Fears of the U.S. dollar’s decline are overblown, say experts

A recent large sell-off of U.S. Treasuries does reflect a challenge to the dominance of the dollar.

"The dollar fades as a reserve currency," warned the headline of a BusinessWeek story, blaming the Presidential mismanagement for a loss of confidence in the U.S. economy. The story notes how investors around the world no longer want the U.S. dollar, and are moving their cash into German bonds, Japanese yen and Swiss francs. Based on this account, it's clear the dollar's dominance is over but for one thing: the article is dated 1978 and describes the events of the Carter Administration.

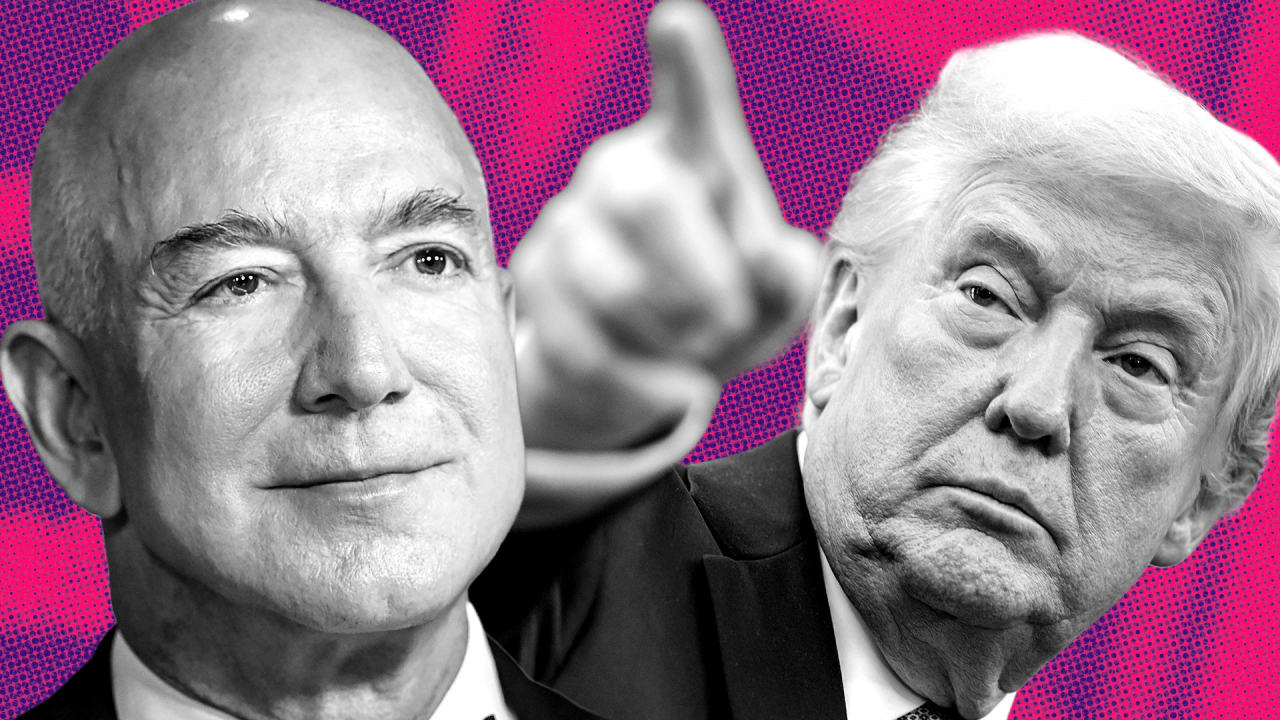

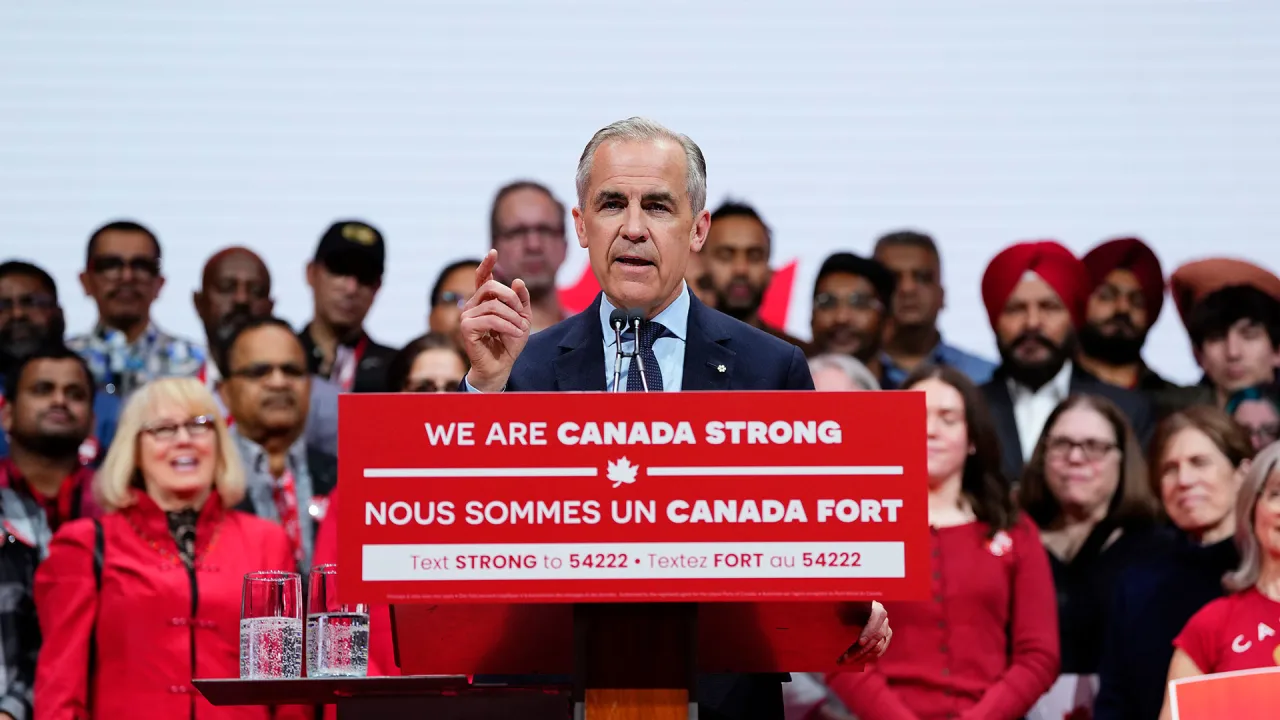

In reality, of course, the U.S. dollar became stronger than ever, and its position as the world's number one currency remains undisputed—until this April, that is. That's when investors responded to President Donald Trump's "Liberation Day" tariffs by dumping U.S. assets, and causing the yield on Treasury Bills to soar as high as 4.62%, up from 3.87% days earlier.

These events have given rise to fears, similar to those expressed in the BusinessWeek article, that the market has lost confidence in the U.S. economy and that the pre-eminence of the dollar—the backbone of foreign reserves and trade finance—is coming to an end.

Not so fast, says Stephen Kelly, a scholar of financial stability at Yale University. He says that the recent sell-off of U.S. assets is a response to current market conditions rather than the beginning of a global re-alignment away from the dollar.

"I reject this idea of a new world. It's a trade war, not a financial crisis," said Kelly. "The dollar weakening is a totally different thing from its reserve status."

Kelly says there is little evidence to support a narrative that foreign governments are strategically dumping Treasury bills to weaken the dollar. He added that it would not be in their financial interest to do so and that, in any case, there is no obvious alternative: "The market can't pick a new reserve currency overnight."

Marc Chandler, a managing director at Bannockburn Capital Markets and an authority on forex markets, agreed with this assessment. He pointed to recent data from the Federal Reserve, which acts as a custodian for the Treasury holdings that make up the bulk of most other nations' foreign reserves. According to Chandler, the central bank's holdings of those foreign reserves has actually increased year-over-year.

"Central banks typically move at glacial speeds. They don’t move in a vacuum," he said, adding that any concerted move to drop the dollar as the world's reserve currency would take place over years, not in the span of a week.

All of this suggests the dollar's pre-eminent status is secure for now. There are still questions, though, about the long-term future of the dollar, as well as what exactly drove the dramatic sell-off that caused Treasury yields to spike this month.

Why the dollar dropped

There's no denying something unusual happened on the night of April 8th, following Trump's "Liberation Day" announcement. The tariff news sparked a mass sell-off of U.S. stocks, which is the market's typical response to bad economic news, but investors also began dumping Treasury Bills and other bonds as well.

In the normal course of things, those investors would be buying Treasury Bills as part of a flight to safe assets. The fact investors sold instead gave rise to theories that nation states like China were dumping their holdings as part of a permanent, world-wide shift away from the dollar.

The reality is more banal. As a recent Fortune investigation revealed, the events of early April were not the result of a concerted effort by nation states or hedge funds, but a broader desire by the market to reduce exposure to U.S. assets.

Chandler, the Bannockburn Capital Markets exec, expressed a similar sentiment, saying the sell-off coincided with broader cyclical events that had seen U.S. assets become over-valued compared to those from other regions of the world.

The tariff shock didn't help, of course. The "Liberation Day" announcement didn't only spark a sell-off that was likely overdue, but magnified it to a point that it triggered further sell-offs. In particular, Chandler points to a meltdown in the highly-leveraged basis trade, which revolves around short-term bets on Treasuries, as a primary cause of soaring yields.

Yale's Kelly offered a similar assessment, saying the tariff-induced drop in equity prices led hedge funds and other leveraged traders to sell off Treasury bills to meet margin calls. He added that Treasury yields have declined significantly since their April 8 highs, and that their future direction is going to be primarily informed by trends in inflation and interest rates—standard macroeconomic factors in other words.

As for the dollar's recent slump against other global currencies, Kelly noted that this reflects an ongoing push by investors to reallocate global equity portfolios, and the poor near-term outlook for the U.S. economy.

"If you zoom out, we are not in extreme territory. If this turns into a true financial crisis, expect appreciation of the dollar," he said.

It has now been a century since the dollar surpassed the U.K. pound as the world's favorite currency and, despite the recent tariff shocks, it faces no obvious challengers. Still, there is only so much shock and unpredictability that investors will tolerate, warns Chandler, who invoked Coca-Cola's ill-fated attempt in 1985 to change its famous formula.

"I do think something serious is happening in the U.S. Compare it to what happened to Coca Cola when they changed the brand," said Chandler. "The potential damage to the U.S. is a long term branding issue where even a political shift might not be enough to reassure people they can trust the U.S."

This story was originally featured on Fortune.com