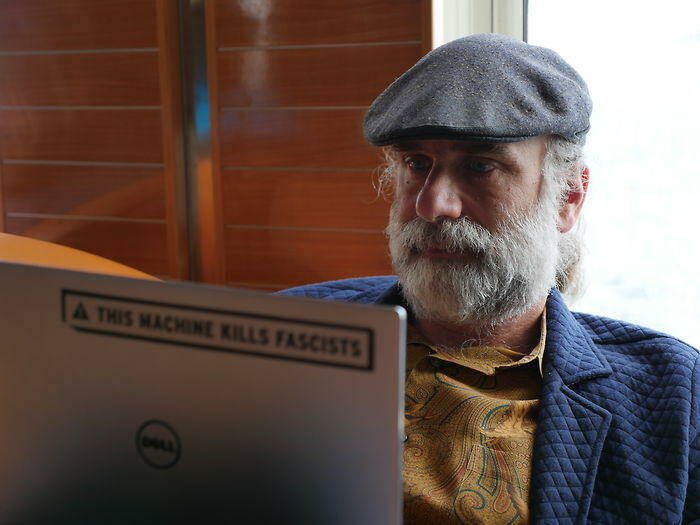

Celcius Logistics Raises Rs 250 Cr to expand cold chain network

Cold chain logistics startup Celcius Logistics has raised Rs 250 crore in a Series B round to expand its cold chain network and bolster its technology platform. The round includes a mix of equity, debt, and secondary transactions. Equity investors Eurazeo and Omnivore co-led the round, alongside r

Cold chain logistics startup Celcius Logistics has raised Rs 250 crore in a Series B round to expand its cold chain network and bolster its technology platform.

The round includes equity, debt, and secondary transactions. Equity investors Eurazeo and Omnivore co-led the round, alongside returning investor IvyCap Ventures. Trifecta Capital, Lighthouse Canton, BlackSoil, UCIC, and GetVantage participated as debt partners.

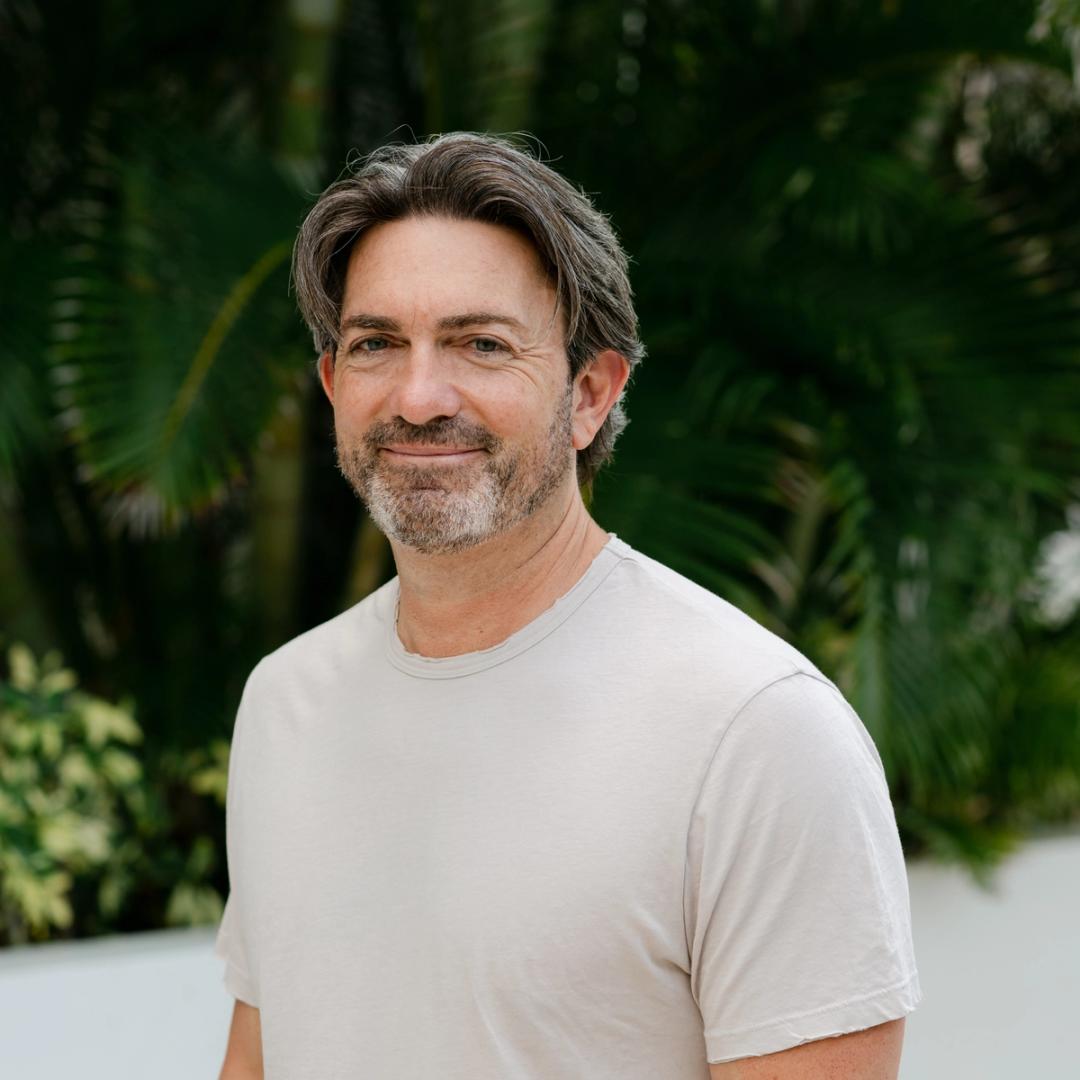

“This funding comes at a pivotal time,” said Swarup Bose, Founder and CEO of Celcius Logistics, in a conversation with YourStory. “We're scaling our operations, strengthening our verticals, and targeting expansion into over 1,000 cities."

The capital injection follows a Rs 40-crore pre-Series B round in May 2024 and brings Celcius’ total funding to Rs 390 crore since its inception in 2020. The company’s goal, Bose said, is to build the most comprehensive and tech-driven cold chain ecosystem in India—a segment traditionally marred by fragmentation, inefficiencies, and high spoilage rates in perishable goods.

Celcius initially focused on transport of frozen foods but recently expanded into pharmaceutical logistics, a move Bose calls a “natural evolution” driven by demand. “When we started in 2020, it was right in the middle of COVID. That made the inefficiencies of the cold chain industry really apparent. We realised early that pharma—like vaccines and insulin—would need far more reliable cold chain infra,” he said.

Pharmaceutical logistics now contributes about 30% of the company’s business. “This is the fastest-growing vertical. We are working with some of the largest pharma companies in India, helping them ship temperature-sensitive medicines, blood samples, and more to over 600 cities.”

Celcius claims a pan-India network of over 4,000 reefer vehicles, over 150 cold storage and distribution points, and a fleet of more than 250 hyperlocal riders. “We are already in 600 cities. The Series B funding will take us to 1,000-plus. We want to ensure that if you're in a Tier III town and you need a temperature-sensitive delivery, we can do it,” said Bose.

Bose emphasised that Celcius has built its entire tech stack in-house, including a proprietary Transport Management System, Warehouse Management System, and Inventory Management System. “From day one, we’ve been a tech-first company. All the software has been built internally—never outsourced,” he said.

According to Bose, the long-term vision is to offer this tech platform as a subscription-based SaaS product, not just in India but globally. “We are building a cross-operational platform that integrates transport, warehousing, inventory, dispatch, and last-mile distribution into one system,” he explained. “Once we hit a certain level of integration—including backward integration into ERPs like SAP—we plan to white label the platform for use by other logistics companies and clients.”

He also hinted that this future product will include AI and blockchain capabilities, especially useful in pharmaceutical logistics where security, traceability, and real-time monitoring are critical. “AI was not feasible for us in the beginning due to lack of data, but now with three to four years of operational data, we’re actively working to embed AI in routing and efficiency,” said Bose.

New-age logistics for small-scale D2C brands

One of the company’s most mission-aligned initiatives is its 'New Age' business vertical, launched in 2024, which focuses on solving logistics for small and regional D2C brands across India. Bose said, “We realised there are thousands of businesses in India—snack brands, ice cream makers, sweet shops—which want to go national but don’t have access to cold chain infra at scale.”

This vertical supports brands that need to transport only small loads—often as little as 50–100 kg, far below the standard 1-tonne requirement in conventional logistics. Celcius uses a multi-modal model, tapping into railways, road, and air cargo, and leverages its 65+ dark stores and a fleet of 250+ hyperlocal riders to manage storage and last-mile distribution.

Clients include legacy businesses like a three-generation sweet shop in Varanasi, and a farmer-led litchi brand in Bihar. “We’ve created infrastructure so that your favourite momo brand in Delhi can sell in Chennai or Hyderabad without having to invest in their own logistics,” Bose noted.

Celcius is currently working with over 160 such small D2C players, and expects this number to grow rapidly in FY25. “This segment is entirely underserved. We’ve built a system that allows micro-quantities to move efficiently while offering warehousing and delivery all through our existing network,” he said.

Edited by Swetha Kannan