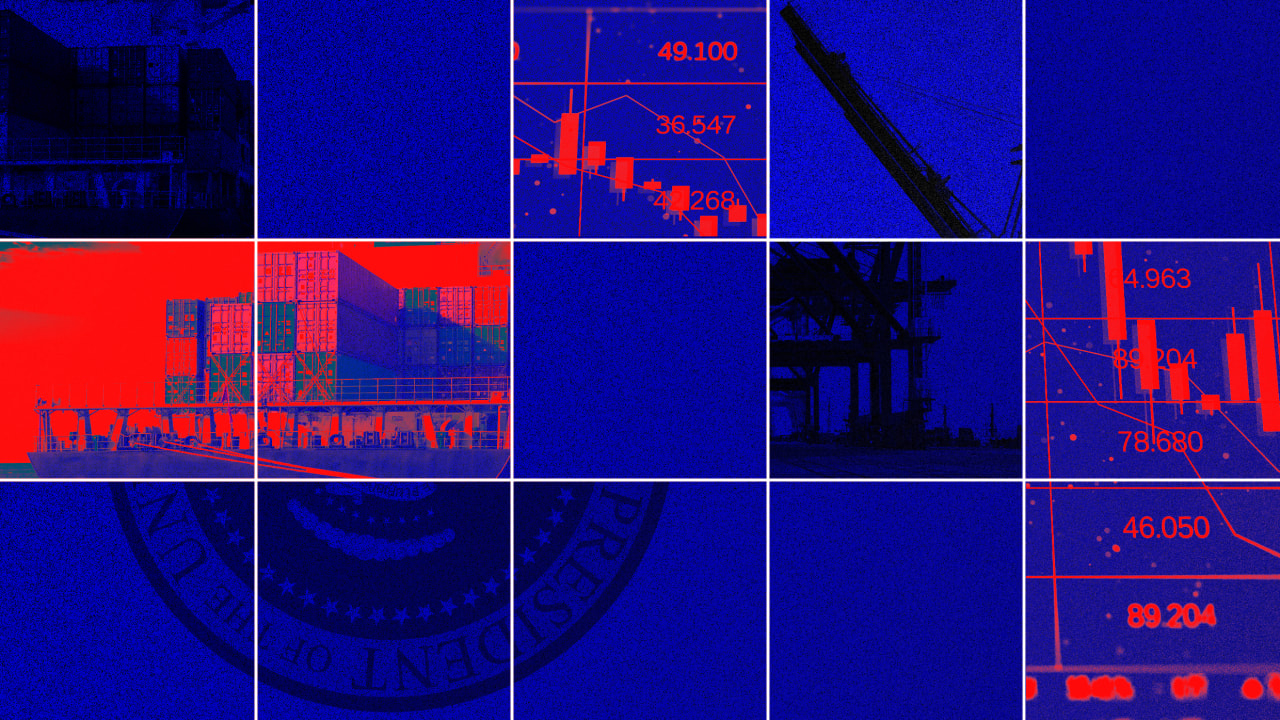

The Stock Market Just Did Something for Only the 29th Time in 75 Years -- and It Has a 96% Success Rate of Forecasting What's Next for the S&P 500

Wall Street's most-trying times often bring about outsized returns.

For the better part of the last century, the stock market has been a wealth-generating machine. Though other asset classes have been successful in increasing the nominal wealth of investors, such as gold, Treasury bonds, and real estate, nothing has come close to the annualized returns generated by stocks.

But while this wide-lens view of the stock market paints a masterpiece, narrowing the timeline exposes the proverbial speed bumps and potholes investors regularly encounter.

Since the broad-based S&P 500 (SNPINDEX: ^GSPC) peaked in mid-February, all three major U.S. stock indexes have declined by a double-digit percentage. Both the mature stock-driven Dow Jones Industrial Average (DJINDICES: ^DJI) and S&P 500 have firmly dipped into correction territory. Meanwhile, the growth-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) officially fell into a bear market, as of April 8.

![Experts Don’t Believe AI Tools Will Lead to Mass Job Losses [Infographic]](https://imgproxy.divecdn.com/gcXE1_Da13Oz-JAszjUwb6v5UqMp2MFMjDAIXPbLad0/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9qb2JfbG9zc2VzLnBuZw==.webp)