EV dilemma: Pragmatic Indian buyers fight between reliability and novelty

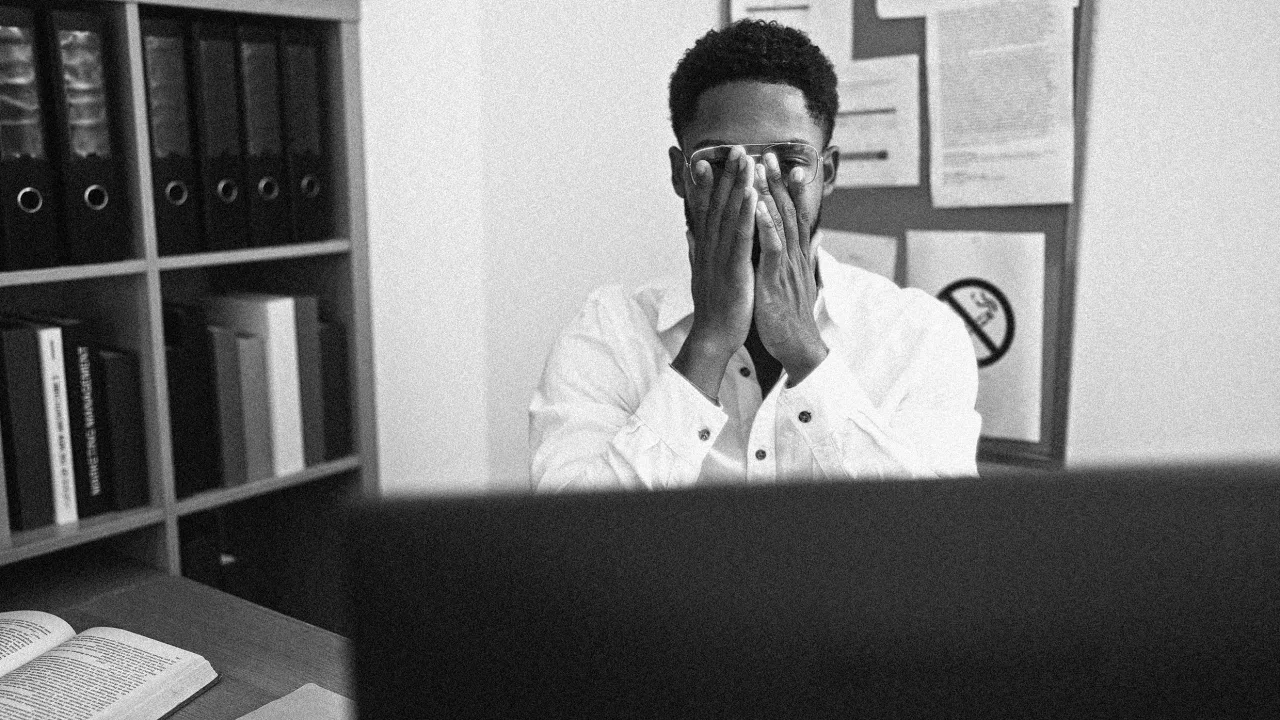

Reliability remains at the heart of automotive decision-making in India. For many, automobiles are long-term investments, and consumers seek assurance in areas like EV battery life, driving range, and service accessibility.

India stands at a crucial juncture in its journey toward adopting electric vehicles (EVs). However, a paradox exists: while the Indian government is pushing for a cleaner, greener future, many consumers remain cautious. On one hand, there is undeniable excitement surrounding the innovation of electric mobility; on the other, there's a strong demand for the tried-and-tested reliability that internal combustion engine (ICE) vehicles have long delivered.

This tension between future-forward aspirations and practical expectations is shaping the contours of India’s EV transition. As the country seeks to reduce its carbon footprint and tackle urban pollution, we are all witnessing whether the promise of new technology can convince a traditionally value-driven consumer base.

India’s EV industry

India’s electric vehicle market, although still in its early stages, is rapidly evolving. In 2023, total EV sales were ~1.6 million units; Excitingly, in 2024, that figure surged to over 2 million units, marking a growth of 24%, according to Vahan data, reflecting an increase in consumer demand. Consequently, the penetration of EVs in India's overall vehicle market increased to approximately 8%, up from 6.8% the previous year, according to JMK Research.

The government has introduced several measures to accelerate adoption, including the PM E-DRIVE, Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. Despite progress, concerns around high upfront costs, limited charging infrastructure, and consumer apprehensions about performance remain.

However, the outlook is far from bleak. The Indian EV battery market is projected to surge from $16.77 billion in 2023 to a remarkable $27.70 billion by 2028, an IBEF report noted. This signals growing confidence among stakeholders, from policymakers to manufacturers to early adopters. While consumer behaviour is still shaped by pragmatism and price sensitivity, there's a visible shift in attitudes, especially in segments where EVs are proving their value.

India’s technological shift

Electric vehicles offer compelling advantages for the Indian market, like zero emissions, reduced fossil fuel reliance, and lower operational costs. With pollution levels rising in urban hubs, EVs present a cleaner and increasingly viable alternative to conventional vehicles.

The Indian government’s proactive stance is evident in its target to make EVs account for 30% of total vehicle sales by 2030. Policy backing, paired with improving technology, is creating the right conditions for market expansion.

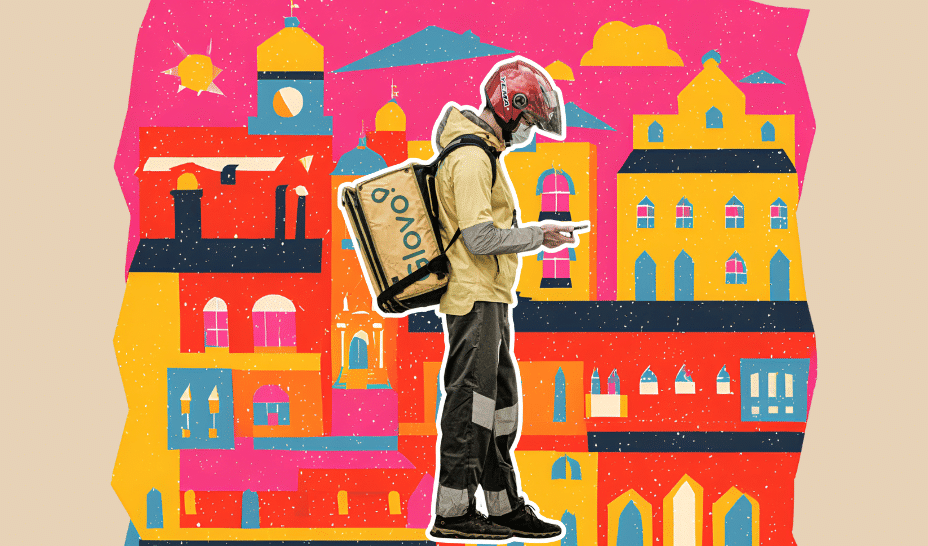

Interestingly, the most significant momentum in EV adoption is currently being driven by the commercial sector, particularly logistics and mobility fleets. Ecommerce and ride-hailing companies are transitioning to EVs for cost efficiency. EVs are set to dominate this space, with fleet owners capitalising on lower operating costs and government incentives.

At the same time, two-wheelers and three-wheelers have emerged as the fastest-growing EV categories. 2W EVs form the majority of EV sales today, accounting for 85%-90% of all EV units sold in India, followed by 4W EVs and 3W EVs, including e-rickshaws which have also seen significant penetration, especially in urban and semi-urban areas. These segments, driven by affordability and practical utility, are playing a pivotal role in normalising electric mobility across diverse demographics.

For young, environmentally conscious Indians, especially in metros, EVs symbolise more than just transport, they represent a progressive lifestyle choice. This trend signals growing trust and acceptance.

That said, infrastructural challenges like the uneven distribution of charging stations, especially beyond Tier I cities, continue to affect mass-scale confidence. "Range anxiety" remains a common concern, particularly in regions where charging networks are still sparse.

Nevertheless, the ecosystem is expanding. The convergence of innovation, state support, and early success in commercial and two-wheeler segments suggests India is steadily building the foundation for a large-scale EV transformation.

Reliability: A deeply rooted Indian preference

Reliability remains at the heart of automotive decision-making in India. For many, automobiles are long-term investments, and consumers seek assurance in areas like battery life, driving range, and service accessibility.

Range anxiety, in particular, continues to be a challenge. While there are many EVs available today, the supporting infrastructure hasn't kept pace, especially in rural areas. Until a robust nationwide network of charging stations is in place, this anxiety is likely to persist.

Cost is another critical consideration. Despite long-term fuel and maintenance savings, the higher upfront price of EVs is a deterrent for many price-sensitive Indian buyers. Still, the market is witnessing innovations aimed at closing this gap, whether through subsidies, battery leasing models, or new financing solutions.

Indian consumers are pragmatic. They weigh benefits with caution, and while EVs are gaining traction, most still want proof of long-term reliability. Yet, this mindset is gradually evolving, especially as more Indians encounter EVs in their daily lives through delivery vehicles, e-rickshaws, and shared mobility platforms.

Financial, emotional, and infrastructural factors, including a deep-rooted connection to legacy auto brands, shape Indian consumer perceptions. Addressing these perceptions requires a multidimensional approach.

To meet its EV targets, India must focus on enabling trust. A wider and more dependable charging network is vital, as is ensuring affordability, both in terms of upfront pricing and maintenance costs. Government policies and private sector collaboration can create an ecosystem where EVs are not only aspirational but also practical.

The adoption of electric vehicles in India is indeed at a crossroads. On one hand is the vision of a sustainable, high-tech future. On the other hand, a consumer base is deeply loyal to value, familiarity, and trust.

But the story isn’t just about resistance. It’s also about evolution. India’s EV journey is picking up speed, led by commercial fleets, two-wheelers, and conscious urban consumers. If the ecosystem can continue addressing concerns around cost, reliability, and infrastructure, this paradox may well transform into a powerful transition narrative.

(Samrath Singh Kochar is the Founder and CEO of Trontek, a manufacturer of Li-ion batteries.)

Edited by Kanishk Singh

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![What Are Website Demographics? [Explained]](https://static.semrush.com/blog/uploads/media/e3/e4/e3e48631e5cd307cd7a4bfee26498e62/0db9c37107a24c016f06d29ca0a5719a/website-demographics-sm.png)

![[Webinar] From Code to Cloud to SOC: Learn a Smarter Way to Defend Modern Applications](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjLbNLee9VlpBpNmlxQSBF7IHwrQajzAJWYjhcHTIVVqzroGXrpk_x9Sbbua1Xi-QtO9jbcX1canKTWWzfaOshSarJol1Ude7LNQMeV5B2x71gaXxWg_cjEJ3bPuuoyyyMLgWB9hCtZ1PV5j3QOGByinGCAETqul2WWz-mVYiuERYWPVu7ob8lSckM-ocw/s1600/soc.jpg?#)