The Stock Market Just Did Something That's Only Happened in 4 Other Periods Since 1987. History Offers a Crystal Clear Answer for What Happens Next

President Donald Trump's tariff announcements on April 2 triggered a historic sell-off. The broader benchmark S&P 500 (SNPINDEX: ^GSPC) fell an astounding 10.5% in two days, one of the worst moves seen in nearly 40 years. In fact, the move was so bad that it's only happened in four other periods since 1987. Situations like this can be very scary for investors because it seems like the selling will never end and that the world might be permanently changed.With tariffs, Trump is attempting to reconfigure the global supply chain, bring manufacturing back to the U.S., and erase the country's global trade deficit, an ambitious slate of goals to pursue all at once and so swiftly. The future is always uncertain, but history offers a crystal clear answer for what has historically happened after this kind of intense sell-off.The stock market has suffered several steep sell-offs over the last four decades, typically caused by some disturbance in the economy. In 1987, there was Black Monday, then the Great Recession in 2008, and of course the COVID-19 pandemic in 2020. The Great Recession in 2008 led to multiple two-day sell-offs that are among the worst of all time, although I am grouping these seven instances into one period, considering they all happened within two months.Continue reading

President Donald Trump's tariff announcements on April 2 triggered a historic sell-off. The broader benchmark S&P 500 (SNPINDEX: ^GSPC) fell an astounding 10.5% in two days, one of the worst moves seen in nearly 40 years. In fact, the move was so bad that it's only happened in four other periods since 1987. Situations like this can be very scary for investors because it seems like the selling will never end and that the world might be permanently changed.

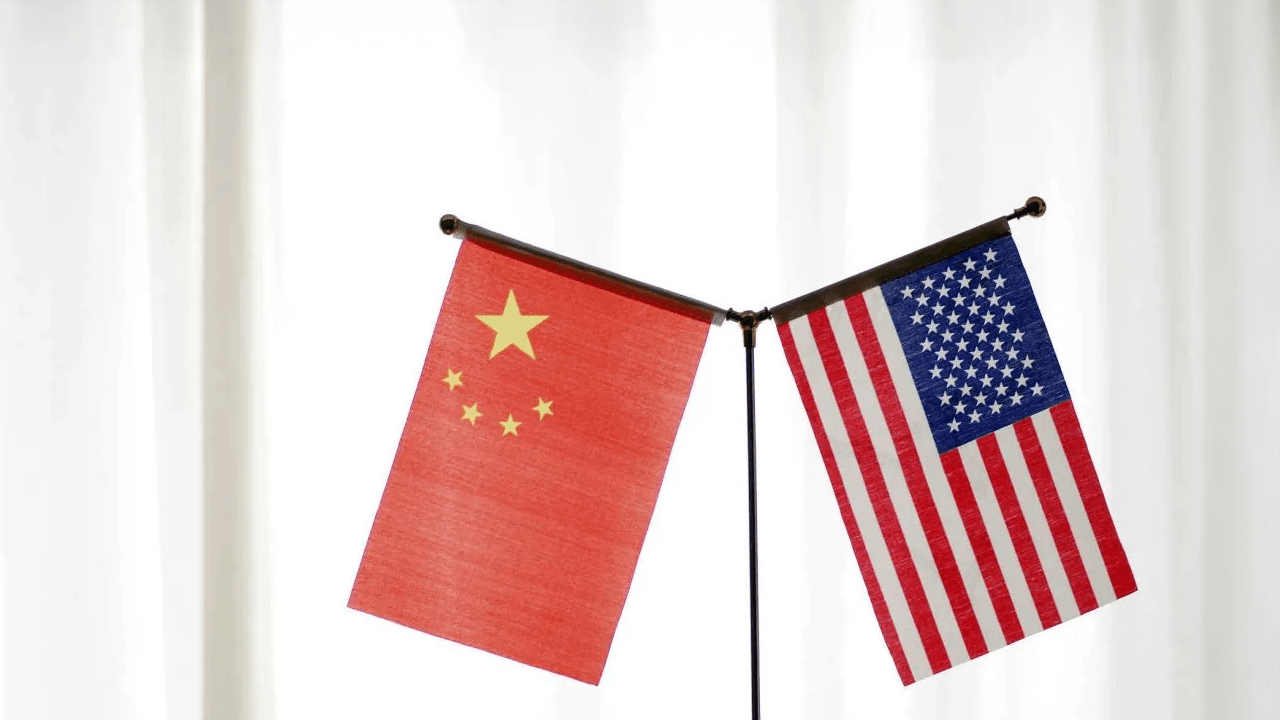

With tariffs, Trump is attempting to reconfigure the global supply chain, bring manufacturing back to the U.S., and erase the country's global trade deficit, an ambitious slate of goals to pursue all at once and so swiftly. The future is always uncertain, but history offers a crystal clear answer for what has historically happened after this kind of intense sell-off.

The stock market has suffered several steep sell-offs over the last four decades, typically caused by some disturbance in the economy. In 1987, there was Black Monday, then the Great Recession in 2008, and of course the COVID-19 pandemic in 2020. The Great Recession in 2008 led to multiple two-day sell-offs that are among the worst of all time, although I am grouping these seven instances into one period, considering they all happened within two months.

![31 Top Social Media Platforms in 2025 [+ Marketing Tips]](https://static.semrush.com/blog/uploads/media/0b/40/0b40fe7015c46ea017490203e239364a/most-popular-social-media-platforms.svg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)