Rizta to drive success for Ather as it banks on expanding distribution to reach profitability

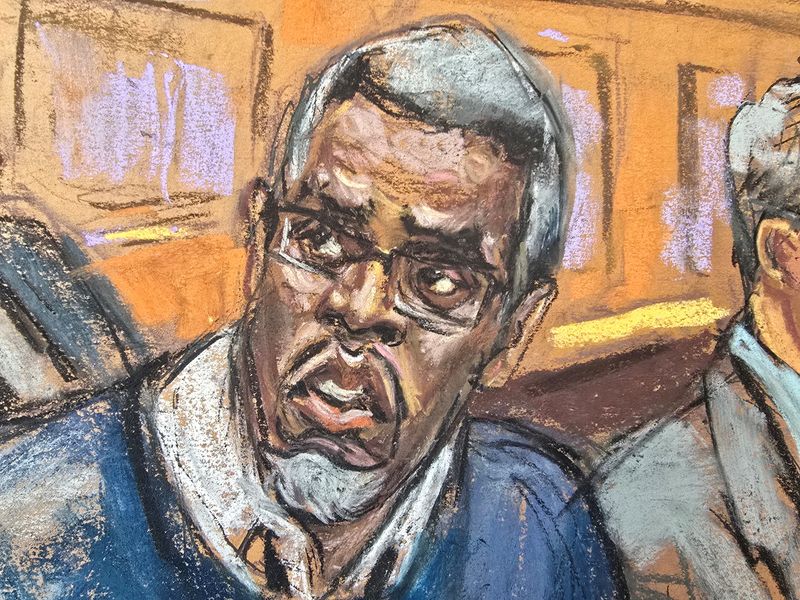

In its post earnings call, CEO and Co-founder Tarun Mehta said that Ather hopes to eat into its peers’ user base in those cities where Ather is yet to set up its first stores, as part of its distribution expansion strategy.

Electric vehicle manufacturer Ather Energy reiterated its focus on profitability and added that the company is counting on expanding its distribution centres to contribute positively to total sales and help with margins.

According to the firm’s presentation deck, the Hero MotoCorp backed company has added 143 experience centres in FY25 in India, bringing the total store footprint to 351.

Ather’s CEO and Co-founder Tarun Mehta also said that the company is looking to reel in its expenses going forward. While marketing expenses will continue to be strong, on a percentage basis, this is expected to see a downward trajectory. “Ather has never been a discount-led brand or a very, very marketing-pushed brand,” Mehta added.

Meanwhile, the company’s products continue to show strong demand, primarily in the southern states, where Ather has hit a 22.4% market share in Q4, according to Mehta. The company has had a historically strong market in the south as opposed to other regions.

However, it is seeing rising demand for its vehicles from non-South markets and is expected to be important growth driver in the coming quarters.

Additionally, the company’s transition to a lithium iron phosphate (LFP) battery is expected to be cheaper than lithium nickel manganese cobalt (NMC) batteries, which are currently used in Ather’s scooters.

Adoption of LFP batteries, which has been traditionally used in four-wheelers, has posed unique challenges in the two-wheeler segment due to constraints in energy and packaging density. However, these battery packs might be a bit difficult to be packaged in higher-range versions, Mehta noted.

“LFP generally tends to be 15-20% cheaper compared to NMC globally. Also, the big advantage of LFP is it's a more supply chain resilient chemistry. There are fewer fluctuations in pricing, unlike NMC, where you've got nickel, manganese, and cobalt—dangerous compounds, from a supply chain perspective, coming together,” he said.

Ather has also seen rising number of units being sold in the quarter compared to the year-ago period, contributing positively to its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) margins.

It sold 1,55,394 units in FY25 compared to 1,09,577 last year. This helped narrow its EBITDA loss margin to 23% in FY25 compared to 36% in FY24.

Shares of the Bengaluru-based company closed up 3.3% at Rs 310 apiece on Monday post its Q4 results—the company’s first financial results announcement post its listing last week.

Edited by Jyoti Narayan

![[Weekly funding roundup May 3-9] VC inflow into Indian startups touches new high](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)