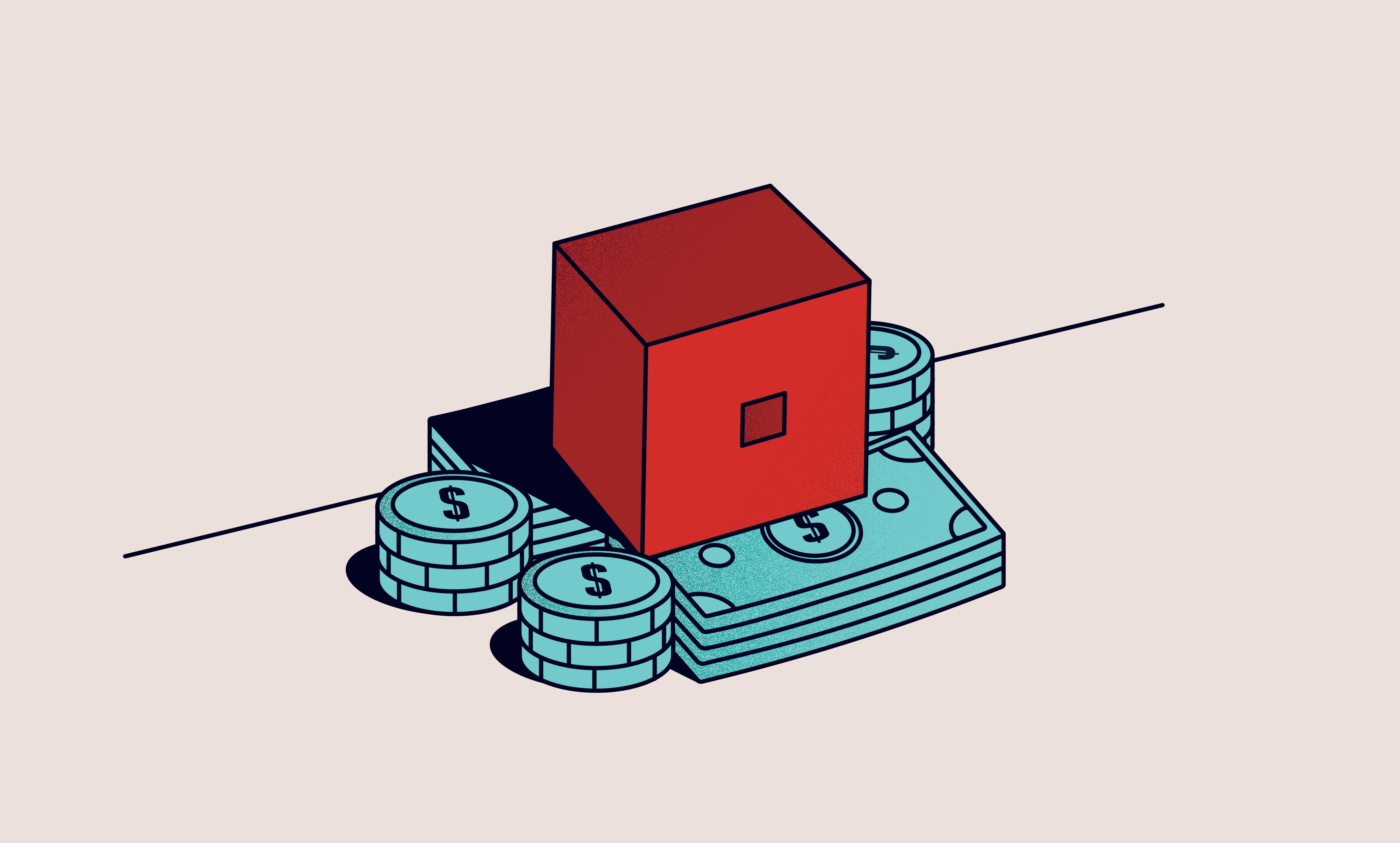

BankBazaar ventures into gold loans through a tie-up with Muthoot FinCorp

As part of the partnership, Muthoot FinCorp has invested in BankBazaar's ongoing Series D2 round as an equity investor.

Non-banking financial company Muthoot FinCorp has invested in fintech platform BankBazaar's ongoing Series D2 round as an equity investor. This is part of a strategic collaboration that will see BankBazaar enter the secured loans market with a gold loan product.

The partnership aims to broaden the fintech firm’s portfolio beyond co-branded credit cards and credit score services.

“This partnership unites two trusted brands—a 138-year-old business conglomerate and a 17-year-old fintech platform,” said Adhil Shetty, CEO of BankBazaar.com. “Gold loans, being countercyclical to unsecured credit, will diversify our portfolio and strengthen our offerings.”

BankBazaar will lead the digital infrastructure of the initiative, overseeing product marketing, financial literacy, and customer experience. Muthoot FinCorp, the flagship company of the Muthoot Pappachan Group, will handle KYC compliance, valuation, storage, and loan disbursal. The companies aim to deliver same-day loan disbursals through a hybrid physical-digital model.

“We are pleased to announce our partnership with BankBazaar, one of the country’s leading fintech firm[s], leveraging their extensive customer base and cutting-edge analytics capabilities to drive superior customer experience,” said Shaji Varghese, CEO of Muthoot FinCorp. “This significant collaboration is poised to be a major milestone in our journey to deliver seamless credit solutions.”

India’s gold loan market is gaining momentum, particularly in underserved regions where traditional lending channels remain inaccessible. BankBazaar sees the gold loan product as a gateway to formal finance for small business owners and individuals with limited credit history.

“Nearly 65% of gold loans are still offered by unregulated players, underscoring the urgent need for secure, high-valuation financing at fair rates,” said Pankaj Bansal, Chief Business Officer at BankBazaar.com.

BankBazaar, which reported a 62.5% increase in co-branded credit cards for FY24, is projecting 46% compound annual revenue growth from FY22 to FY25. It also expects to achieve full-year EBITDA profitability in FY25.

The investment in BankBazaar aligns with Muthoot FinCorp’s strategy to digitise and expand access to credit, particularly in semi-urban and rural regions. The company operates more than 3,700 branches nationwide and is part of the Muthoot Pappachan Group, a 138-year-old conglomerate with interests in financial services, real estate, IT, and hospitality.

Edited by Swetha Kannan

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)