2 Buffett Stocks You Can Buy During a Market Crash and Hold Forever

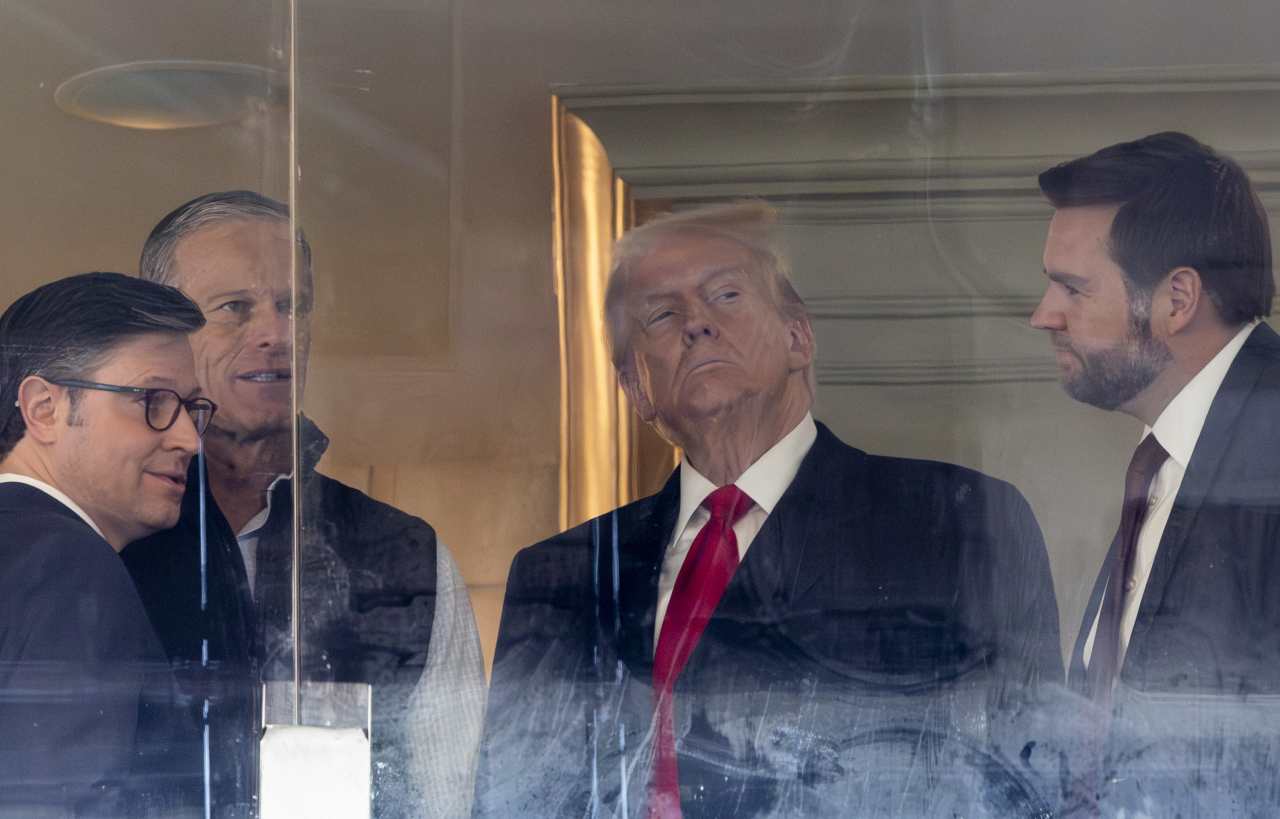

The market crash that followed President Donald Trump's tariff announcement on April 2 was a disaster for short-term-minded investors. For those of us who like to buy and hold dividend-paying stocks for years, though, market crashes create relative bargains out of stocks that previously seemed a little too pricey.Warren Buffett took control of Berkshire Hathaway in 1965, and since then, shares of the holding company have produced a 19.9% average annual return. The legendary investor and his team produced this result despite seven official recessions and even more market crashes.Buffett's outstanding track record makes the Berkshire Hathaway portfolio a great place to look for recession-resistant stocks. Constellation Brands (NYSE: STZ) and Coca-Cola (NYSE: KO) are two relatively reliable beverage stocks in the Berkshire portfolio that everyday investors should want to pounce on if the market crashes again.Continue reading

The market crash that followed President Donald Trump's tariff announcement on April 2 was a disaster for short-term-minded investors. For those of us who like to buy and hold dividend-paying stocks for years, though, market crashes create relative bargains out of stocks that previously seemed a little too pricey.

Warren Buffett took control of Berkshire Hathaway in 1965, and since then, shares of the holding company have produced a 19.9% average annual return. The legendary investor and his team produced this result despite seven official recessions and even more market crashes.

Buffett's outstanding track record makes the Berkshire Hathaway portfolio a great place to look for recession-resistant stocks. Constellation Brands (NYSE: STZ) and Coca-Cola (NYSE: KO) are two relatively reliable beverage stocks in the Berkshire portfolio that everyday investors should want to pounce on if the market crashes again.

![How AI Use Is Evolving Over Time [Infographic]](https://imgproxy.divecdn.com/YImJiiJ6E8mfDrbZ78ZFcZc03278v7-glxmQt_hx4hI/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9ob3dfcGVvcGxlX3VzZV9BSV8xLnBuZw==.webp)