Is Now the Time to Buy Beaten-Down AI Stocks?

Investors rushed to get in on artificial intelligence (AI) stocks over the past two years as it became clear that AI might be the next big thing. The idea was that this newish technology could join the ranks of electricity or the internet, revolutionizing our daily lives and a whole lot more. As a result, companies such as AI chip giant Nvidia (NASDAQ: NVDA) and AI-driven software company Palantir Technologies saw their stock prices soar -- these two surged 171% and 340%, respectively, last year.But recently, the excitement has turned to concern about what's ahead. Early last month, President Donald Trump announced a detailed plan for tariffs on imports, and stocks -- particularly tech and AI players -- sank.Though the president paused the tariffs for a 90-day negotiation period and even temporarily halted tariffs on electronics products, the issue remains a risk for U.S. companies. The concern is that the tariffs will result in higher prices, hurting both the U.S. consumer and companies, particularly those, such as tech players, that heavily import parts and finished products.Continue reading

Investors rushed to get in on artificial intelligence (AI) stocks over the past two years as it became clear that AI might be the next big thing. The idea was that this newish technology could join the ranks of electricity or the internet, revolutionizing our daily lives and a whole lot more. As a result, companies such as AI chip giant Nvidia (NASDAQ: NVDA) and AI-driven software company Palantir Technologies saw their stock prices soar -- these two surged 171% and 340%, respectively, last year.

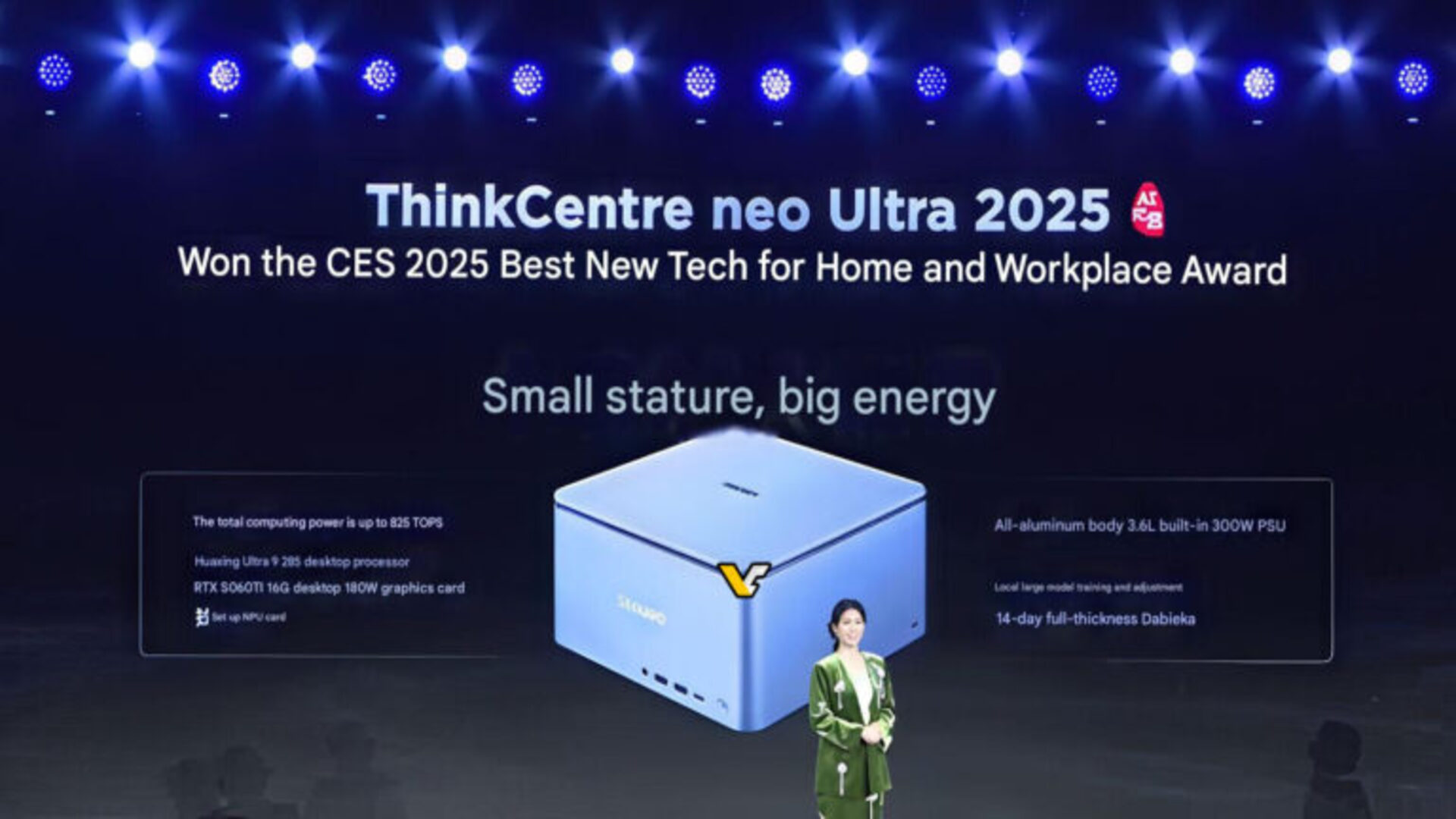

But recently, the excitement has turned to concern about what's ahead. Early last month, President Donald Trump announced a detailed plan for tariffs on imports, and stocks -- particularly tech and AI players -- sank.

Though the president paused the tariffs for a 90-day negotiation period and even temporarily halted tariffs on electronics products, the issue remains a risk for U.S. companies. The concern is that the tariffs will result in higher prices, hurting both the U.S. consumer and companies, particularly those, such as tech players, that heavily import parts and finished products.