What's Warren Buffett's Secret to Surviving a Nasdaq Bear Market? Collecting Nearly $3.3 Billion in Dividend Income From 4 Remarkable Businesses.

The Oracle of Omaha's affinity for dividend stocks has played a key role in Berkshire Hathaway's ongoing outperformance.

Few (if any) Wall Street money managers trust in the U.S. economy and the stock market more than Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett. The affably dubbed "Oracle of Omaha" has delivered a stunning cumulative return of 6,325,426% for Berkshire's Class A shares (BRK.A) since becoming CEO six decades ago.

While Warren Buffett's company has handily outperformed Wall Street's leading stock indexes over the long run, what's equally impressive is its returns on a year-to-date basis. Whereas the benchmark S&P 500 has slumped by 10.2% since 2025 began, as of the closing bell on April 17, Berkshire's stock is up 15%!

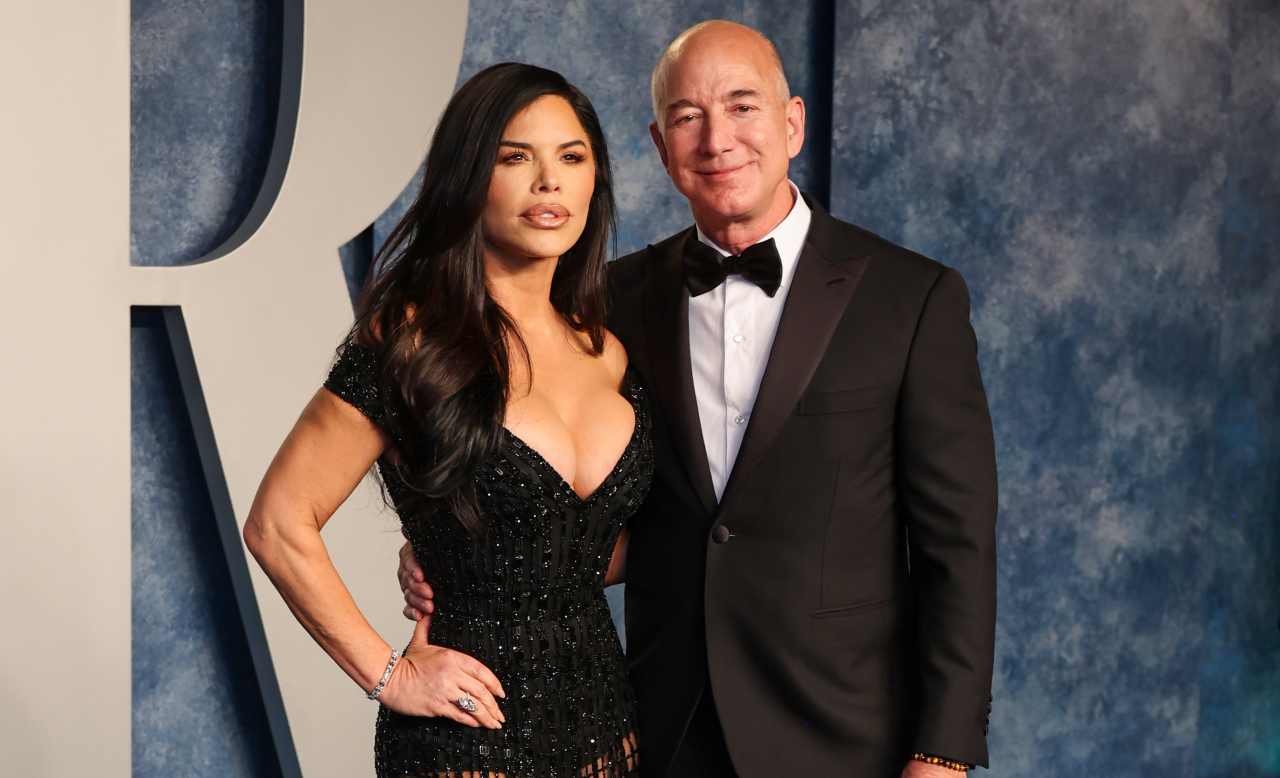

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

![7 Days, 7 Posts: A Simple Strategy to Grow on LinkedIn [Infographic]](https://imgproxy.divecdn.com/7epzwm9-fB6KXqQAejiRwM9a7W7L7TDsZIpMgqiNbSc/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9zdGFydF9wb3N0aW5nX2xpbmtlZGluMi5wbmc=.webp)

![31 Top Social Media Platforms in 2025 [+ Marketing Tips]](https://static.semrush.com/blog/uploads/media/0b/40/0b40fe7015c46ea017490203e239364a/most-popular-social-media-platforms.svg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)