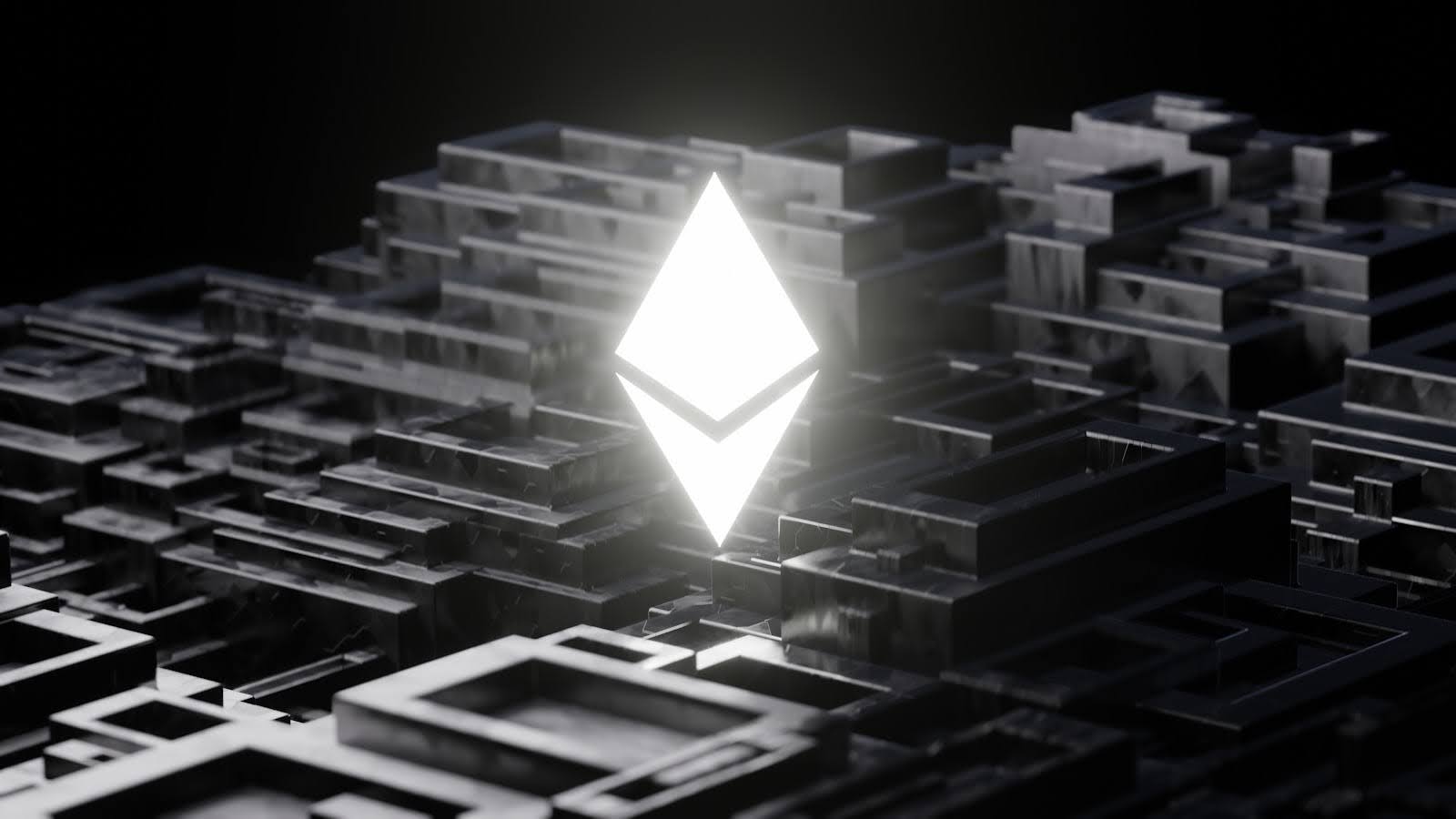

Monero price prediction: is XMR on course to $235 after the golden cross?

Golden cross signals potential rise for Monero price. Monero (XMR) may hit $235, but volatility and governments cracking down on privacy coins pose a real risk. XMR price will have to hold above $200 and surge above $230 to attempt reaching $235. Since its launch in 2014, Monero (XMR) has carved a niche by offering […] The post Monero price prediction: is XMR on course to $235 after the golden cross? appeared first on CoinJournal.

- Golden cross signals potential rise for Monero price.

- Monero (XMR) may hit $235, but volatility and governments cracking down on privacy coins pose a real risk.

- XMR price will have to hold above $200 and surge above $230 to attempt reaching $235.

Since its launch in 2014, Monero (XMR) has carved a niche by offering secure, untraceable transactions through advanced cryptographic techniques like ring signatures and stealth addresses.

Unlike Bitcoin, where transaction details are an open book, Monero keeps sender, receiver, and amount under wraps, making it a go-to for those who value financial discretion.

XMR price forms a golden cross on the hourly chart

However, while the Monero blockchain is hailed for its privacy, its native token, XMR, has been on a roller coaster since hitting a high of $239.18 in February.

The privacy coin has been hitting lower highs and lower lows until April 7, 2025, when it hit a low of $185.60 on Kraken and started bouncing back up.

At press time on April 16, 2025, the Monero price had risen to around $219 after a golden cross on April 13, 2025.

The golden cross, a classic bullish signal, happens when a short-term moving average, like the 50-day, crosses over a long-term one, such as the 200-day.

Historically, this pattern hints at upward momentum, and it’s got traders eyeing potential gains.

The price has since steadied, with resistance looming at $230 and $235, and support holding at $200 and $193.

This technical setup suggests Monero price could be gearing up for a breakout, but the road ahead isn’t without hurdles.

Monero price prediction

Monero’s privacy edge gives it a unique advantage as demand for secure transactions grows.

Rising cyber threats and a push for financial autonomy could drive adoption, nudging its price upward.

On the flip side, governments cracking down on privacy coins pose a real risk.

Enhanced blockchain analytics might also chip away at Monero’s anonymity, though its tech remains a tough nut to crack.

These dynamics make its price trajectory a balancing act between innovation and external pressures.

After dipping to $165 earlier this year and rallying sharply to around $219, Monero’s recent price movements tell a story of recovery.

The golden cross has added fuel to the fire, reinforcing optimism among investors, with most anticipating a surge past $230 rather than a drop towards the $200 support.

This optimism leans on technical signals and a Fear & Greed Index showing fear, which could flip into a buying spree.

However, more cautious estimates peg Monero (XMR) between $185 and $279 by year-end, with Bitcoin’s performance, regulatory shifts, and growing demand for privacy in digital transactions playing a role in shaping these outlooks.

Past performance also offers some clues. Back in 2017, Monero rocketed from $13.79 to $349.55 in a single year, proving it’s capable of big leaps.

But today’s landscape is trickier, with tighter regulations and rival privacy coins in the mix.

If Monero price holds above $200 and clears $230, $235 looks plausible, although the broader market trends will have the final say.

The post Monero price prediction: is XMR on course to $235 after the golden cross? appeared first on CoinJournal.

![31 Top Social Media Platforms in 2025 [+ Marketing Tips]](https://static.semrush.com/blog/uploads/media/0b/40/0b40fe7015c46ea017490203e239364a/most-popular-social-media-platforms.svg)

![[Weekly funding roundup April 12-18] VC inflow declines to 2nd lowest level for the year](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)