Zettai’s proposed restructuring scheme receives majority creditors’ approval

The next step is to get the Singapore Court’s sanction, after which the gradual resumption of withdrawals and trading will happen in phases.

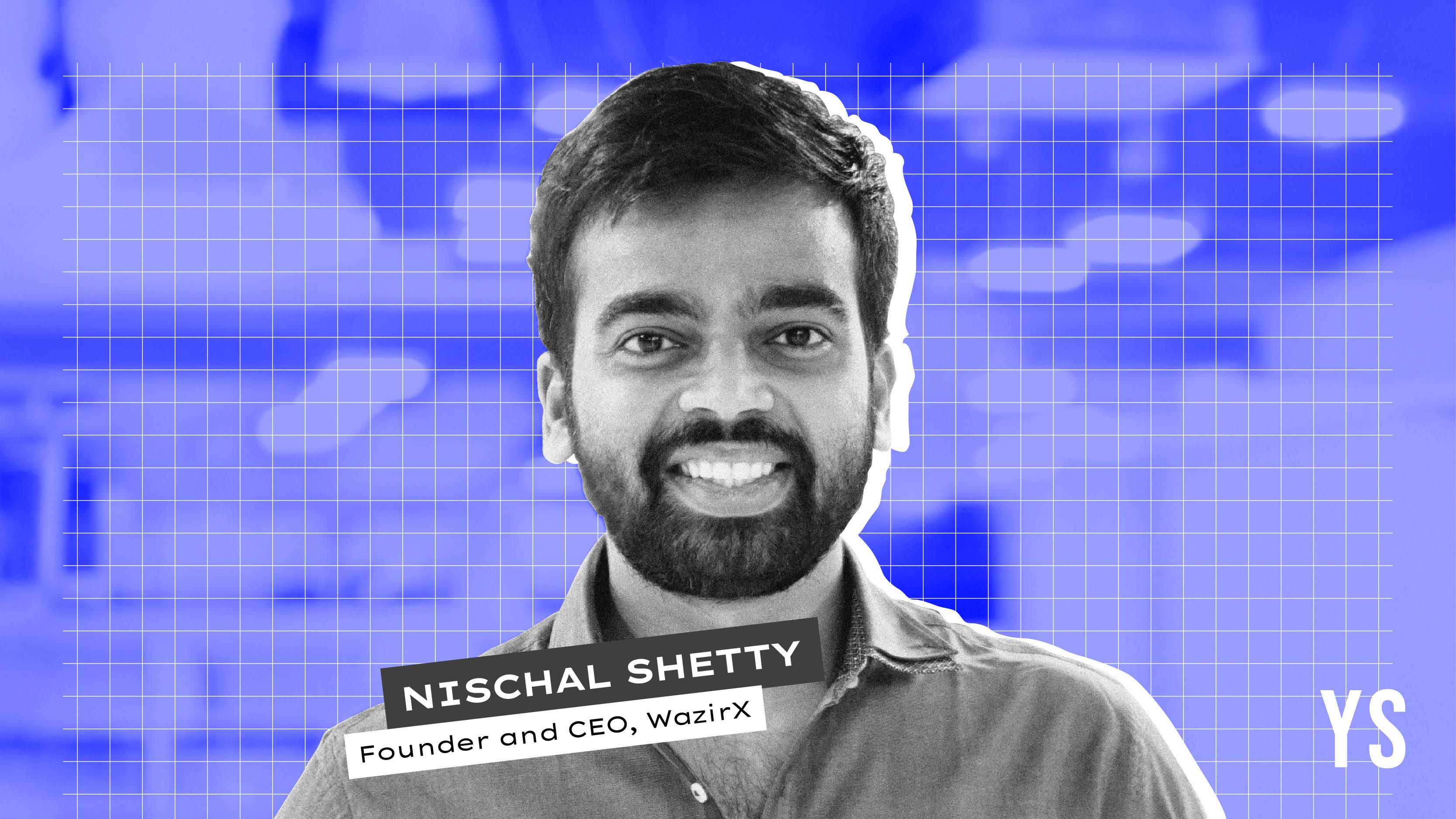

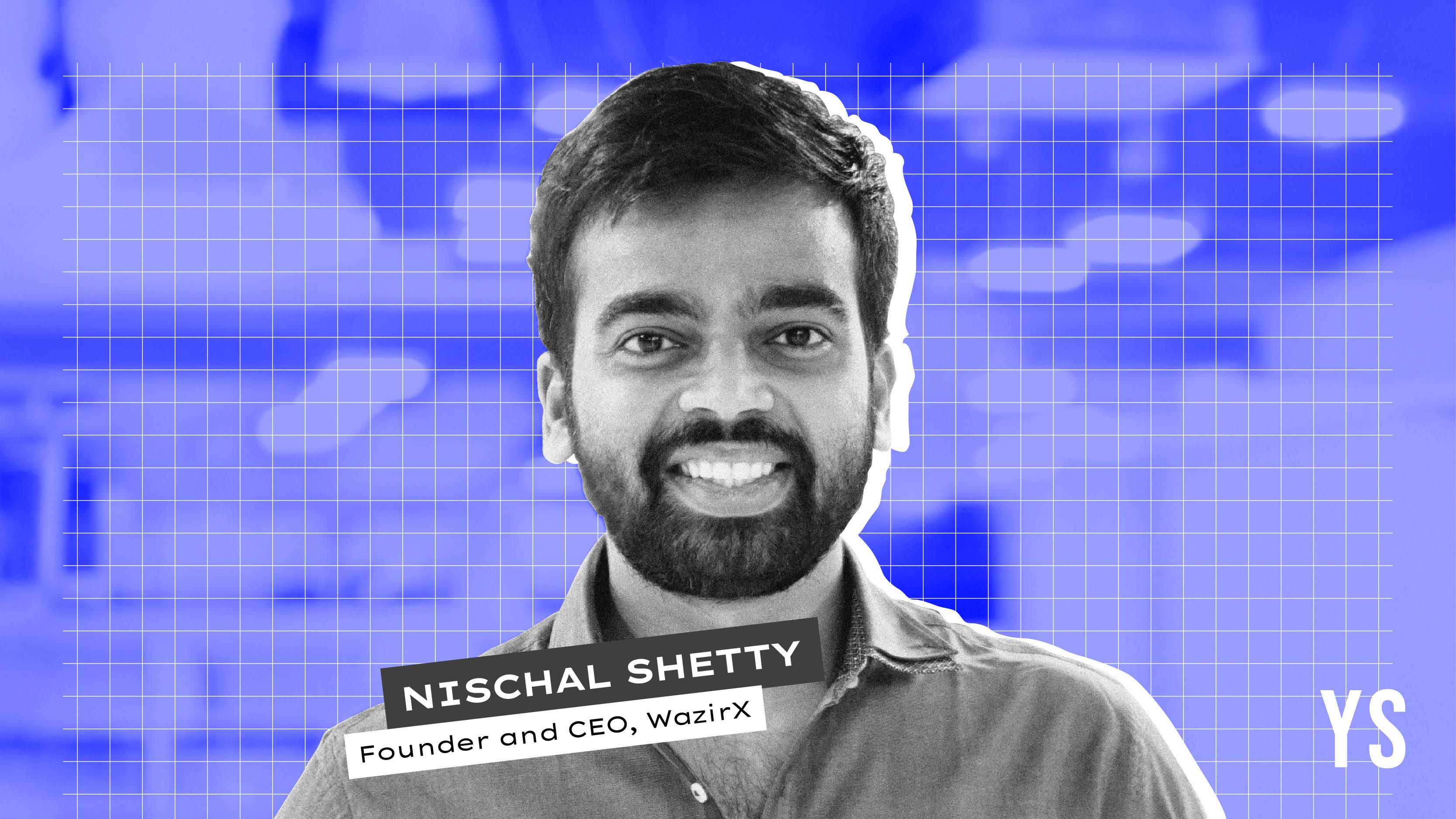

Zettai Pte Ltd, which operates the crypto assets of WazirX in India, on Monday said it has received majority votes in approval of its restructuring scheme.

In total, about 141,476 scheme creditors representing $195.6 million in approved claims cast a vote. Of the scheme creditors, 131,659 voted ‘FOR’ the scheme. This majority accounts for 93.1% by count and 94.6% by value, according to the company.

The approval for the scheme significantly exceeds the statutory voting threshold requirement, which needed at least a majority by count and at least 75% of the total value of creditors’ claims.

"We are grateful for the strong vote of confidence," said Nischal Shetty, Founder of WazirX. "This consistent support across our entire base demonstrates shared belief in our restructuring approach and recovery plan."

As part of the next set of steps, Zettai will shortly file an application with the Singapore Court for the sanction of the creditor approved scheme. Once the filing is accepted by the court, Zettai will issue an update to all creditors with a copy of the legal filings.

After the court’s sanction, within the next 10 business days, the scheme will become legally effective post which the first distribution will begin.

The resumption of withdrawals, and trading, will happen in phases, the company said.

Earlier this year, WazirX, which is looking to make a comeback after cyberattack that resulted in the theft of $235 million worth of digital assets, said it had successfully frozen the first tranche of assets worth $3 USDT.

Edited by Jyoti Narayan

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)