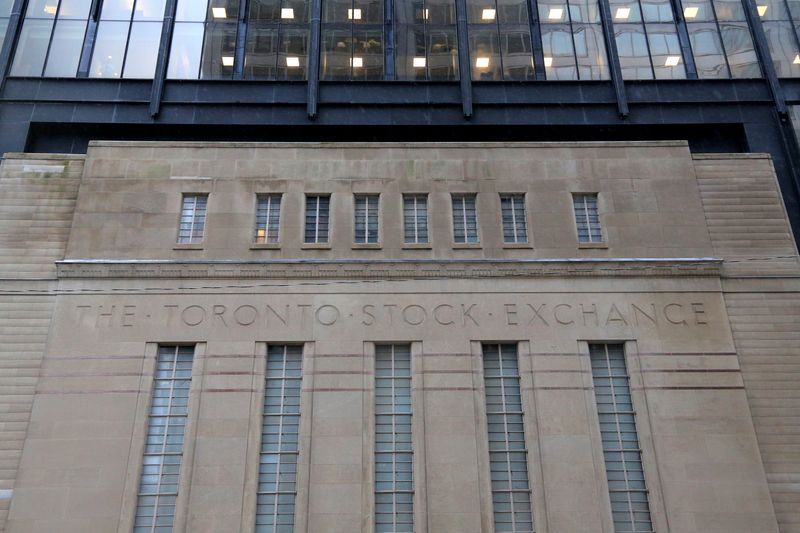

Nvidia's China Risk: Is It a Red Flag for Investors?

Shares of Nvidia (NASDAQ: NVDA) tumbled last week after the company announced that it would take a charge of up to $5.5 billion related to China export restrictions.The company said it would no longer be able to export its H20 chip, a less powerful version of its H100 GPU and designed to comply with earlier export rules, without a license. Nvidia's filing implies that getting a license is unlikely. Wall Street analysts had varying estimates of the impact to Nvidia's bottom line. Wedbush said that the restriction would lower its revenue by 10%. Bank of America said a "dire" tariffs scenario would reduce revenue by 9% to 13% in 2025 and 2026. The reduction in Nvidia's revenue will be more than the $5.5 billion charge since that reflects the cost of the chips rather than their selling price. Continue reading

Shares of Nvidia (NASDAQ: NVDA) tumbled last week after the company announced that it would take a charge of up to $5.5 billion related to China export restrictions.

The company said it would no longer be able to export its H20 chip, a less powerful version of its H100 GPU and designed to comply with earlier export rules, without a license. Nvidia's filing implies that getting a license is unlikely.

Wall Street analysts had varying estimates of the impact to Nvidia's bottom line. Wedbush said that the restriction would lower its revenue by 10%. Bank of America said a "dire" tariffs scenario would reduce revenue by 9% to 13% in 2025 and 2026. The reduction in Nvidia's revenue will be more than the $5.5 billion charge since that reflects the cost of the chips rather than their selling price.

![Which Countries Have Invested the Most Into AI Development [Infographic]](https://imgproxy.divecdn.com/qnTgGmUnhhtyx1NChJZ7bBc4fHuHc9BC8NoXo_nBWUE/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9pbnZlc3RtZW50X2luZm8yLnBuZw==.webp)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)