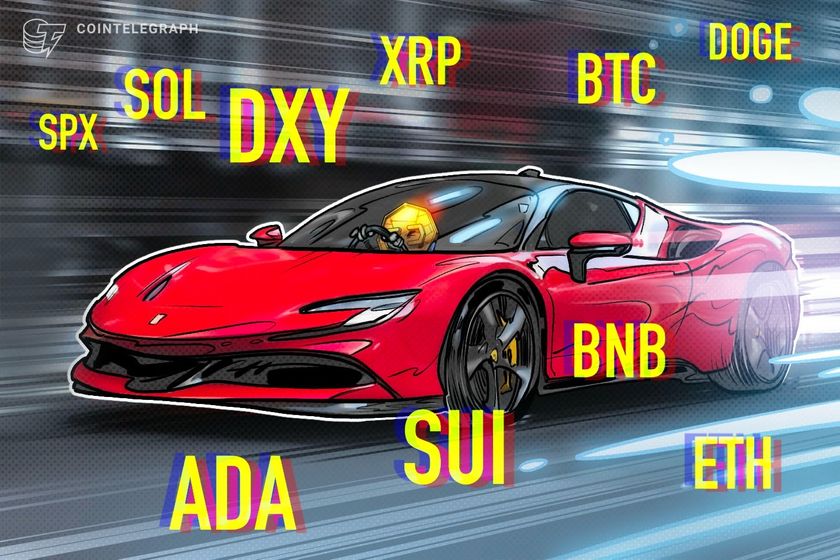

3 Bitcoin vs Macro economic indicators to watch

One thing is for sure, Bitcoin is a play on global liquidity. So the following 3 charts IMO are essential to follow. 1st up, Bitcoin vs the Federal Fund Rate. Bitcoin vs. Fed funds rate from 2015–2023 is like a cat and a laser pointer, generally unpredictable, but when rates drop, Bitcoin jumps. https://preview.redd.it/75injk9xjyye1.png?width=2902&format=png&auto=webp&s=f7dec57fbf845023bed6c194b18b8da2db391bfa 2nd we have the ever-controversial Bitcoin vs Global M2 Liquidity chart. Bitcoin’s price moves with global M2 (the total money in the world’s major economies), is a chart that almost holds your hand like a baby showing you BTC's growing role as a monetary asset., It's not just "number go up", it's bitcoin absorbing all the monetary premium as the more superior form of money. https://preview.redd.it/whqptry4lyye1.png?width=2864&format=png&auto=webp&s=d81955e8f351ddc03191a96fd6cc03f96c14853a Last but not least, Bitcoin vs US M2 Supply. Need I say more? When the current fiat reserve currency of the world starts Brrrr, you watch. https://preview.redd.it/xg66w72rmyye1.png?width=2874&format=png&auto=webp&s=9293fee593bf3022bbb3a4919dcd1a7ef1047c16 submitted by /u/AlonShvarts [link] [comments]

| One thing is for sure, Bitcoin is a play on global liquidity. So the following 3 charts IMO are essential to follow. 1st up, Bitcoin vs the Federal Fund Rate. 2nd we have the ever-controversial Bitcoin vs Global M2 Liquidity chart. Bitcoin’s price moves with global M2 (the total money in the world’s major economies), is a chart that almost holds your hand like a baby showing you BTC's growing role as a monetary asset., It's not just "number go up", it's bitcoin absorbing all the monetary premium as the more superior form of money. Last but not least, Bitcoin vs US M2 Supply. Need I say more? When the current fiat reserve currency of the world starts Brrrr, you watch. [link] [comments] |