High-Yield AGNC Investment Tells Investors What to Pay and They Still Keep Overpaying

AGNC Investment (NASDAQ: AGNC) is a mortgage real estate investment trust (REIT). That is an important fact to remember as you consider its astonishingly high 16% dividend yield. One really interesting fact about the company is that it literally tells investors what the stock is worth every quarter. And investors keep paying more than that price for the stock. Here's what you need to know before you buy this high-yield mREIT.AGNC Investment is a mortgage REIT, which is vastly different from a property owning REIT. A property owning REIT basically does what you would do if you owned a rental property, just on a much larger scale. Thus, it isn't complicated to wrap your head around buying a property and leasing it out to tenants. But AGNC Investment doesn't do that, it buys mortgages that have been pooled together into bond-like securities.Image source: Getty Images.Continue reading

AGNC Investment (NASDAQ: AGNC) is a mortgage real estate investment trust (REIT). That is an important fact to remember as you consider its astonishingly high 16% dividend yield. One really interesting fact about the company is that it literally tells investors what the stock is worth every quarter. And investors keep paying more than that price for the stock. Here's what you need to know before you buy this high-yield mREIT.

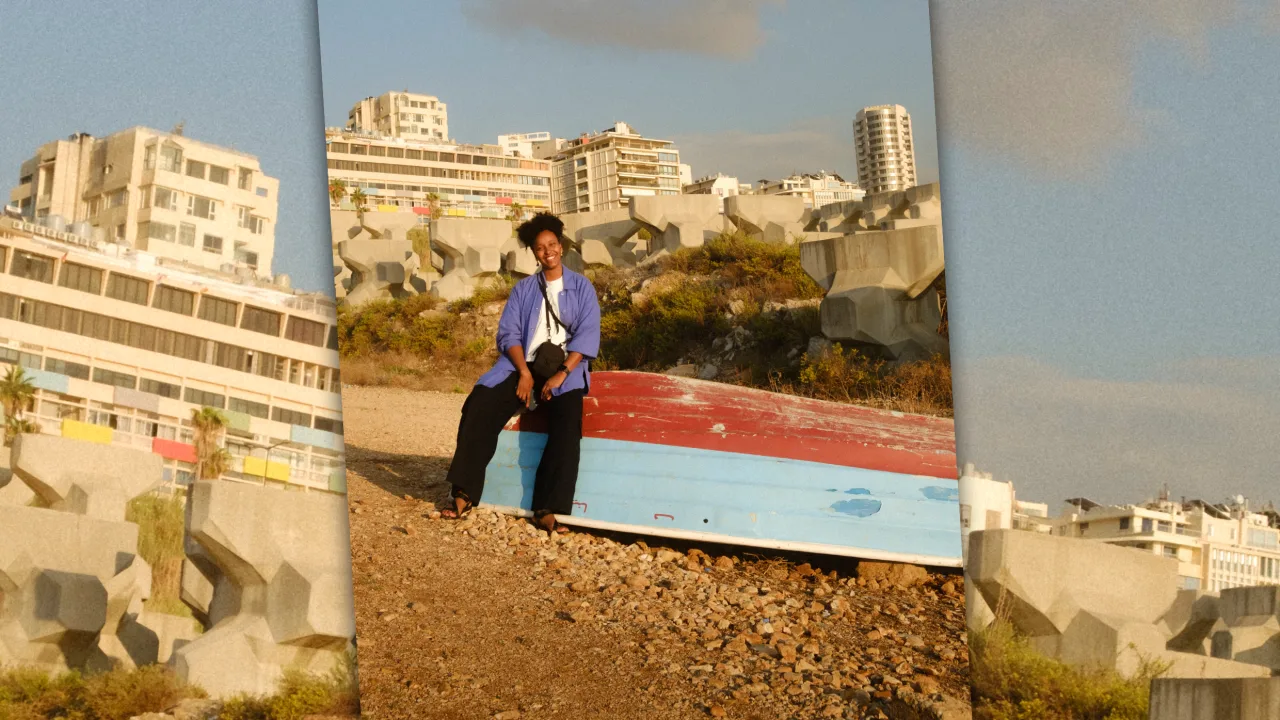

AGNC Investment is a mortgage REIT, which is vastly different from a property owning REIT. A property owning REIT basically does what you would do if you owned a rental property, just on a much larger scale. Thus, it isn't complicated to wrap your head around buying a property and leasing it out to tenants. But AGNC Investment doesn't do that, it buys mortgages that have been pooled together into bond-like securities.

Image source: Getty Images.

![The Most Visited Websites in the World [Infographic]](https://imgproxy.divecdn.com/3KPmuOfGXy00YRzOoNbqLzjer0DNjeNRDdEboVf734o/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9tb3N0X3Zpc2l0ZWRfd2Vic2l0ZXMyLnBuZw==.webp)

![So your [expletive] test failed. So [obscene participle] what?](https://regmedia.co.uk/2016/08/18/shutterstock_mobile_surprise.jpg)