How tariffs could change the way Americans buy video games

In a time where tariff price hikes are invading seemingly every element of life, diving into a video game could offer a welcome reprieve, both spiritually and fiscally. Digital video games do not require materials, shipping, or manufacturing costs, allowing them to cross borders without incurring extra fees. And the video game industry has been shifting to digital long before Trump’s so-called Liberation Day. “In terms of software, PC gaming is now overwhelmingly digital, and physical versions are largely obsolete,” says Manu Rosier, market intelligence director at Newzoo. “We do not expect tariffs to significantly impact the price of video game software.” However, video-game-industry analysts say that although the prices of digital software likely will not increase, stress about the tariffs may still cause a shift in U.S. consumer spending on games. When thinking about the ways that spending on games may change in the coming months, Mat Piscatella, executive games director at Circana, says that it’s important to consider the ways that other parts of life will be impacted by the tariffs. “One of the big reasons for what we saw happen with the November elections was around the cost of everyday-spending categories like groceries and housing,” he says. “That certainly won’t be alleviated in the current tariff layout, and so that could further push video game consumers toward the big free-to-play or more accessible games.” Because of this, Piscatella tentatively projects that the video game industry may see a drop in demand for premium video games. However, games with long and deep connections to their player bases—such as Fortnite, Minecraft, Grand Theft Auto, Roblox, and Call of Duty—could gain more ground. In Newzoo’s 2025 PC and Console Gaming Report, analysts found that in 2024, 58% of all PC gaming revenue came from microtransactions, such as players purchasing loot boxes and other in-game goods. This was only a 1.4% growth increase from 2023, but tariff worries could prompt a steeper incline. “Spending $5 or $20 on a game you already love is easier than dropping $80 on a new title,” says Piscatella. “These titles already have social and monetary hooks that keep players engaged.” This continued engagement is crucial in the video game industry, which hit peak audience growth during the worst years of the COVID-19 pandemic. “From the late ’70s onward, every year we would have more people playing and more people playing for more hours,” says Piscatella. “Then, in 2020 and 2021, we had this huge wave of people come in. So we hit a ceiling on both the number of players and hours of engagement, in the U.S. in particular.” Ever since then, the goals of the industry have shifted from growing the audience to maintaining and increasing the spending from the existing audience. One part of the gaming industry that will have a more difficult time with retention is undoubtedly physical games and gaming hardware in general. This is bad news for a company like Nintendo which was set to begin preorders in the U.S. for its Switch 2 but had to push the date back to April 24 due to tariff announcements. A chief concern revolves around the Switch 2. “Nintendo systems are the most physical forward of all the in-market devices. They’ve made a big point about delivering physical software so games could be easily shared among family members,” says Piscatella. “How many units of Switch hardware can you even allocate to the U.S., given all the uncertainties, right? How much is the potential market for physical cartridges really going to be, at least in the short term?” Rosier agrees. “Tariffs could affect packaged games, which are already set to be more expensive than their digital versions,” he says. “This might encourage more players to shift to digital, and Nintendo may adjust physical production accordingly.” However, it’s important to note that economic factors are shifting so rapidly that it is difficult to make any solid predictions of the future to come. “Right now the uncertainties are off the charts,” says Piscatella. “People will still love video games and they’ll still play them, but how they play them and how they spend on them, that might certainly change.”

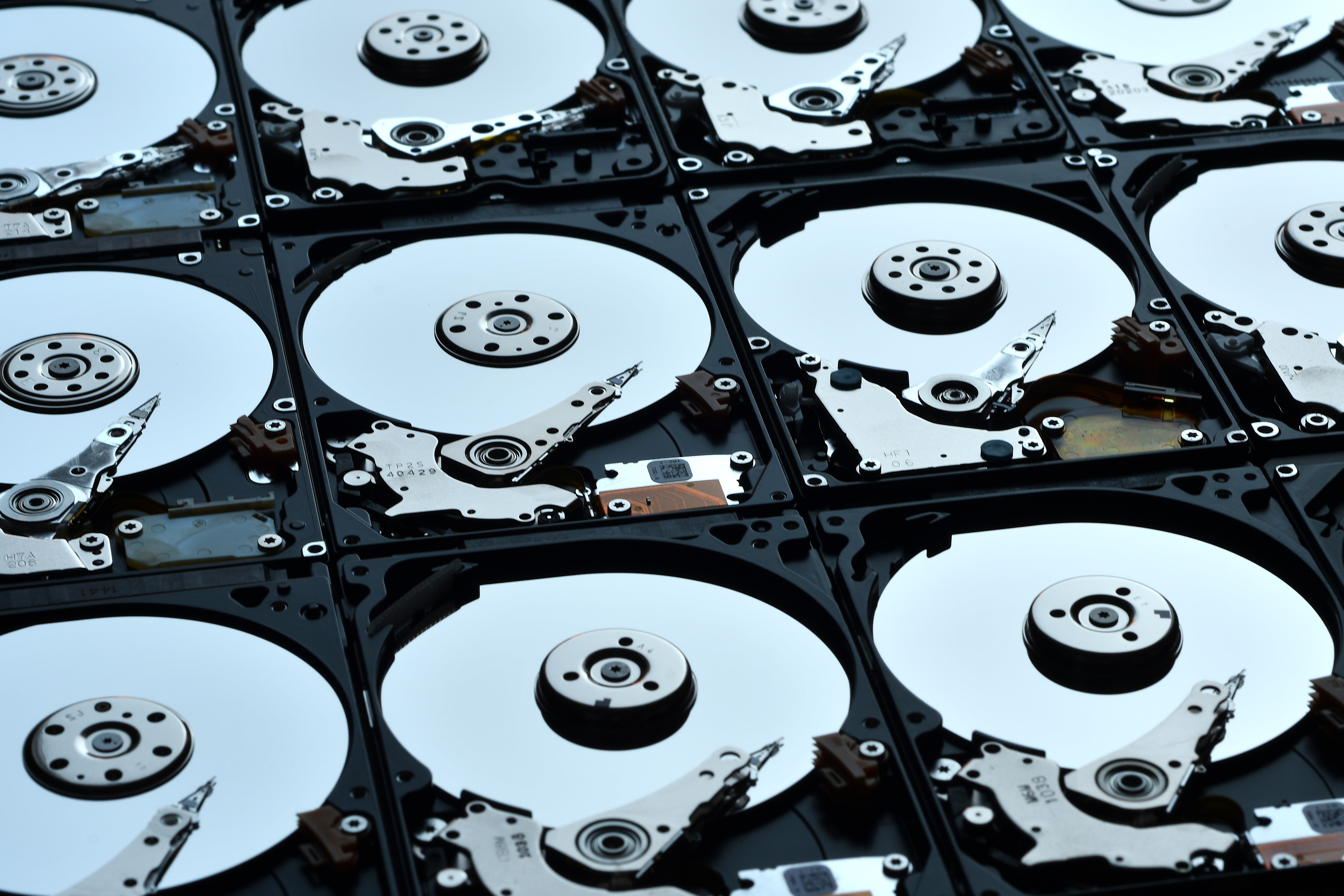

In a time where tariff price hikes are invading seemingly every element of life, diving into a video game could offer a welcome reprieve, both spiritually and fiscally. Digital video games do not require materials, shipping, or manufacturing costs, allowing them to cross borders without incurring extra fees. And the video game industry has been shifting to digital long before Trump’s so-called Liberation Day.

“In terms of software, PC gaming is now overwhelmingly digital, and physical versions are largely obsolete,” says Manu Rosier, market intelligence director at Newzoo. “We do not expect tariffs to significantly impact the price of video game software.”

However, video-game-industry analysts say that although the prices of digital software likely will not increase, stress about the tariffs may still cause a shift in U.S. consumer spending on games.

When thinking about the ways that spending on games may change in the coming months, Mat Piscatella, executive games director at Circana, says that it’s important to consider the ways that other parts of life will be impacted by the tariffs. “One of the big reasons for what we saw happen with the November elections was around the cost of everyday-spending categories like groceries and housing,” he says. “That certainly won’t be alleviated in the current tariff layout, and so that could further push video game consumers toward the big free-to-play or more accessible games.”

Because of this, Piscatella tentatively projects that the video game industry may see a drop in demand for premium video games. However, games with long and deep connections to their player bases—such as Fortnite, Minecraft, Grand Theft Auto, Roblox, and Call of Duty—could gain more ground. In Newzoo’s 2025 PC and Console Gaming Report, analysts found that in 2024, 58% of all PC gaming revenue came from microtransactions, such as players purchasing loot boxes and other in-game goods. This was only a 1.4% growth increase from 2023, but tariff worries could prompt a steeper incline. “Spending $5 or $20 on a game you already love is easier than dropping $80 on a new title,” says Piscatella. “These titles already have social and monetary hooks that keep players engaged.”

This continued engagement is crucial in the video game industry, which hit peak audience growth during the worst years of the COVID-19 pandemic. “From the late ’70s onward, every year we would have more people playing and more people playing for more hours,” says Piscatella. “Then, in 2020 and 2021, we had this huge wave of people come in. So we hit a ceiling on both the number of players and hours of engagement, in the U.S. in particular.” Ever since then, the goals of the industry have shifted from growing the audience to maintaining and increasing the spending from the existing audience.

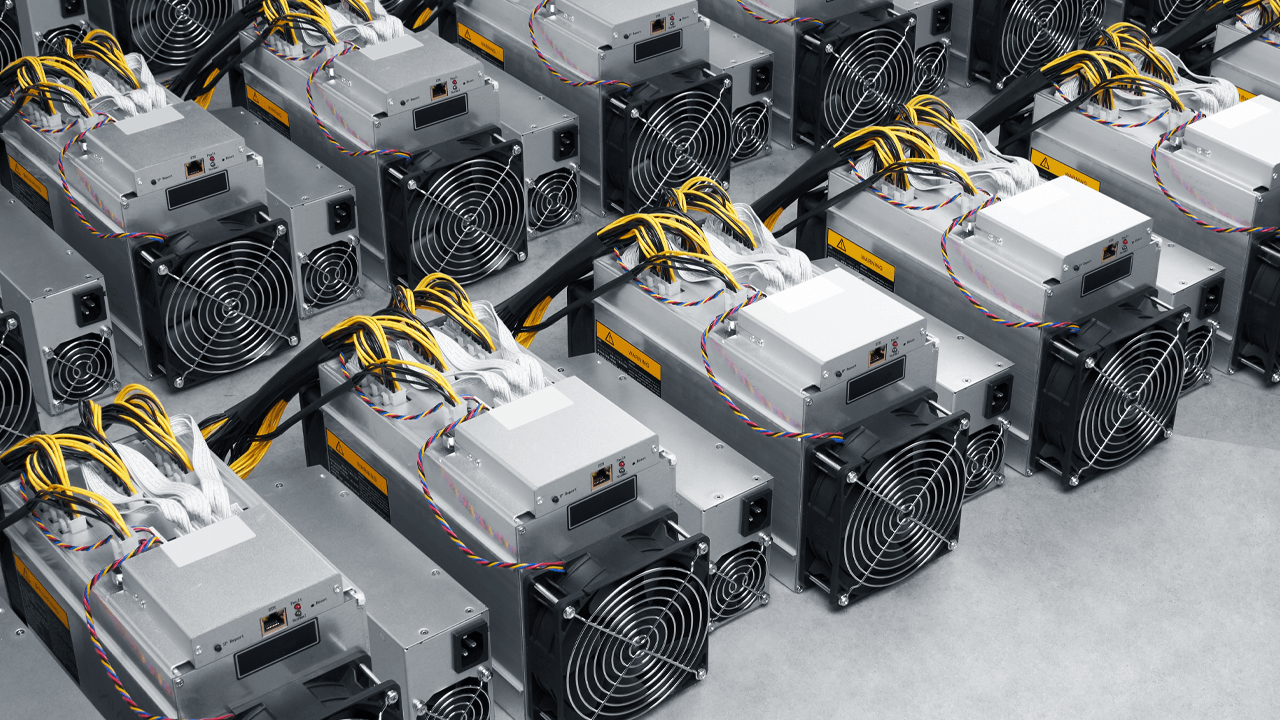

One part of the gaming industry that will have a more difficult time with retention is undoubtedly physical games and gaming hardware in general. This is bad news for a company like Nintendo which was set to begin preorders in the U.S. for its Switch 2 but had to push the date back to April 24 due to tariff announcements.

A chief concern revolves around the Switch 2. “Nintendo systems are the most physical forward of all the in-market devices. They’ve made a big point about delivering physical software so games could be easily shared among family members,” says Piscatella. “How many units of Switch hardware can you even allocate to the U.S., given all the uncertainties, right? How much is the potential market for physical cartridges really going to be, at least in the short term?”

Rosier agrees. “Tariffs could affect packaged games, which are already set to be more expensive than their digital versions,” he says. “This might encourage more players to shift to digital, and Nintendo may adjust physical production accordingly.”

However, it’s important to note that economic factors are shifting so rapidly that it is difficult to make any solid predictions of the future to come. “Right now the uncertainties are off the charts,” says Piscatella. “People will still love video games and they’ll still play them, but how they play them and how they spend on them, that might certainly change.”

![Which Companies Have Invested the Most into AI Development [Infographic]](https://imgproxy.divecdn.com/qnTgGmUnhhtyx1NChJZ7bBc4fHuHc9BC8NoXo_nBWUE/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9pbnZlc3RtZW50X2luZm8yLnBuZw==.webp)

![31 Top Social Media Platforms in 2025 [+ Marketing Tips]](https://static.semrush.com/blog/uploads/media/0b/40/0b40fe7015c46ea017490203e239364a/most-popular-social-media-platforms.svg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)