Morgan Stanley planned to convince Mark Zuckerberg to buy WhatsApp before Google could scoop it up and build a social media platform to rival Facebook

Zuckerberg worried about Google diving into social media, and created a competitive buffer around Meta through M&A, according to allegations in court documents.

- In a bid to advise WhatsApp, Morgan Stanley planned to emphasize the dangers of Google owning the messaging platform to Facebook execs, according to a Federal Trade Commision expert witness Jihoon Rim. Zuckerberg had reportedly been concerned about another company acquiring WhatsApp and its user base to build a social media platform, according to court documents.

If Google acquired WhatsApp instead of Meta (then Facebook), the search engine-driven tech firm would have threatened Facebook’s dominance in the world of social media. At least that was Morgan Stanley’s pitch when the bank sought to advise WhatsApp during acquisition talks, according to a Federal Trade Commission expert witness.

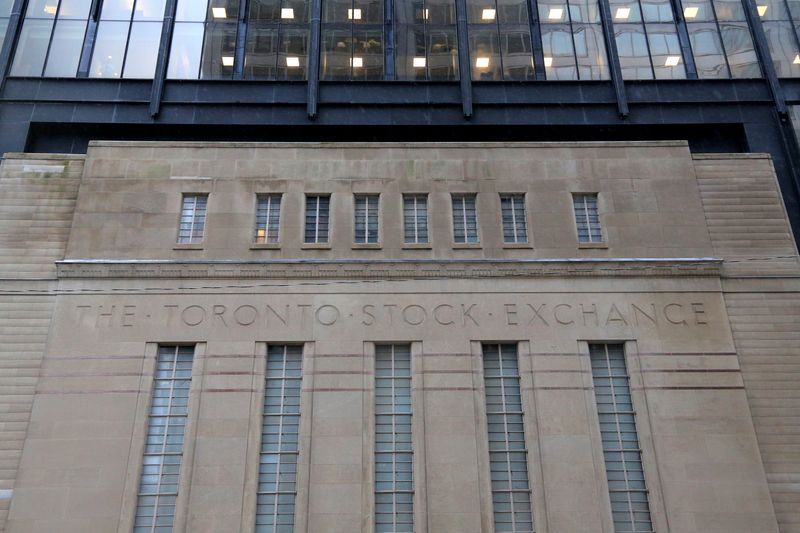

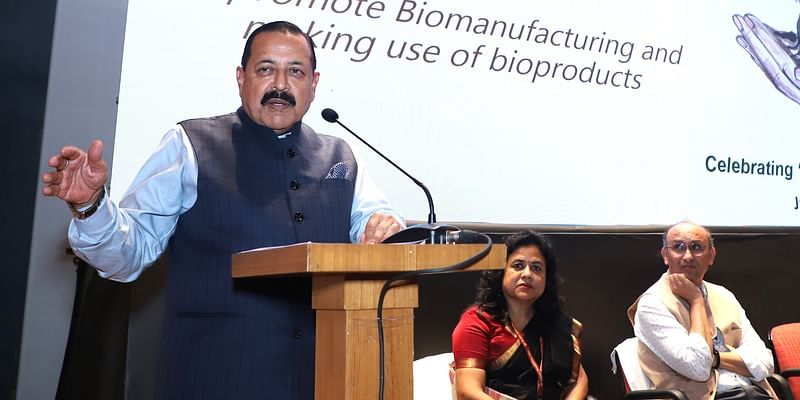

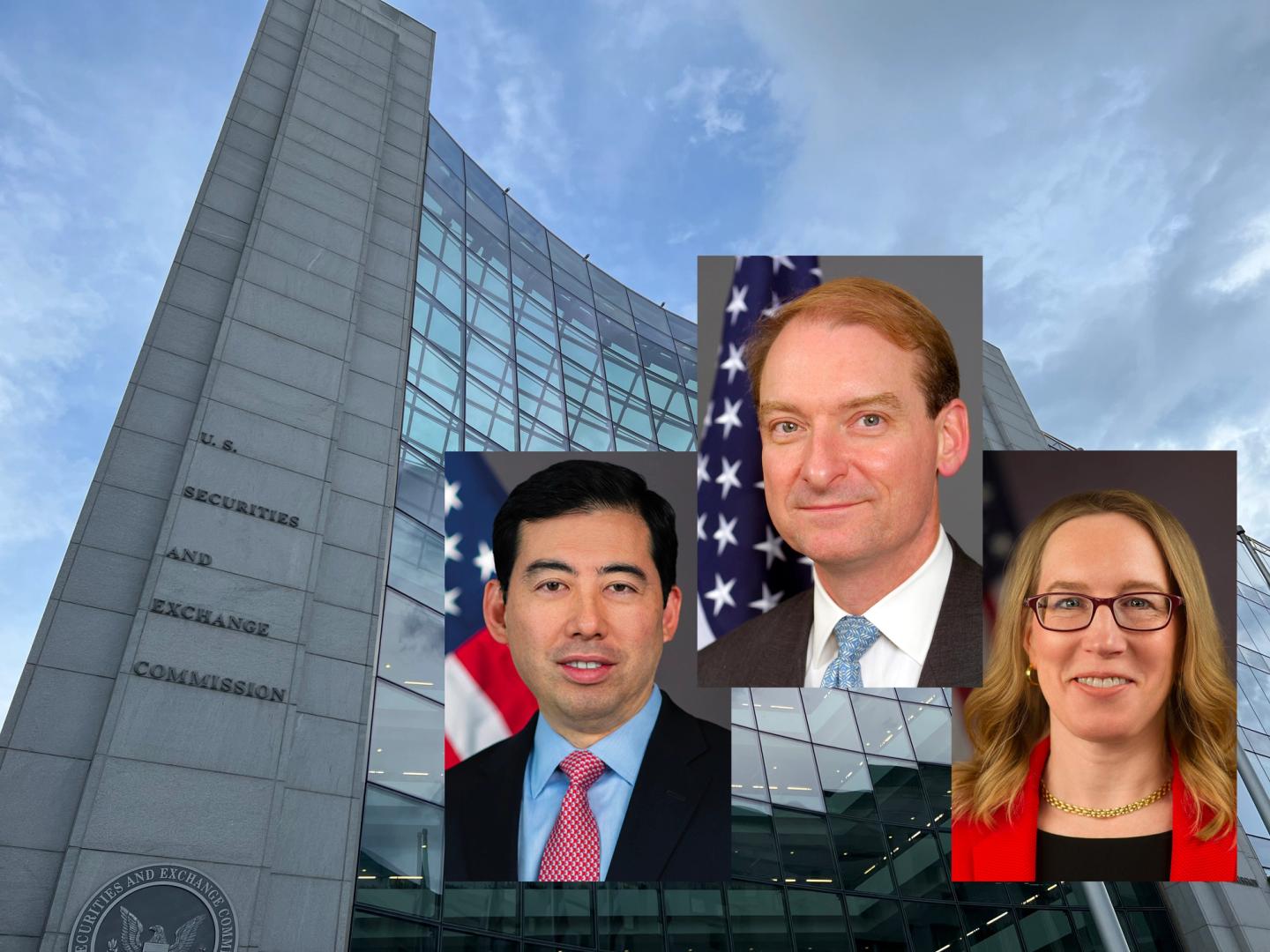

Last week, the high-stakes antitrust trial began between Meta and the FTC, in which the agency has alleged the company has built a social media monopoly through its acquisitions of Instagram and WhatsApp. If found to have violated antitrust laws, Meta could be forced to divest these platforms, which are central to the social media giant’s revenues and strategic long-term growth plans. Executives who have been called to testify during the 8-week trial include CEO Mark Zuckerberg, chief operating officer Sheryl Sandberg, and Instagram co-founder Kevin Systrom.

On Monday, the FTC called on Jihoon Rim, New York University professor and former CEO of messaging app and WhatsApp competitor Kakao, as its expert witness, The Verge reported.

During Rim’s testimony, he emphasized that both WhatsApp and Instagram were “highly likely to be successful” regardless of an acquisition. Both platforms saw 60% of their monthly active users on a daily basis, and WhatsApp's lead investor—Jim Goetz of Sequoia Capital—had dubbed the app the highest-engagement platform he had ever seen, according to Rim.

WhatsApp's success made Meta executives nervous after the messaging platform saw breakout popularity overseas, surpassing Meta’s Facebook Messenger. But the real danger was WhatsApp's potential as a social media competitor, according to a 92-page memorandum opinion that was introduced in the case. The memo, a ruling on cross-motions for summary judgment, also outlines the FTC antitrust lawsuit against Meta, specifically surrounding the company’s acquisitions of WhatsApp and Instagram.

Meta leadership was openly concerned about WhatsApp’s scalability into more than just a messaging platform if Meta didn’t buy it or another competitor got to it first. According to the memorandum opinion, during an internal presentation some leaders said WhatsApp was “‘one of the most significant competitive threats [Meta] face[s]’ because developers were ‘increasingly moving into core social networking product areas,’ posing ‘a direct threat to [Meta’s] primary products.’”

Additionally, in February 2013, Zuckerberg alerted the company’s board of directors that the “use of M&A to build a competitive moat around [Meta] on mobile and ads” was necessary. He emphasized that “the biggest competitive vector for [Meta] is for some company to build out a messaging app for communication with small groups of people, and then transform that into a broader social network,” according to the memo.

Subsequently, Morgan Stanley wanted in on a deal between the messaging platform and a potential buyer. In its bid to advise WhatsApp, Morgan Stanley bankers drew on Zuckerberg’s concerns about potential Facebook rivals, including any budding deal between Google and WhatsApp.

“WhatsApp could determine the social network winner on mobile,” the bank wrote on a deck referenced by Rim in the trial as reported by The Verge. “Google’s resources combined with WhatsApps’s user base and traction could create the predominant social network on Mobile (surpassing Facebook).”

While it's unclear if the specific pitch was ever delivered, Morgan Stanley represented WhatsApp during the acquisition negotiation in early 2014.

Morgan Stanley and Rim did not immediately return Fortune’s request for comment.

Google was interested in acquiring the message platform, and reportedly had been trying since 2010 after its plans to grow social media platform Google+ failed to gain traction.

Ultimately, Meta paid $19 billion for WhatsApp in February 2014 after its acquisition of Instagram for $1 billion in April 2012. The FTC originally approved the acquisitions at the respective times of purchase, but is now seeking to unwind Meta’s ownership by breaking up the company. The FTC alleges the effects of the acquisitions have been anticompetitive.

The trial is expected to continue this week with witnesses such as TikTok’s head of operations Adam Presser, VP of Product at X Keith Coleman, and former Google exec Bradley Horowitz.

The FTC, Meta and Google did not return Fortune’s request for comment.

This story was originally featured on Fortune.com

![Which Countries Have Invested the Most Into AI Development [Infographic]](https://imgproxy.divecdn.com/qnTgGmUnhhtyx1NChJZ7bBc4fHuHc9BC8NoXo_nBWUE/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9pbnZlc3RtZW50X2luZm8yLnBuZw==.webp)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)