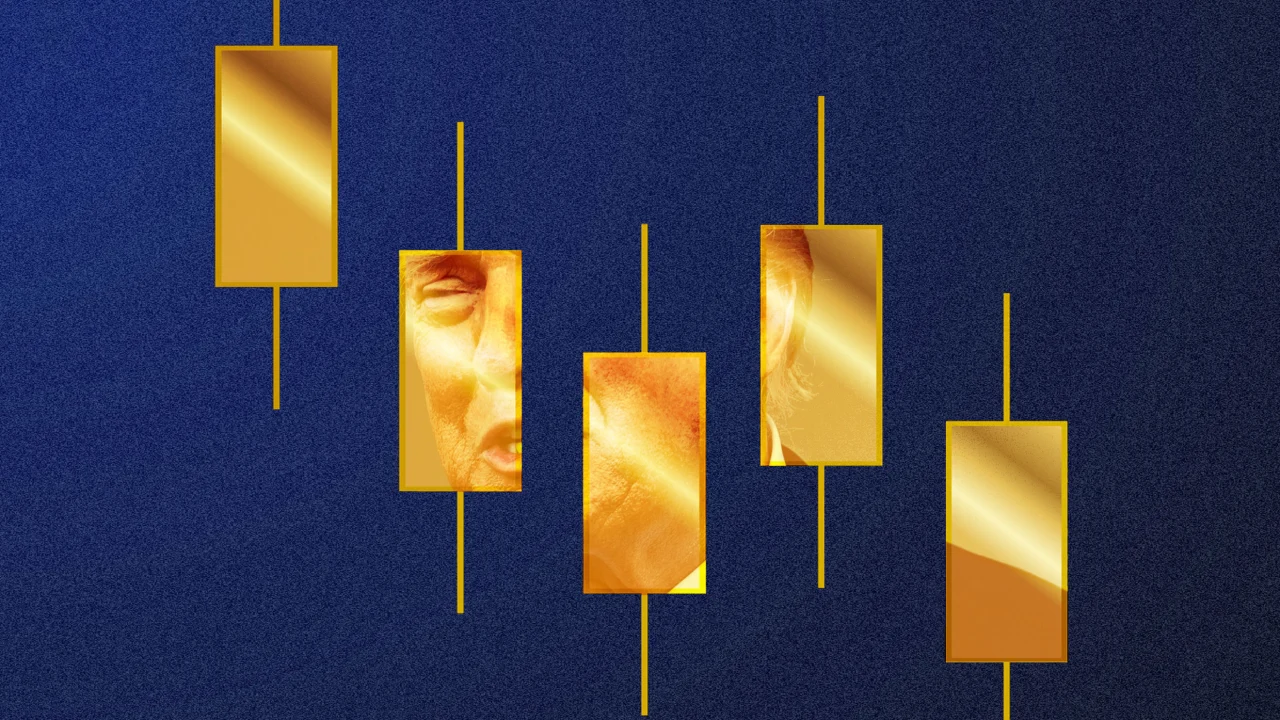

Donald Trump says he’s our ‘crypto president,’ but he’s tanking its best shot at adoption

Donald Trump said on the campaign trail ahead of his election that he intended to be the “crypto president.” But his vision and reality have collided in a way that could ultimately do more harm than good to crypto’s broader adoption in the years ahead. Last week, the U.S. Senate dealt the cryptocurrency industry a significant setback, voting to block further advancement of the GENIUS Act, a bill aimed at establishing regulatory guardrails for dollar-pegged stablecoins by classifying them as securities under the jurisdiction of the Securities and Exchange Commission. The surprise collapse of the act—which had passed through the Senate Banking Committee with Democratic support—stems from several factors, says Timothy Massad, a former chair of the Commodity Futures Trading Commission. One major issue, according to Massad, is the bill’s quality. “It didn’t address some key concerns,” he tells Fast Company. Bipartisan negotiations to refine the bill’s language were ongoing, he adds, but a larger obstacle loomed: the president of the United States. Trump is a vocal supporter of crypto, so much so that some view him as too deeply involved in the industry and too likely to benefit financially from any policy decisions he makes to be a neutral actor in shaping crypto adoption. First, World Liberty Financial—a crypto firm run by Trump’s sons—announced that its new USD1 stablecoin would serve as the conduit for a $2 billion investment from Abu Dhabi’s MGX fund into Binance, the world’s largest exchange. At the same time, the president’s $TRUMP meme coin, launched in January and already responsible for $320 million in trading fees, stands to gain from favorable crypto regulation. In March, Trump also named five tokens that the U.S. would begin stockpiling as part of a new crypto strategic reserve. Critics argue that these ventures blur the line between policymaker and market participant. “Trump has been so brazenly self-dealing and corrupt that it has given some Democrats pause,” says Corey Frayer, a former Senate Banking Committee aide. Massad agrees. “Both the activities of the president that many people feel are corrupt and entirely inappropriate, coupled with the weaknesses in the bill, led Democrats to say, ‘We can’t support this,’” he says. White House press secretary Karoline Leavitt has stated that “the president is abiding by all conflict of interest laws.” But the perception of personal benefit has already derailed what many saw as crypto’s best chance at mainstream legitimacy. “It’s a source of incredible conflict and potential bribery,” Massad says. Trump’s involvement—and the potential for him to profit from crypto-related policy decisions—has forced lawmakers to scrutinize their choices more carefully, including whether to legitimize stablecoins. “Stablecoins don’t do anything that we don’t already do more efficiently in the financial system,” Frayer says. That doesn’t necessarily mean the bill is dead, or that Trump will get a pass for what critics see as self-serving actions. “There’s been this basic agreement that it is bad when politicians use their position to benefit themselves,” Frayer says, referencing support for legislation to ban lawmakers from trading stocks based on insider knowledge. “This is the exact same type of issue,” he continues. “It crosses party lines. At least up until now, there has been a bright line at corruption.” But the key phrase, as Trump knows all too well, is “up until now.”

Donald Trump said on the campaign trail ahead of his election that he intended to be the “crypto president.” But his vision and reality have collided in a way that could ultimately do more harm than good to crypto’s broader adoption in the years ahead.

Last week, the U.S. Senate dealt the cryptocurrency industry a significant setback, voting to block further advancement of the GENIUS Act, a bill aimed at establishing regulatory guardrails for dollar-pegged stablecoins by classifying them as securities under the jurisdiction of the Securities and Exchange Commission.

The surprise collapse of the act—which had passed through the Senate Banking Committee with Democratic support—stems from several factors, says Timothy Massad, a former chair of the Commodity Futures Trading Commission. One major issue, according to Massad, is the bill’s quality. “It didn’t address some key concerns,” he tells Fast Company. Bipartisan negotiations to refine the bill’s language were ongoing, he adds, but a larger obstacle loomed: the president of the United States.

Trump is a vocal supporter of crypto, so much so that some view him as too deeply involved in the industry and too likely to benefit financially from any policy decisions he makes to be a neutral actor in shaping crypto adoption. First, World Liberty Financial—a crypto firm run by Trump’s sons—announced that its new USD1 stablecoin would serve as the conduit for a $2 billion investment from Abu Dhabi’s MGX fund into Binance, the world’s largest exchange. At the same time, the president’s $TRUMP meme coin, launched in January and already responsible for $320 million in trading fees, stands to gain from favorable crypto regulation. In March, Trump also named five tokens that the U.S. would begin stockpiling as part of a new crypto strategic reserve.

Critics argue that these ventures blur the line between policymaker and market participant. “Trump has been so brazenly self-dealing and corrupt that it has given some Democrats pause,” says Corey Frayer, a former Senate Banking Committee aide. Massad agrees. “Both the activities of the president that many people feel are corrupt and entirely inappropriate, coupled with the weaknesses in the bill, led Democrats to say, ‘We can’t support this,’” he says.

White House press secretary Karoline Leavitt has stated that “the president is abiding by all conflict of interest laws.” But the perception of personal benefit has already derailed what many saw as crypto’s best chance at mainstream legitimacy. “It’s a source of incredible conflict and potential bribery,” Massad says.

Trump’s involvement—and the potential for him to profit from crypto-related policy decisions—has forced lawmakers to scrutinize their choices more carefully, including whether to legitimize stablecoins. “Stablecoins don’t do anything that we don’t already do more efficiently in the financial system,” Frayer says.

That doesn’t necessarily mean the bill is dead, or that Trump will get a pass for what critics see as self-serving actions. “There’s been this basic agreement that it is bad when politicians use their position to benefit themselves,” Frayer says, referencing support for legislation to ban lawmakers from trading stocks based on insider knowledge.

“This is the exact same type of issue,” he continues. “It crosses party lines. At least up until now, there has been a bright line at corruption.” But the key phrase, as Trump knows all too well, is “up until now.”

![SWOT Analysis: What It Is & How to Do It [Examples + Template]](https://static.semrush.com/blog/uploads/media/86/6a/866a1270ca091a730ed538d5930e78c2/do-swot-analysis-sm.png)