Prediction: The Block Sell-Off Is a Buying Opportunity

Block (NYSE: XYZ) got blocked by a number of potential investors after the fintech company's first-quarter earnings disappointed the market. The stock is now trading down more than 46% on the year as of this writing, following its recent sell-off.While best known for its original Square business, it was Block's Cash App business that led to the sell-off. Square was originally developed to allow merchants to accept credit card payments from their phones and tablets and has since become a platform that lets retailers better manage their entire operation. Cash App is a peer-to-peer payment platform that sprang out of the business that was launched in 2013 under the name Square Cash. Cash App has since grown to be an important part of Block's business, offering additional services such as savings accounts, brokerage accounts, crypto services, debit cards, lending, and tax preparation, all in an attempt to grow its user base and better monetize it. However, despite its continued push into lending and other financial services, the company saw a material deceleration in inflows while active user growth stalled.Continue reading

Block (NYSE: XYZ) got blocked by a number of potential investors after the fintech company's first-quarter earnings disappointed the market. The stock is now trading down more than 46% on the year as of this writing, following its recent sell-off.

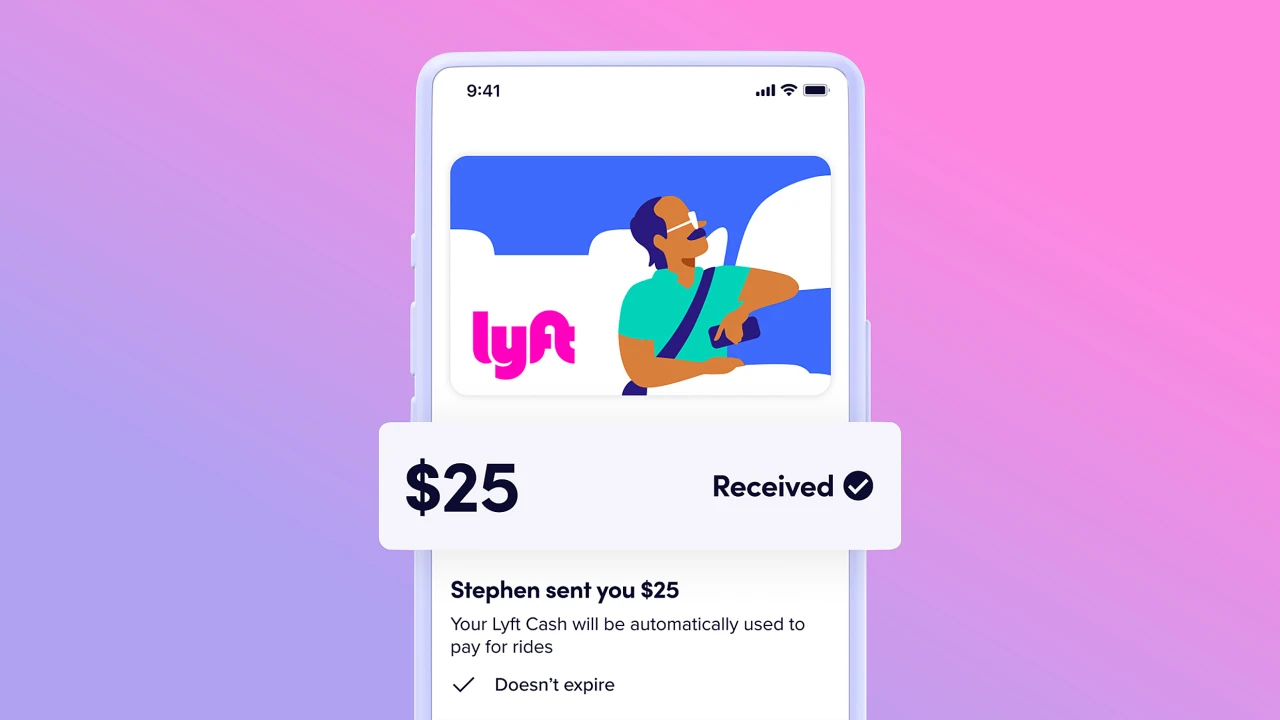

While best known for its original Square business, it was Block's Cash App business that led to the sell-off. Square was originally developed to allow merchants to accept credit card payments from their phones and tablets and has since become a platform that lets retailers better manage their entire operation. Cash App is a peer-to-peer payment platform that sprang out of the business that was launched in 2013 under the name Square Cash.

Cash App has since grown to be an important part of Block's business, offering additional services such as savings accounts, brokerage accounts, crypto services, debit cards, lending, and tax preparation, all in an attempt to grow its user base and better monetize it. However, despite its continued push into lending and other financial services, the company saw a material deceleration in inflows while active user growth stalled.