2 Growth Stocks to Buy in the Tariff-Fueled Market Correction

What should investors do during a market downturn? Some might resort to panic selling, but that's hardly a good strategy. Unless a company's investment thesis has changed because of recent developments, market downturns aren't a good enough reason for most investors to sell.For those who can afford it without blowing their budget, it's actually a great idea to pick up shares of top companies on the dip during a correction. With that in mind, here are two excellent growth-oriented companies to buy in the ongoing market meltdown: tech giant Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and medical device maker DexCom (NASDAQ: DXCM).President Donald Trump's tariffs threaten to send the economy into a recession. If that happens, Alphabet, Google's parent company, could suffer. Alphabet makes the bulk of its revenue from advertising. During challenging economic times, consumers and businesses spend less -- companies are likely to decrease their ad budgets, harming Alphabet's results. So the tech giant's near-term prospects seem uncertain, but investors looking at the next five years and beyond should consider pouncing on this opportunity.Continue reading

What should investors do during a market downturn? Some might resort to panic selling, but that's hardly a good strategy. Unless a company's investment thesis has changed because of recent developments, market downturns aren't a good enough reason for most investors to sell.

For those who can afford it without blowing their budget, it's actually a great idea to pick up shares of top companies on the dip during a correction. With that in mind, here are two excellent growth-oriented companies to buy in the ongoing market meltdown: tech giant Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and medical device maker DexCom (NASDAQ: DXCM).

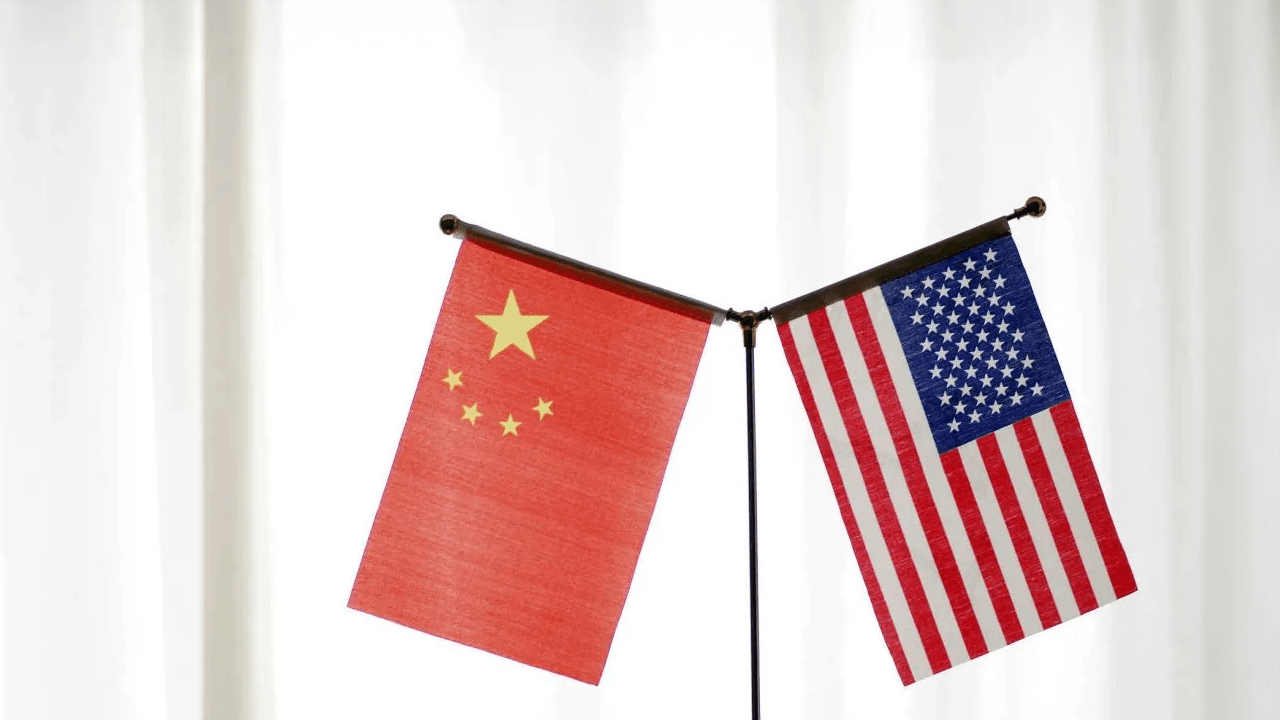

President Donald Trump's tariffs threaten to send the economy into a recession. If that happens, Alphabet, Google's parent company, could suffer. Alphabet makes the bulk of its revenue from advertising. During challenging economic times, consumers and businesses spend less -- companies are likely to decrease their ad budgets, harming Alphabet's results. So the tech giant's near-term prospects seem uncertain, but investors looking at the next five years and beyond should consider pouncing on this opportunity.

![31 Top Social Media Platforms in 2025 [+ Marketing Tips]](https://static.semrush.com/blog/uploads/media/0b/40/0b40fe7015c46ea017490203e239364a/most-popular-social-media-platforms.svg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)