China is shaping the future of shipping with a new army of ghost trucks

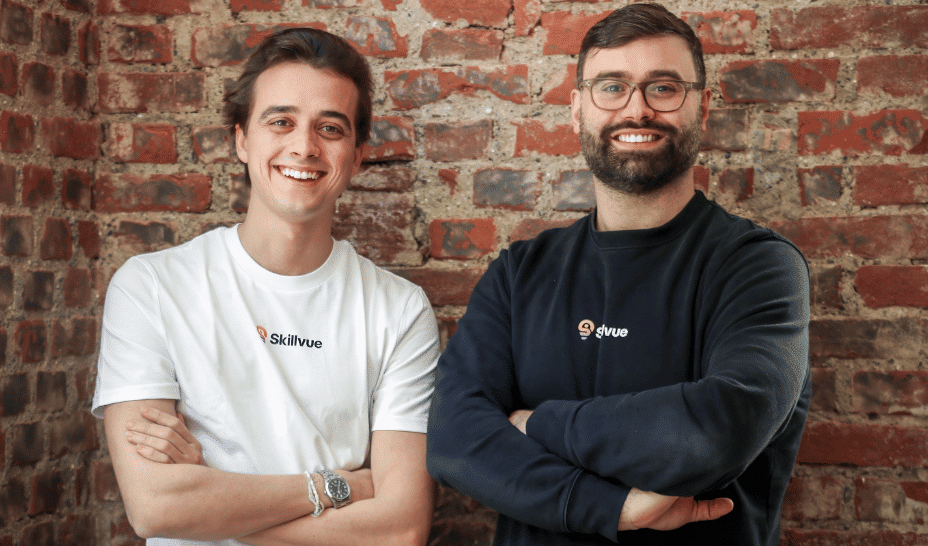

An empty light truck is cruising along a sun-drenched highway of Qionghai, a city in Hainan Island, the southernmost part of China. As the car that’s filming overtakes it, we can see the truck has no driver. In fact, it doesn’t even have a cabin: Its front is just a flat wall crowned by what looks to be sensors and cameras. It’s an eerie and surreal view, a Headless Horseman of trucks just as scary as an actual headless horseman. View this post on Instagram A post shared by Ai Revolution (@aitherevolution) The futuristic yet cheap-looking vehicle is part of a fleet of driverless light trucks that can carry 1,000 parcels each completely unattended over a range of more than 110 miles. These vehicles, operated by Chinese logistics giant ZTO Express, are the vanguard of a silent, state-sponsored effort to revolutionize the way China ships goods around the country. Their fleet is already vastly outperforming the efforts of startups in the U.S. They navigate Hainan’s suburban and rural routes thanks to an artificial intelligence–powered computer that sees the world in 3D using lasers and high-resolution cameras. The trucks are capable of obeying traffic lights, dodging obstacles, yielding to pedestrians, and “talking” to the road itself and other vehicles. The program began in November 2024 with a single vehicle, followed by three additional trucks as part of a pilot overseen by the Eastern Postal Administration of Hainan Province. Its director Zhang Zhi called it at its launch “the beginning of a new intelligent era” for the region’s courier industry. The initial pilot focused on Qionghai’s campuses, commercial districts, and residential areas, but ZTO quickly expanded it throughout the island and the rest of China. Beijing turbocharge It’s just another step in China’s road to automated logistics. The company already had experience with this autonomous technology for last-mile and long-haul logistics. In July 2024, ZTO launched autonomous delivery vans in Taizhou—south of Shanghai—each capable of carrying 600 to 800 parcels per trip—double the capacity of human couriers. These vans, which started development in 2021, are equipped with 360-degree cameras and AI-trained obstacle detection. They now handle nearly a third of last-mile deliveries in Taizhou’s industrial zones. The vehicles use V2X (vehicle-to-everything) communication systems, a technology that allows them to “talk” to traffic lights, road sensors, and other vehicles in real time. Allegedly, V2X reduces collisions and optimizes traffic flow by sharing data like speed, direction, and road conditions. Then, in August, ZTO deployed 400 autonomous heavy-duty trucks across China’s highway network, developed jointly with Shanghai-based autonomous driving startup Inceptio Technology and Dongfeng Commercial Vehicle, a subsidiary of China’s state-owned Dongfeng Motor Group. This marked the largest single delivery of intelligent freight trucks globally at the time, each equipped with light detection and ranging sensors that create 3D maps of surroundings, redundant braking systems, and Inceptio autonomous driving software, a proprietary system designed to optimize long-haul freight efficiency by reducing fuel consumption and human error. The company claims the software has driven 124 million miles, a truly impressive record. The key to this success is Beijing’s aggressive push to fully automate its logistics sector as part of its ambitious 2030 agenda, a national program aimed at ”building a modern, harmonious, and creative society,” according to the World Bank. Hainan was an experiment in which regulatory agility paved the way for this rapid scaling. The province slashed certification requirements to just 1,864 miles of testing, compared to China’s most populous province—Guangdong—which has a 9,320–18,600-mile mandate. Since then, 12 provinces have adopted Hainan’s fast-track certification model, and Beijing has allocated $1.4 billion to retrofit highways with 5G networks and V2X infrastructure. 5G’s ultralow latency provides near-instant data transmission and it ensures autonomous vehicles can process sensor data and communicate with infrastructure without delays, which is a prerequisite for safe operation at high speeds. ZTO’s own proprietary unmanned vehicle management platform, launched a year ago, now monitors a 200 autonomous vehicles fleet across 40 cities, tracking everything from battery levels to pedestrian interactions in real time. An army of ghost trucks and bots And it’s all scaling up this year. As of April 2025, 27 driverless vehicles operate at the company’s Laiwu logistics park in Shandong, south of Beijing. Their routes synced with workers’ handheld scanners. Government officials in this province confirm plans to deploy at least 1,500 such vehicles across Shandong by late 2025, targeting a 50% reduction in labor costs. This shift is driven by necessity: labor costs in China’s logistics sec

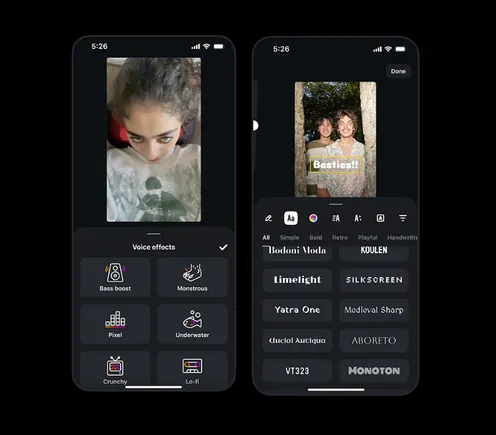

An empty light truck is cruising along a sun-drenched highway of Qionghai, a city in Hainan Island, the southernmost part of China. As the car that’s filming overtakes it, we can see the truck has no driver. In fact, it doesn’t even have a cabin: Its front is just a flat wall crowned by what looks to be sensors and cameras. It’s an eerie and surreal view, a Headless Horseman of trucks just as scary as an actual headless horseman.

The futuristic yet cheap-looking vehicle is part of a fleet of driverless light trucks that can carry 1,000 parcels each completely unattended over a range of more than 110 miles. These vehicles, operated by Chinese logistics giant ZTO Express, are the vanguard of a silent, state-sponsored effort to revolutionize the way China ships goods around the country. Their fleet is already vastly outperforming the efforts of startups in the U.S. They navigate Hainan’s suburban and rural routes thanks to an artificial intelligence–powered computer that sees the world in 3D using lasers and high-resolution cameras. The trucks are capable of obeying traffic lights, dodging obstacles, yielding to pedestrians, and “talking” to the road itself and other vehicles.

The program began in November 2024 with a single vehicle, followed by three additional trucks as part of a pilot overseen by the Eastern Postal Administration of Hainan Province. Its director Zhang Zhi called it at its launch “the beginning of a new intelligent era” for the region’s courier industry. The initial pilot focused on Qionghai’s campuses, commercial districts, and residential areas, but ZTO quickly expanded it throughout the island and the rest of China.

Beijing turbocharge

It’s just another step in China’s road to automated logistics. The company already had experience with this autonomous technology for last-mile and long-haul logistics. In July 2024, ZTO launched autonomous delivery vans in Taizhou—south of Shanghai—each capable of carrying 600 to 800 parcels per trip—double the capacity of human couriers. These vans, which started development in 2021, are equipped with 360-degree cameras and AI-trained obstacle detection. They now handle nearly a third of last-mile deliveries in Taizhou’s industrial zones. The vehicles use V2X (vehicle-to-everything) communication systems, a technology that allows them to “talk” to traffic lights, road sensors, and other vehicles in real time. Allegedly, V2X reduces collisions and optimizes traffic flow by sharing data like speed, direction, and road conditions.

Then, in August, ZTO deployed 400 autonomous heavy-duty trucks across China’s highway network, developed jointly with Shanghai-based autonomous driving startup Inceptio Technology and Dongfeng Commercial Vehicle, a subsidiary of China’s state-owned Dongfeng Motor Group. This marked the largest single delivery of intelligent freight trucks globally at the time, each equipped with light detection and ranging sensors that create 3D maps of surroundings, redundant braking systems, and Inceptio autonomous driving software, a proprietary system designed to optimize long-haul freight efficiency by reducing fuel consumption and human error. The company claims the software has driven 124 million miles, a truly impressive record.

The key to this success is Beijing’s aggressive push to fully automate its logistics sector as part of its ambitious 2030 agenda, a national program aimed at ”building a modern, harmonious, and creative society,” according to the World Bank. Hainan was an experiment in which regulatory agility paved the way for this rapid scaling. The province slashed certification requirements to just 1,864 miles of testing, compared to China’s most populous province—Guangdong—which has a 9,320–18,600-mile mandate.

Since then, 12 provinces have adopted Hainan’s fast-track certification model, and Beijing has allocated $1.4 billion to retrofit highways with 5G networks and V2X infrastructure. 5G’s ultralow latency provides near-instant data transmission and it ensures autonomous vehicles can process sensor data and communicate with infrastructure without delays, which is a prerequisite for safe operation at high speeds. ZTO’s own proprietary unmanned vehicle management platform, launched a year ago, now monitors a 200 autonomous vehicles fleet across 40 cities, tracking everything from battery levels to pedestrian interactions in real time.

An army of ghost trucks and bots

And it’s all scaling up this year. As of April 2025, 27 driverless vehicles operate at the company’s Laiwu logistics park in Shandong, south of Beijing. Their routes synced with workers’ handheld scanners. Government officials in this province confirm plans to deploy at least 1,500 such vehicles across Shandong by late 2025, targeting a 50% reduction in labor costs. This shift is driven by necessity: labor costs in China’s logistics sector have risen 8% annually since 2022, while e-commerce parcel volumes exceeded 130 billion in 2024. That’s why Beijing is so adamant to make this happen.

ZTO is not alone in this. Alibaba’s logistics arm Cainiao claims to have deployed “thousands” of autonomous delivery robots and vehicles during its 2024 Cainiao Smart Global Logistics Summit. Chinese retail giant JD’s logistics division has 600 autonomous vehicles in operation, making millions of deliveries. And food delivery titan Meituan has been deploying “hundreds” of fully driverless delivery vehicles in major urban centers like Beijing and Shenzhen, according to its Q3 2024 earnings call. Neolix has been deploying thousands of its homegrown autonomous vehicles for various commercial delivery applications since 2021.

It’s a stark contrast with what’s happening in the U.S., where there’s a patchwork of state- and city-led policies. Companies like Kodiak Robotics and Gatik are testing autonomous trucks for middle-mile delivery, with Gatik operating a small fleet of box trucks for Walmart in Arkansas. However, deployments remain constrained by fragmented state regulations and a lack of centralized infrastructure investment. For example, California requires permits from both the DMV and Public Utilities Commission for commercial autonomous operations, while Texas allows driver-out testing in the state: In May 2024, Pittsburgh-based autonomous truck technology company Aurora Innovation announced that its first commercial trucks—developed with Volvo—are now driving between Dallas and Houston. The company said that, to date, its self-driving tech has completed 1,200 miles without a driver. Compare that to Inceptio’s 124 million miles.

As for smaller vehicles, Waymo Via’s publicly acknowledged deployment of fully driverless delivery vans is likely in the dozens, primarily within pilot programs. Waymo-powered trucks were in trial runs until 2022, but the company stopped its efforts in 2023. Nuro claims it has expanded its autonomous vehicle operations in a handful of cities: Mountain View, Palo Alto, and Houston. Notably, Amazon has not disclosed large-scale deployment numbers for fully driverless road vehicles in commercial operation, and its nutty air delivery system is just not flying as Jeff Bezos probably expected.

By 2030, S&P Global Mobility estimates that China will dominate autonomous freight, with 250,000 Level 4 logistics vehicles in operation, compared to 230,000 in the U.S.—most of which will remain focused on ride-hailing, not freight. Seems optimistic for the U.S. side. “China’s strong push for automated driving, bolstered by significant government support and regulatory frameworks, positions it as a potential leader in the development of autonomous vehicle technology and relative to commercialization of the autonomous vehicle industry,” the report says. A centralized strategy, which has resulted in 28,000 miles of roads that are now open for autonomous vehicles with 16,000 licenses issued nationwide. Only time will tell if the U.S. can overtake Beijing, but for now, I can only see a formidable army of Chinese ghost trucks amassing beyond the Great Wall and shaping the future of roads, while we are still playing with cars in geofenced Disneyland rides.