In a first, a pension fund has voted to block new investments in Tesla: ‘Musk has destroyed the brand’

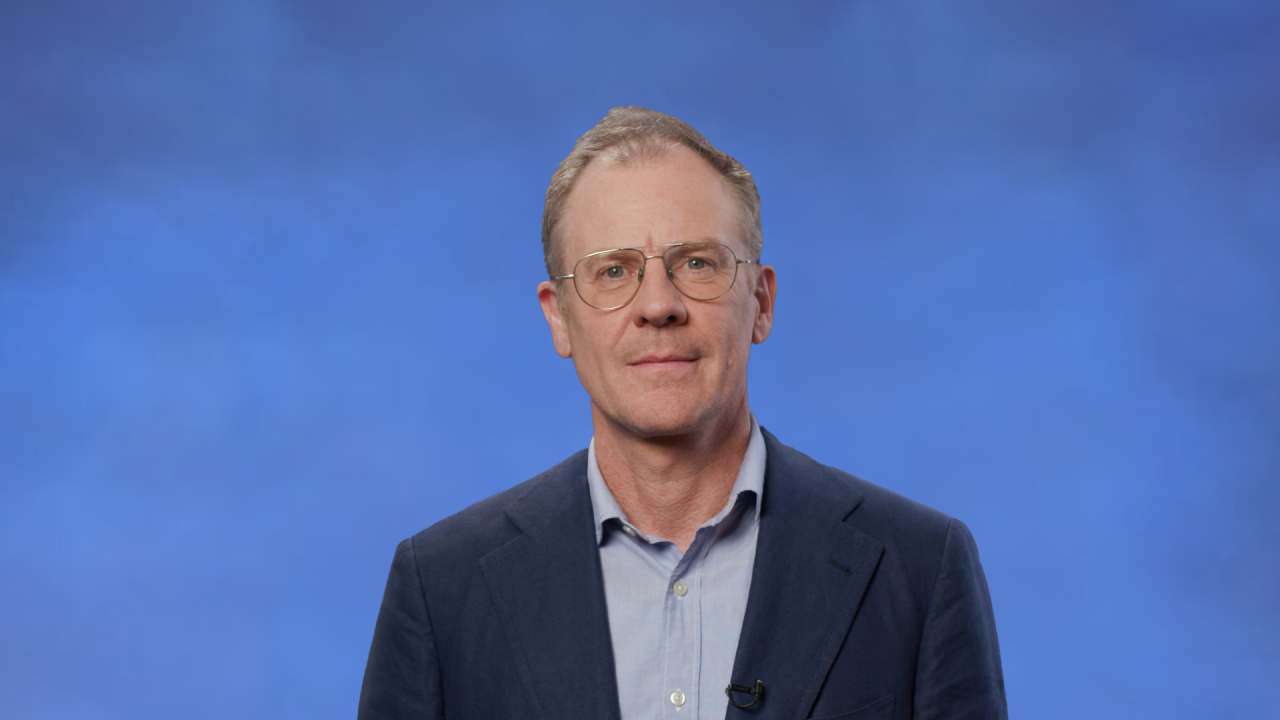

“He doesn’t seem to care that when he’s out there with a chainsaw it impacts people,” said Controller Mark Pinsley.

- A U.S. pension fund has taken measures to pause new buying in Tesla stock because of the risks posed by the carmaker’s CEO Elon Musk and the lagging financial performance at the company. Lehigh County Controller Mark Pinsley said the fiduciary oversight duties of the pension board required them to clearly understand the risks of further investing retirees’ assets in the Tesla without more information.

Pennsylvania’s Lehigh County Pension Board, which oversees retirement assets valued at about $593 million, voted this week to immediately stop new investments in Tesla in the county’s actively managed investment funds.

The relatively small pension, which has less than 1% of its assets invested in Tesla stock through S&P 500-based index funds, is the first in the U.S. to take such a step, although lawmakers in other states have encouraged treasurers and fiduciaries to consider limiting further investments in the electric vehicle company. Lehigh County Controller Mark Pinsley told Fortune that even despite Tesla CEO Elon Musk’s decision to refocus his attention on the electric carmaker, Musk’s public actions have inflicted considerable damage on the brand.

“I don’t think him going back to Tesla is what makes a difference,” said Pinsley. “What makes a difference is if he keeps his face out of the news.”

Musk’s moves at X, formerly Twitter, are a cautionary tale for investors as to how Musk thinks about brand value and reputation, the controller said.

“He literally threw away the Twitter brand and now he’s basically doing the same thing to Tesla,” Pinsley said. “He doesn’t seem to care that when he’s out there with a chainsaw it impacts people. They know his political bent and they don’t want to buy from him—and he represents Tesla.”

Tesla did not immediately respond to a request for comment.

In a four-to-two vote, the pension board directed no new investments until its next meeting, and ordered a report from its investment consultant detailing Tesla’s financial, governance, and reputational risks and the fund’s exposure. The resolution cited Tesla’s recent 71% plunge in net income to $409 million in the first quarter, 9% drop in total revenues to $19.3 billion, and the 20% drop in automotive revenue to $13.9 billion.

Musk has faced significant criticism for his work with President Donald Trump and the Department of Government Efficiency (DOGE) which has slashed millions in government funding and thousands of federal jobs. Tesla analysts and investors have begged Musk to step back from his work in government and redirect his energy toward Tesla. In a call with analysts last month, Musk pledged to reduce his time on DOGE efforts and give Tesla more attention.

“Probably starting next month, in May, my time allocation at DOGE will drop significantly,” Musk said. “I’ll have to continue doing it. I think we have the remainder of the President’s term just to make sure that the waste and fraud that we stopped does not come roaring back, which it’ll do if it has the chance.”

Musk said he would spend “a day or two per week on government matters for as long as the President would like me to do so, as long as it is useful.”

Trump, for his part, told Musk during a White House Cabinet meeting that Musk was “invited to stay as long as you want” in his administration.

Tesla, meanwhile, has seen sales plummet in Europe and China. Even in California, long a stronghold of the EV market, new registrations for Tesla-made electric vehicles have slipped 15% year over year, according to the California New Car Dealers Association, while registrations for all other zero-emission vehicles rose 35%. Tesla’s market share in California fell from 55.5% in the first quarter of 2024 to 43.9% this year.

The group attributed the declines to “an aging product lineup and backlash against Elon Musk’s political initiatives.”

This story was originally featured on Fortune.com

-Reviewer-Photo-SOURCE-Julian-Chokkattu-(no-border).jpg)