CleanSpark Reports $181.7M in Q2 Revenue, Stays on Course to Hit 50 EH/s Bitcoin Mining Target

Bitcoin Magazine CleanSpark Reports $181.7M in Q2 Revenue, Stays on Course to Hit 50 EH/s Bitcoin Mining Target Strong revenue growth contrasts with net loss as CleanSpark stays committed to scaling bitcoin mining operations and targets 50 EH/s hashrate by June. This post CleanSpark Reports $181.7M in Q2 Revenue, Stays on Course to Hit 50 EH/s Bitcoin Mining Target first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

Bitcoin Magazine

CleanSpark Reports $181.7M in Q2 Revenue, Stays on Course to Hit 50 EH/s Bitcoin Mining Target

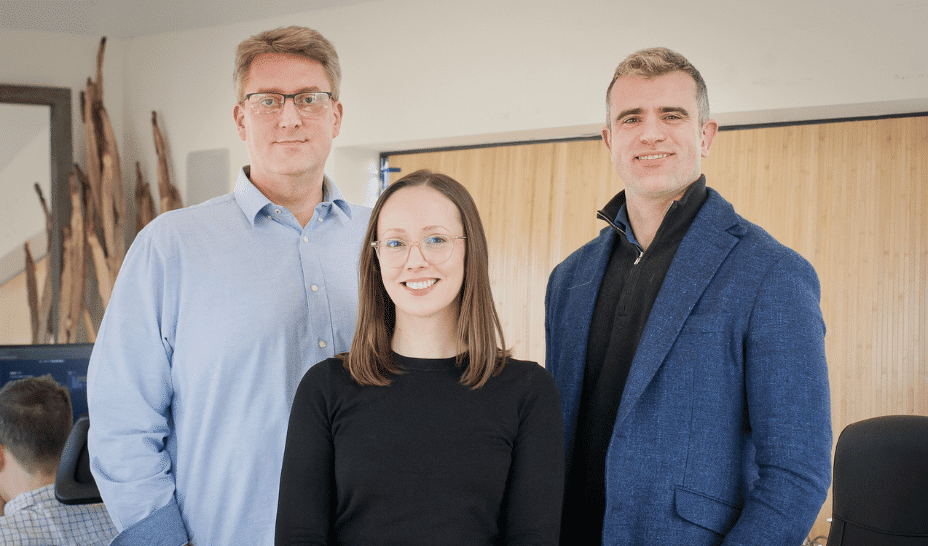

CleanSpark, American Bitcoin mining company, announced its financial results for the second quarter of fiscal year 2025, reporting $181.7 million in revenue for the three months ended March 31. This marks a 62.5% increase from $111.8 million in the same quarter last year.

Despite the revenue growth, the company reported a net loss of $138.8 million, or $0.49 per basic share, compared to net income of $126.7 million, or $0.59 per basic share, during the prior-year period. Adjusted EBITDA also declined to negative $57.8 million from $181.8 million a year ago.

As of March 31, 2025, CleanSpark held $97.0 million in cash and $979.6 million in bitcoin. Total current assets stood at $947.5 million, with mining assets (including prepaid deposits and deployed miners) totaling $899.6 million. Total assets reached $2.7 billion. The company’s liabilities amounted to $766.5 million, with $109.3 million in current liabilities and $641.7 million in long-term debt. Total stockholders’ equity was $1.9 billion.

CleanSpark reported working capital of $838.2 million as of March 31, 2025, which includes a $50 million bitcoin-backed credit line. This facility provides flexible funding while allowing the company to preserve equity and strategically leverage its bitcoin holdings.

Zach Bradford, CleanSpark CEO, said their performance reflects a disciplined and focused approach in a rapidly evolving bitcoin mining landscape. “As other players shift direction or decelerate growth, CleanSpark has doubled down on being the only remaining pure-play, public bitcoin miner,” Bradford stated. “We believe that focus matters now more than ever, and we remain on track to reach our 50 EH/s target during June, all while growing our bitcoin treasury, strengthening the balance sheet, and prioritizing long-term stockholder value.”

Bradford emphasized CleanSpark’s continued leadership in infrastructure and financial strategy, referencing its pioneering ASIC option structure and non-dilutive financing methods.

Gary Vecchiarelli, CleanSpark’s CFO, echoed these sentiments, noting that CleanSpark maintained one of the most efficient cost structures in the industry while expanding operations without diluting shareholder equity. “We continued to invest in strategic and accretive expansion without relying on dilutive capital, as demonstrated by our expanded revolving line with Coinbase,” he said. “Our Digital Asset Management group made meaningful progress during the quarter and is preparing to optimize our treasury, positioning bitcoin as both a productive asset and a source of strength on our balance sheet.”

This post CleanSpark Reports $181.7M in Q2 Revenue, Stays on Course to Hit 50 EH/s Bitcoin Mining Target first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

%20Abstract%20Background%20102024%20SOURCE%20Amazon.jpg)