Warren Buffett Absolutely Nailed the Trump-Induced Market Sell-Off. But When Will the Oracle of Omaha Turn Bullish?

By now, it's no secret that Warren Buffett and his company Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) absolutely nailed the stock market sell-off caused by President Donald Trump's tariffs and global trade tensions. While the market raged in 2024, Buffett and Berkshire stayed conservative, stockpiling a staggering amount of cash and buying very little in stocks. Berkshire also repurchased far fewer shares of its own stock than it has in past years.Whether Buffett and Berkshire foresaw a Trump win in the election and the ensuing trade battle is unknown. But it's clear that Buffett and Berkshire didn't like what they were seeing and largely stayed on the sidelines. With the broader benchmark S&P 500 down about 10% this year (as of April 22), the big question is: When will the Oracle of Omaha turn bullish?Investors typically only get a look at what large funds like Berkshire are buying once every 90 days or so. That's because large funds are only required to disclose their stock holdings within 45 days of the end of each quarter. Since the first quarter ended on March 31, Berkshire won't need to submit a 13F filing until around May 15.Continue reading

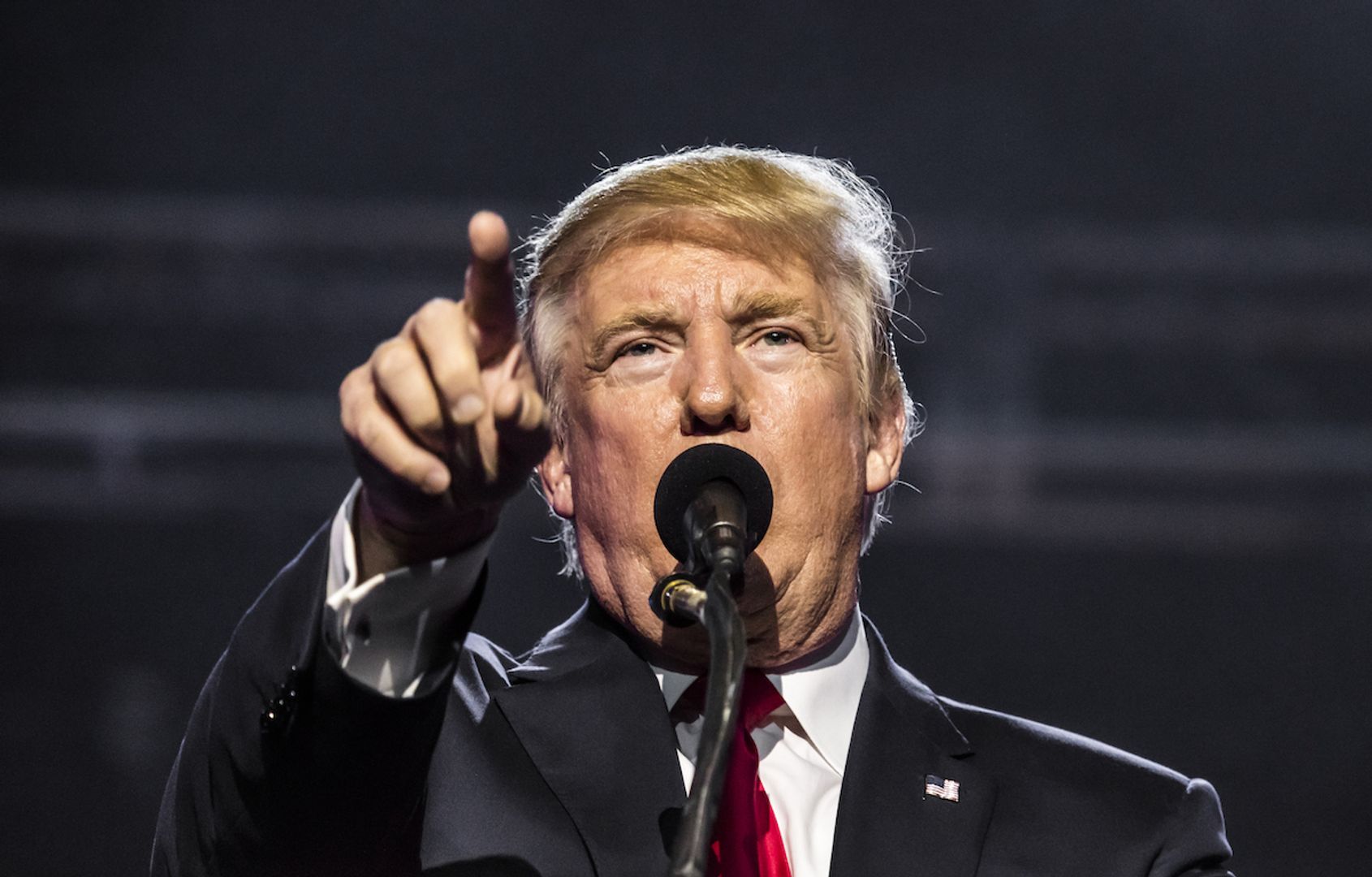

By now, it's no secret that Warren Buffett and his company Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) absolutely nailed the stock market sell-off caused by President Donald Trump's tariffs and global trade tensions. While the market raged in 2024, Buffett and Berkshire stayed conservative, stockpiling a staggering amount of cash and buying very little in stocks. Berkshire also repurchased far fewer shares of its own stock than it has in past years.

Whether Buffett and Berkshire foresaw a Trump win in the election and the ensuing trade battle is unknown. But it's clear that Buffett and Berkshire didn't like what they were seeing and largely stayed on the sidelines. With the broader benchmark S&P 500 down about 10% this year (as of April 22), the big question is: When will the Oracle of Omaha turn bullish?

Investors typically only get a look at what large funds like Berkshire are buying once every 90 days or so. That's because large funds are only required to disclose their stock holdings within 45 days of the end of each quarter. Since the first quarter ended on March 31, Berkshire won't need to submit a 13F filing until around May 15.

![How AI Use Is Evolving Over Time [Infographic]](https://imgproxy.divecdn.com/YImJiiJ6E8mfDrbZ78ZFcZc03278v7-glxmQt_hx4hI/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9ob3dfcGVvcGxlX3VzZV9BSV8xLnBuZw==.webp)