Fiat currencies are also credit money, so why not buy Bitcoin on credit too?

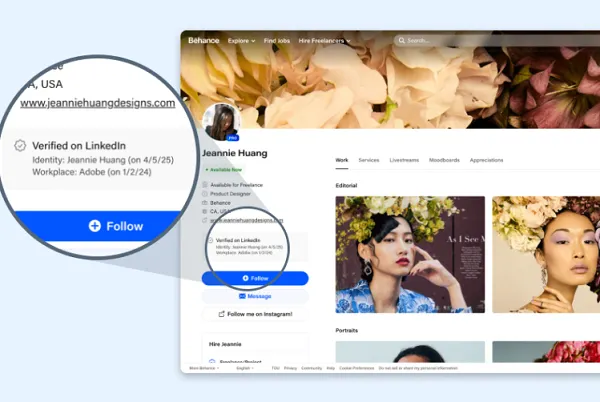

https://preview.redd.it/6jz4931l9ywe1.png?width=1024&format=png&auto=webp&s=294567039870ca4e350b8aead9d3426871aa405c In 2021, the total crypto market cap peaked at $3 trillion. Fast forward to 2025, and we’ve already hit a new all-time high of $3.73 trillion. That sounds huge, until you realize the U.S. alone prints that much in a single year. Let that sink in: the entire crypto market, at its absolute peak, is roughly equal to one year of USD creation. Fiat is being inflated at a staggering rate, and yet people still think buying Bitcoin on credit is "too risky"? Since the First Industrial Revolution, global GDP has exploded, from a few hundred billion in the 1800s to over $105 trillion in 2024. This growth, driven by fossil fuels, tech, and industry, is now hitting hard limits. The Earth is finite. The current system demands 3% growth forever, but physics, ecosystems, and energy flows don’t play that game. What does this mean? Fiat currencies are already credit-based, backed by debt, endless printing, and faith in perpetual expansion. It’s a system built on borrowed time. So here’s the controversial take: if you're going to live in a world built on debt, why not use that to your advantage? Buying Bitcoin on credit isn’t just speculation, it’s a hedge against the slow implosion of a debt-based fiat system. No, this doesn’t mean max out your credit cards recklessly. But intelligently using leverage to exit a doomed system might not be as crazy as it sounds. Especially when the alternative is watching your savings silently melt under inflation. Is it risky? Sure. But so is staying in fiat. submitted by /u/Cold-Enthusiasm5082 [link] [comments]

| In 2021, the total crypto market cap peaked at $3 trillion. Fast forward to 2025, and we’ve already hit a new all-time high of $3.73 trillion. That sounds huge, until you realize the U.S. alone prints that much in a single year. Let that sink in: the entire crypto market, at its absolute peak, is roughly equal to one year of USD creation. Fiat is being inflated at a staggering rate, and yet people still think buying Bitcoin on credit is "too risky"? Since the First Industrial Revolution, global GDP has exploded, from a few hundred billion in the 1800s to over $105 trillion in 2024. This growth, driven by fossil fuels, tech, and industry, is now hitting hard limits. The Earth is finite. The current system demands 3% growth forever, but physics, ecosystems, and energy flows don’t play that game. What does this mean? Fiat currencies are already credit-based, backed by debt, endless printing, and faith in perpetual expansion. It’s a system built on borrowed time. So here’s the controversial take: if you're going to live in a world built on debt, why not use that to your advantage? Buying Bitcoin on credit isn’t just speculation, it’s a hedge against the slow implosion of a debt-based fiat system. No, this doesn’t mean max out your credit cards recklessly. But intelligently using leverage to exit a doomed system might not be as crazy as it sounds. Especially when the alternative is watching your savings silently melt under inflation. Is it risky? Sure. But so is staying in fiat. [link] [comments] |

![How AI Use Is Evolving Over Time [Infographic]](https://imgproxy.divecdn.com/YImJiiJ6E8mfDrbZ78ZFcZc03278v7-glxmQt_hx4hI/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9ob3dfcGVvcGxlX3VzZV9BSV8xLnBuZw==.webp)

![[Weekly funding roundup April 19-25] VC inflow continues to remain subdued](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)