BlackRock's Larry Fink Says "Buy Infrastructure:" Here's How to Do That and Collect a 6% Yield

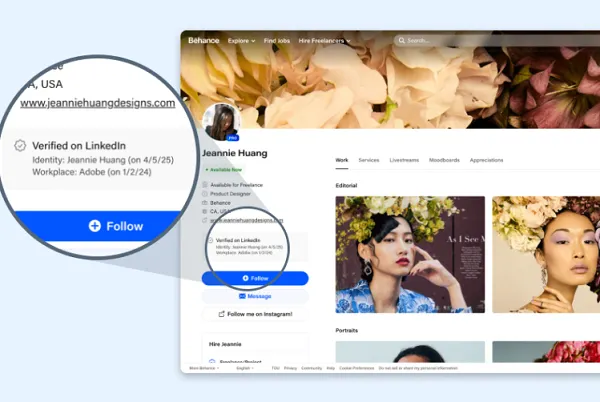

Larry Fink, the CEO of BlackRock (NYSE: BLK), recently suggested that the 60/40 portfolio model needed to be replaced by a 50/30/20 portfolio. The new 20% portion is dedicated to things like infrastructure and real estate. Real estate investment trusts (REITs) are pretty easy to come by, but infrastructure isn't. Which is why you'll want to get to learn all about this globally diversified infrastructure business offering a huge 6% yield.When Fink penned his 2024 shareholder letter, he included a discussion about the typical balanced fund mix of 60% stocks and 40% bonds. That's a Wall Street rule of thumb that has, overall, been a good choice for small investors who don't want to spend all of their free time thinking about Wall Street and investing theory.Image source: Getty Images.Continue reading

Larry Fink, the CEO of BlackRock (NYSE: BLK), recently suggested that the 60/40 portfolio model needed to be replaced by a 50/30/20 portfolio. The new 20% portion is dedicated to things like infrastructure and real estate. Real estate investment trusts (REITs) are pretty easy to come by, but infrastructure isn't. Which is why you'll want to get to learn all about this globally diversified infrastructure business offering a huge 6% yield.

When Fink penned his 2024 shareholder letter, he included a discussion about the typical balanced fund mix of 60% stocks and 40% bonds. That's a Wall Street rule of thumb that has, overall, been a good choice for small investors who don't want to spend all of their free time thinking about Wall Street and investing theory.

Image source: Getty Images.

![How AI Use Is Evolving Over Time [Infographic]](https://imgproxy.divecdn.com/YImJiiJ6E8mfDrbZ78ZFcZc03278v7-glxmQt_hx4hI/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9ob3dfcGVvcGxlX3VzZV9BSV8xLnBuZw==.webp)