement, to generate stable, contracted revenue streams for Hut 8’s power and digital infrastructure segments.Related: Bitcoin miner Hut 8 grows hashrate 79% despite $134M quarterly lossWhat is American Bitcoin?Hut 8 acquired a majority stake in American Bitcoin when it was unveiled at the end of March, with backing from several members of Trump's family. The company, formerly known as American Data Center, was founded by a group of investors, including Trump’s sons, Donald Trump Jr. and Eric Trump.Following the deal, American Bitcoin took ownership of Hut 8’s Bitcoin mining hardware. The announcement at the time explained that the new firm “aims to become the world’s largest, most efficient pure-play Bitcoin miner while building a robust strategic Bitcoin reserve.”Magazine: Bitcoiners are ‘all in’ on Trump since Bitcoin ’24, but it’s getting risky

Bitcoin mining firm American Bitcoin is going public through a merger with crypto mining firm Gryphon Digital Mining, the companies announced on May 12.

Under the terms of the deal, Gryphon Digital Mining will acquire American Bitcoin in a stock-for-stock transaction. After the merger, the new company will operate under the American Bitcoin brand and be led by its board of directors, which includes Eric Trump, son of US President Donald Trump.

News of the merger coincided with a sharp rise in Graphon Digital Mining’s stock price, which climbed from $0.52 on May 9 to $2.15 at the time of writing, a gain of more than 313%, according to Google Finance.

The announcement follows early April reports that American Bitcoin was considering an initial public offering (IPO).

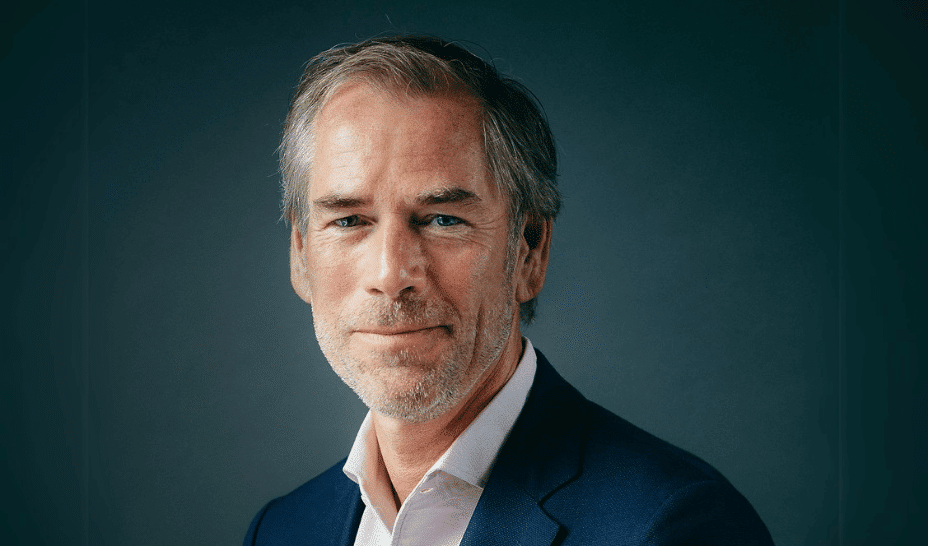

American Bitcoin is a majority-owned subsidiary of energy infrastructure, crypto mining, and data center firm Hut 8. Hut 8 CEO Asher Genoot said the company aims to make American Bitcoin “a purpose-built vehicle for low-cost Bitcoin accumulation at scale.” He added:

“By taking American Bitcoin public, we expect to unlock direct access to dedicated growth capital independent of Hut 8’s balance sheet, while preserving long-term exposure to Bitcoin upside for our shareholders.”

Related: Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Shareholders and post-merger structure

According to the announcement, existing American Bitcoin shareholders will own roughly 98% of the newly formed company. Following the transaction, the new company will control most of the outstanding stock.

Hut 8 will continue to manage American Bitcoin’s infrastructure and operations through long-term commercial agreements. Those deals are expected, according to the announcement, to generate stable, contracted revenue streams for Hut 8’s power and digital infrastructure segments.

Related: Bitcoin miner Hut 8 grows hashrate 79% despite $134M quarterly loss

What is American Bitcoin?

Hut 8 acquired a majority stake in American Bitcoin when it was unveiled at the end of March, with backing from several members of Trump's family. The company, formerly known as American Data Center, was founded by a group of investors, including Trump’s sons, Donald Trump Jr. and Eric Trump.

Following the deal, American Bitcoin took ownership of Hut 8’s Bitcoin mining hardware. The announcement at the time explained that the new firm “aims to become the world’s largest, most efficient pure-play Bitcoin miner while building a robust strategic Bitcoin reserve.”

Magazine: Bitcoiners are ‘all in’ on Trump since Bitcoin ’24, but it’s getting risky