Stock Market Sell-Off: 3 "Magnificent Seven" Stocks Down 20% or More to Buy Right Now

Even though the stock market has rebounded since "Liberation Day" three weeks ago, it has not been a fun year for technology investors. Plenty of "Magnificent Seven" stocks are still down over 20% from all-time highs, including Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Meta Platforms (NASDAQ: META). Wall Street is concerned about tariffs and their impact to 2025 earnings.This short-sighted thinking can be a buying opportunity for investors focused on more than just the next few quarters. Here's why these three are perfect stocks to buy the dip on during this market volatility.Meta Platforms owns three of the largest social media platforms in the world: Facebook, Instagram, and WhatsApp. Last quarter, 3.35 billion people used a Meta service every day. Excluding China -- where Meta does not operate -- that is over half of the world's population using a Meta product daily. That incredible global scale is rivaled only by its other technology peer in Alphabet.Continue reading

Even though the stock market has rebounded since "Liberation Day" three weeks ago, it has not been a fun year for technology investors. Plenty of "Magnificent Seven" stocks are still down over 20% from all-time highs, including Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Meta Platforms (NASDAQ: META). Wall Street is concerned about tariffs and their impact to 2025 earnings.

This short-sighted thinking can be a buying opportunity for investors focused on more than just the next few quarters. Here's why these three are perfect stocks to buy the dip on during this market volatility.

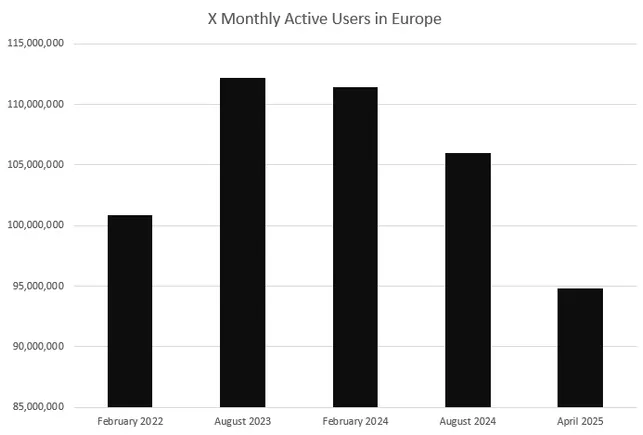

Meta Platforms owns three of the largest social media platforms in the world: Facebook, Instagram, and WhatsApp. Last quarter, 3.35 billion people used a Meta service every day. Excluding China -- where Meta does not operate -- that is over half of the world's population using a Meta product daily. That incredible global scale is rivaled only by its other technology peer in Alphabet.